Published as: Morcov, S., & Puiu, A.M. (2023). Implementation of a Business-to-Government (B2G) Sales Analytics Tool – Hermix. Economic Insights – Trends and Challenges, 12(4), 61-69. doi:10.51865/EITC.2023.04.05

Abstract: The public sector sales market, i.e. Business-to-Government

(B2G) market is large and relevant. It is similar, yet differs in several key aspects from other markets such as retail, consumer (B2C), or Business-to-Business (B2B). B2G is huge, at 2 trillion Euro per year in Europe, but insufficiently researched and it lacks proper tools and methods. Public

contracts are difficult to access and require specialized expertise and a significant initial investment. This paper explores the implementation and

evaluation of an IT platform that supports and automates public sector sales, Hermix, in a large company. This study had a qualitative

longitudinal approach. It consisted of 7 workshops and 2 interviews with 8 case study participants, performed over the duration of a year. It

highlights the implementation steps and results. Hermix automated a set of public sector sales processes for the host company, including: tender

monitoring with email notifications, opportunity qualification, and market research, i.e. the analysis of the tactical and strategic context: buyers

(public buyers), budgets, competition, partnership affinities, groups of interest, trends. It uses advanced data analytics, big-data and machine

learning to provide market intelligence such as governmentgraphics, firmographics, geographics and monetary segmentation. Implementing

public sector sales automation tools provides direct benefits to companies, related to: cost and time efficiency, improved proposal success rates, and strategic planning optimization. Indirect benefits for companies refer to delivery quality. Data analytics tools also support overall public procurement transparency, public spending efficiency and better public governance.

Keywords: Public Procurement; Business-to-Government B2G; Public

Sector Sales; Market Research; Analytics.

Introduction

Public sector sales, or Business-to-Government (B2G), is the marketing and sales of products, services, and works to public sector organizations (Cambridge Dictionary).

B2G is similar, but distinct from other markets, such as retail, consumer, Business-to-Consumer (B2C) or Business-to-Business (B2B) (Kenton, 2021). According to the European Commission (EC) and Eurostat, the public sector is 53% of the Gross Domestic Product (GDP) of the European Union (EU) (Eurostat, 2022). In the US, public spending amounts to 47% of the GDP. Public sector procurement forms a significant part of the public sector spending, estimated at more than 14% of the global GDP. In Europe, the EC estimates the size of public sector procurement at 2 trillion Euro, and the number of public buyers at 250k. These include public institutions at international, European, national, federal, regional, or local level.

A significant number of companies are active on the B2G market. The EC estimates that 400k companies are engaged in public contracts. Worldwide, 60% of Fortune 1000 companies are engaged in public sector contracts. In general, having government business has a positive impact on a firm’s value. The impact varies depending on factors such as company size and the variety of its customers (Josephson et al., 2019).

The public sector sales market is not yet analyzed, studied or defined formally. Even the terminology is still being defined. Thus, there are various alternative names used for the domain, such as Business-to-Government (B2G), public sector (PS), public procurement (PP), Business-to-Public-Administration (B2PA), or Business-to-Public-Sector (B2PS).

There are insufficient tools or methods for supporting this market. There are no specialized tools for analysis, market research, or for sales. Public sector sales relies on manual data analysis and general data management tools, such as business intelligence (BI) or Customer relationship management (CRM).

Hermix is a new platform that aims to automate and support public sales and access to public funds. Hermix helps companies to understand and win public contracts. It offers functionality such as:

- Tender monitoring, such as email notifications and in-app notifications;

- Opportunity qualification of tenders, such as analysis of customer budgets, similar projects,competition, previous winners, potential partners, similar buyers;

- Deep market intelligence and market segmentation, with big-data analytics and AI/ML:reports with information about where is the money, who buys & sells, what, when, how, where, and how much, for each market.

The sources of the data of Hermix are mostly public, such as the European public procurement portal (TED), Eurostat, the European Central Bank (ECB), the European Commission (EC), the European Open Data portal.

During the past 2 years, the technology and business case of Hermix were tested for evaluation and validation purposes in cca. 600 workshops, with 350 users, experts, and researchers, including 22 pre commercial customers.

One of the major case studies that was used for the evaluation and validation of the implementation, results, and benefits of Hermix was implemented together with a European software engineering company, a subsidiary of a global IT and communications company headquartered in Europe, but with a global business. The company has a significant IT service business for the European Commission and other European institutions, services clients such as the Directorate-General for Communications Networks, Content and Technology, the Directorate-General for Education and Culture, the Directorate-General for Digital Services, the Directorate-General for Research and Innovation, the Joint Research Centre of the EU, the European Environment Agency, the European Food Safety Buyer. The project was partially funded by the Bucharest-Ilfov Regional Development Agency.

Background

The European public procurement market (Business-to-Government, B2G) is huge (€2 trillion), complex, and difficult to access. Buyers and contractors have a critical need to understand their ecosystem and automate their processes.

Vast amounts of open multilingual data are available, but lack standardization, integration and semantic quality, thus being not exploited sufficiently. Accessing public funds and tenders is a manual process that requires incredible investment, effort and resources. The market is therefore dominated by a few specialized actors.

New, disruptive technologies and methods (artificial intelligence, machine learning, large language models) are not yet being used on the B2G market. Thus, there is a huge gap between B2C/B2B technologies and methods used, vs. the public sector sales.

Business-to-Government B2G

The public sector market, a.k.a. Business-to-Government or B2G, is huge, distinct and relevant. Public funds solve critical economic and social needs. For instance, the EC already disbursed €807 bil. via the Recovery and Resilience Facility. The EU’s infrastructure, education, transportation, health, social care, and research are largely publicly funded. A huge amount of these projects are executed through public procurement.

At the same time, despite significant policy and regulatory efforts, access to public funds is still an elitist affair, dominated by a few large, specialized players. The market is skewed. Only 400k companies, i.e. 1.3% of the total 30 mil. EU companies, access public contracts (Eurostat,2022). Based on our analysis of data from the Financial Transparency System (FTS) of the European Commission, only 1.5% of the beneficiaries of EC R&D grants receive 57% of the total EC R&D budget.

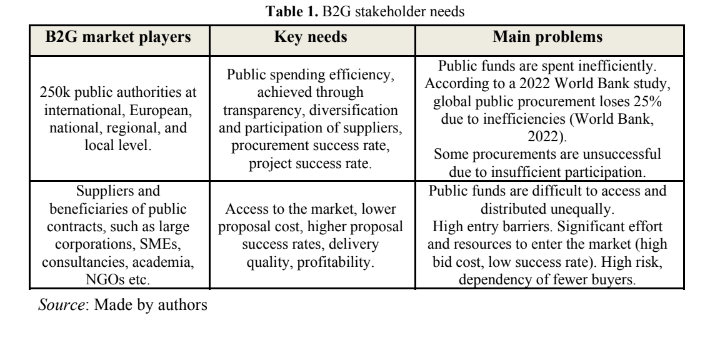

Unlike B2B and B2C, there are no automation or analytics tools to support B2G stakeholders. Table 1 presents the core needs and main problems faced by B2G actors.

The Public Sector Sales Analytics Platform Implemented – Hermix

Hermix supports companies to win public contracts. It offers functionalities such as monitoring the market and providing market research reports. It offers features covering:

- Strategic market research, positioning, targeting, prediction and decision-support, withadvanced infographics, using traditional segmentation (such as firmographics, geographics,demographics, monetary), as well as innovative segmentation: government graphics, affinity maps (Morcov, 2022).

- Intelligent opportunity qualification. Analysis of probable winners, patterns of behavior,

abnormal behavior. - Lead generation, identification of relevant opportunities, smart market watch (Hermix,

2023).

A summary of Hermix’ modules is presented in Figure 1.

Fig 1. Hermix main modules

Source: Made by authors based on Hermix product descriptions (Hermix, 2023)

Methods

This paper studies the impact of implementing a specialized market analytics and sales enablement tool, Hermix, for supporting public sector sales in a large IT company.

It is a longitudinal study, based on a single case-study, consisting of the implementation of the platform Hermix for a large IT software business.

This research was executed as a single, longitudinal case study. Besides the implementation of the platform, it consisted of a set of 7 workshops and 2 interviews with a total of 8 participants from the host company.

Case study research is a qualitative, exploratory research method. Qualitative research, and especially case study research, can help researchers to develop initial understandings in new domains, such as B2G, which is a domain insufficiently analyzed and understood (Levitt et al.,2018; Gummesson, 2000). This methodology is particularly useful in the design, building, as well as in the external validation of new theories (Gibbert & Ruigrok, 2010).

The case study research methodology employed included data collection through workshops and interviews, as well as the application and evaluation of the implemented tool (Yin, 2011).

The data was collected through 7 online workshops and 2 interviews, with 8 participants. Offline written questionnaires or data collection tools were not applied. Live interviews are typical tools used in qualitative and in case-study research, as they help uncover new insights through open discussions and especially open questions. They are also helpful in clarifying the terminology, considering that the terms used in B2G are sometimes overloaded and not sufficiently defined nor specific. During the workshops and interviews, stronger importance was placed on negative responses and feedback, rather than on positive. The workshops had as purpose to discover arguments, potential causality between arguments, as well as to analyze the larger context of the case study and of the host organization (Wieringa, 2014).

The discussions during the workshops and interviews were not recorded due to confidentiality reasons, but notes were taken and the answers were documented in writing, for further in-depth text and feedback analysis, and to ensure construct validity.

The research for the case study consisted of the following main activities, detailed below.

- The research design activity consisted of defining the research methods, designing the structure of the workshops and interviews, and selecting the case study and its participants.

The participants involved represented several functions and organizational levels:

- 4 sales managers and executives;

- 1 presales manager;

- 1 presales/bid expert;

- 2 executive managers.

The participants have a personal involvement, i.e. skin in the game. This ensures their involvement and interest in the direct results of the research.

2. The case study execution consisted of:

a) preliminary desk research;

b) 7 workshops with project case participants.

Starting with 24 Oct. 2022, the modules of Hermix were made available incrementally, for testing and evaluation, to a team of account and presales manager from the company. Hermix supported the team of the IT company to automate several key sales and bid processes, as described above. The pilot provided key insights. During the pilot, 7 workshops were held, for extracting feedback and validating the product, functionality and business case.

- The analysis and interpretation of the research results was qualitative. Card-sorting was used

for analyzing the data (Spencer & Warfel, 2004).

Limitations, Validity, and Reliability

In case study and in general in qualitative research, the researcher has an active role, playing also the role of a consultant. Often, there is no clear demarcation between these 2 roles. This effect is that qualitative case study research is usually a personal journey, often impacted by the personal contribution and subjectivity of the researchers and of the participants. Management research acknowledges this phenomenon as ”the action research paradigm” (Gummesson,2000).

At the same time, this poses specific limitations, e.g. construct validity and reliability. To enhance them, multiple sources of data were used, to ensure triangulation, e.g. there were 8 participants, in 7 workshops and 2 interviews. This supported ensuring the convergence of the results, but also exploring possible additional, divergent paths and insights.

A chain of evidence was established and documented. Meeting notes are kept for each meeting and workshop. Standard configuration management is used, i.e. Google Docs for managing document versions, Hubspot for organizing, managing and documenting meetings.

The external validity of the research methodology might be affected by limitations related to the case-study context. A single case-study, deployed in a single organization, could have limited relevance. The case study, the host organization, as well as the participants were selected based on convenience, i.e. they volunteered for participation. The results of this research might therefore pose difficulties for generalization to other types of organizations, to other roles, or to other industry sectors. In order to enhance generalizability and external validity, further research should be conducted, including analyzing additional case-studies, in other organizations.

The research was qualitative. No quantitative methods were used. The analysis and interpretation of the data were qualitative, and explored elements such as the type of arguments used by participants. The characteristics of the participants and the specific organizational context was taken into consideration.

Results and Discussion

The company that is analyzed in the case study is based in Europe, but it is part of a large global corporation. Their main business is software development and related services. Their public sector business targets clients such as the European Commission and EU agencies in various European countries such as Belgium, Luxembourg, Italy, Denmark, Netherlands and Spain. It has 500-1000 employees. It has a team of 3 sales managers involved in public sector sales, and 5 presales and bid experts.

The main processes that the company uses for public sector sales are the following:

- Strategic planning, i.e. defining the market strategy and building long-term pipelines. This is done yearly, and updated quarterly, in slides, spreadsheets, diagramming applications.

- The market research requires 2-3 weeks of effort per year.

- Monitoring tenders. This is done daily. Before Hermix, this was done with monitoring

portals such as TED and UNGM. Relevant tenders are recorded in the company’s CRM,

but only after an initial pre-qualification. - Commercial qualification of tenders. This is performed daily. It results in a bid / no-bid

decision. Before Hermix, this was done by searching for relevant information in TED, with

Google or reading the customer website and social media. This was a process that required

between 30 minutes (for simple small tenders) up to 2+ days (for critical, complex tenders).

Data was collected manually and analyzed in Excel files. - Technical qualification of tenders. This is done daily, in conjunction with the commercial

qualification, and also results in a bid / no-bid decision. The technical analysis is being

done by reading the tender specifications, and requires between 2-3 hours per tender for the

initial preliminary analysis, and 2+ days for a later detailed analysis. The analysis is

registered in a standard template. Selected tenders are recorded in the CRM. - Finding and validating partners. This is a task similar to the commercial qualification of

tenders. It is done only for pre-qualified tenders. Data was obtained from public search

engines, company websites, official registers of companies, as well as from commercial

databases of companies. - Proposal preparation. The proposal process and workflow is managed using tools such as

Jira or custom tools. The files are organized on document management tools such as MS

OneDrive/Office 365 or Google Drive/Apps.

The results of the implementation of Hermix were the following, for each key process:

- For the Strategic planning process: Hermix successfully automated this process, by providing already aggregated market research data, in visual reports and tables.

- For Monitoring daily tenders process: Hermix successfully automated this process, by

providing collaborative features such as opportunity flags and sending emails. - For Commercial qualification of tenders. Hermix automated a part of this process,

presenting reports with relevant information regarding the background of a tender or

buyer. The reports are not entirely automated; some filters and parameters need manual

adjustment to fine-tune the reports.

The following key processes were not automated. These could be the topic of further research, development, and evaluation:

- Automating the technical qualification of tenders, i.e. analysis of tender specifications and additional context documents, such as work programs, methodologies, policy documents, and strategic plans. While Hermix indexes the tender documentation and allows searching in tender specifications, the qualification process is still mostly manual.

- Automating the proposal preparation. Hermix does not support this process at the time of the execution of the case study.

Overall, the impact of Hermix in the organization and processes of the company was positive.

Examples of the qualitative feedback received during the workshops are presented in short below:

- Hermix delivers relevant information daily, by email;

- Hermix allows to prioritize tenders based on market intelligence;

- It allows tracking and managing tender qualification status;

- The platform aims to become a single authoritative source of intelligence related to European public procurement;

- The tender qualification report and the market analytics reports aggregate data from

- multiple cleaned up sources of raw data;

- Hermix offers information about the public procurement landscape on competitors and on

- public buyers;

- The learning curve of using Hermix is steep due to the amount of data, so the first experience may be overwhelming, requiring a period of accommodation;

- Future useful features could relate to extracting info from tender documents.

Amongst the direct impact of the implementation of sales analytics tools we can enumerate:

- Cost: automating a part of the effort spent with manual search and manual data aggregation and interpretation using Excel files. The market research, sales, and presales teams can re-focus their efforts from data entry to data analysis.

- Efficiency: better selection of the opportunities in which to invest.

- Increase proposal success rates, with a better alignment of prices and proposals to client needs and requirements.

- Increase delivery quality by better choices for the technology and partners.

- Better medium- and long-term strategy alignment, by using big-data analysis of the market, customers, competitors, and partners.

Besides direct implications to public contractors, data analytics tools also show indirect impact:

- Societal impact: opening markets to SMEs, new smaller players, innovation;

- Better public governance: increasing transparency and public spending efficiency.

Conclusions

The paper presents a case study for implementing a public sector sales analytics tool in a large IT company, for automating and supporting processes related to sales. The case study was analyzed from multiple perspectives, with multiple participants, for triangulation. The research approach was longitudinal, consisting of 7 workshops and 2 interviews, over one year, with 8 participants.

We analyzed the impact of a public sector sales analytics platform in the organization.

The tool has demonstrated its capability to enhance and streamline sales processes for the public

sector – B2G.

The major benefits of implementing the tools relate to cost efficiency, increased success rates, real-time awareness, strategic planning optimization, real-time tender monitoring, more efficient qualification processes, and improved partner validation and proposal preparation.

Indirect benefits relate to enhanced delivery quality, due to a better alignment of the proposals with the requirements and needs of customers.

Future directions of research could focus on quantitative analysis of the benefits of implementing automation and analytics tools in public sector sales, and comparison with the tools that are already deployed in B2C and B2B sales.

Future directions of research and development could focus on extracting and summarizing information from tender specifications and other documents, and on automating the proposal

preparation process.

References

- Cambridge Dictionary (n.d.). B2G | English meaning. Retrieved March 22, 2023, from https://dictionary.cambridge.org/dictionary/english/b2g

- European Commission (n.d.). Public Procurement. Retrieved March 22, 2023, from https://single-

market-economy.ec.europa.eu/single-market/public-procurement_en - European Commission (2021). An analysis of SMEs’ needs in public procurement. Internal Market, Industry, Entrepreneurship and SMEs. Retrieved June 16, 2022, from https://single-market-economy.ec.europa.eu/publications/analysis-smes-needs-public-procurement_en

- Eurostat (2022). Government expenditure by function – COFOG. Eurostat – Statistics Explained. Retrieved June 16, 2022, from https://ec.europa.eu/eurostat/statistics- explained/index.php?title=Government_expenditure_by_function_%E2%80%93_COFOG

- Gibbert, M., & Ruigrok, W. (2010). The ‘‘What’’ and ‘‘How’’ of Case Study Rigor: Three

Strategies Based on Published Work. Organizational Research Methods, 13(4), 710-737.

https://doi.org/10.1177/1094428109351319 - Gummesson, E. (2000). Qualitative Methods in Management Research. Sage.

- Hermix (2023). Hermix – Public sector – Business-to-Government. Retrieved October 6, 2023, from

www.hermix.com - Josephson, B. W., Lee, J.-Y., Mariadoss, B. J., & Johnson, J. L. (2019). Uncle Sam Rising:

Performance Implications of Business-to-Government Relationships. Journal of Marketing, 83(1),

51-72. https://doi.org/10.1177/0022242918814254 - Kenton, W. (2021, August 30). Business to Government (B2G): Selling to The Government. Investopedia. Retrieved on October 10, 2023, from https://www.investopedia.com/terms/b/business-to-government.asp

- Levitt, H. M., Bamberg, M., Creswell, J. W., Frost, D. M., Josselson, R., & Suárez-Orozco, C.

(2018). Journal article reporting standards for qualitative primary, qualitative meta-analytic, and

mixed methods research in psychology: The APA Publications and Communications Board task

force report. American Psychologist, 73(1), 26–46. https://doi.org/10.1037/amp0000151 - Morcov, S. (2022). The B2G Manifesto: Structured approach to Business-to-Government marketing

and public sector market segmentation. https://doi.org/10.13140/RG.2.2.22267.39203/2 - Morcov, S., Pintalon, L., & Kusters, R. J. (2021). A Practical Assessment of Modern IT Project

Complexity Management Tools: Taming Positive, Appropriate, Negative Complexity. International

Journal of Information Technology Project Management (IJITPM), 12(3), 90-108. Article 6.

https://doi.org/10.4018/ijitpm.2021070106 - SMB Guide (2021, October 7). What is Business to Government (B2G)? The SMB Guide. Retrieved

on October 10, 2023, from https://www.thesmbguide.com/business-to-government - Statista (2020). Public spending ratio in the member states of the European Union in 2020.Retrieved June 16, 2022, from https://www.statista.com/statistics/263220/public-spending-ratio-in-eu-countries/

- Trading Economics (n.d.). European Union | EUROSTAT Indicators: GDP and main components.Retrieved June 16, 2022, from https://tradingeconomics.com/european-union/indicators-eurostat-data.html?g=gdp+and+main+components

- Wieringa, R. J. (2014). Design Science Methodology for Information Systems and Software

Engineering. Springer. - World Bank (2022). A Global Procurement Partnership for Sustainable Development: An

International Stocktaking of Developments in Public Procurement. Retrieved on October 10, 2023 from https://www.worldbank.org/en/events/2022/01/06/a-global-procurement-partnership-for-sustainable-development-an-international-stocktaking-of-developments-in-public-proc - Yin, R. K. (2011). Qualitative Research from Start to Finish. Guilford.