A 24-month design-and-build contract for 100 new dwellings and commercial space at a former depot site signals Eastbourne’s commitment to affordable housing delivery and brownfield regeneration

Create a free account and see the full public tender details here: https://app.hermix.com/opportunities/ukfts_004056-2026

Eastbourne Borough Council has published a £30 million (€35.4M) construction tender for a major mixed-use development at the former Bedfordwell Road Depot in East Sussex. With a February 16, 2026 deadline and a two-year build program, this procurement represents one of the largest current housing construction opportunities in the UK’s southeast coastal region.

The scheme encompasses design and construction of 100 new dwellings—80 for affordable rent and 20 for shared ownership—alongside a commercial shell-and-core unit and the sympathetic refurbishment of an existing historic pump house. The authority’s procurement track record of 17 historical contracts worth £48 billion (€57B), combined with 32 upcoming renewals valued at £367 million (€435M), positions this as a significant opportunity within a broader pipeline of local authority construction activity.

Opportunity Overview

Contracting Authority: Eastbourne Borough Council

Reference Number: ocds-h6vhtk-060803

Tender Title: EBBC – Bedfordwell Road Development

Scope of Work:

The scheme requires comprehensive design-and-build services for a mixed-tenure residential development with heritage and commercial components:

Residential Construction:

- 100 new build dwellings total

- 80 dwellings for affordable rent

- 20 dwellings for shared ownership

- Housing types and configurations to be designed and built

Commercial Development:

- 1 commercial shell-and-core unit for future fit-out

Heritage Component:

- Repair and refurbishment of retained elements of existing pump house structure

- Conservation-sensitive approach to historic building integration

Site Infrastructure:

- Site remediation works (former depot site)

- Highways works and access improvements

- Hard and soft landscaping throughout development

- Services installation and connections

- All necessary on-site and off-site enabling works

Location: Bedfordwell Road Depot, Eastbourne, East Sussex, BN22 8XD

Estimated Total Value: €35,435,023.98 (approximately £30M)

Lot Value: €7,547,359.68 (approximately £6.4M)

Contract Duration: 24 months

Procedure Type: Competitive flexible procedure

Award Criteria: Price (simple description)

Key Dates:

- Publication: January 16, 2026

- Submission Deadline: February 16, 2026 (31 days from publication)

- Tender Opening: February 16, 2026

EU Funding: No

Contact Details:

- Email: james.white@lewes-eastbourne.gov.uk

Ready to identify and qualify UK housing construction opportunities faster?

Create your free Hermix account at https://hermix.com/sign-up/ and access AI-powered tender analysis, competitive intelligence, and automated monitoring across the UK’s public sector construction market.

Authority Profile: Eastbourne Borough Council’s Housing Delivery Program

Eastbourne Borough Council serves the seaside town of Eastbourne in East Sussex, on England’s south coast. As a ministry or national/federal authority operating within the UK’s local government framework, the council is actively pursuing housing delivery objectives to address local affordable housing needs and regenerate underutilized brownfield sites.

The Bedfordwell Road site represents a strategic regeneration opportunity—transforming a former municipal depot into much-needed housing while preserving heritage elements of the existing pump house structure.

Overall Procurement Activity:

- Total Contract Awards: 17 contracts worth €57 billion

- Active Tender Pipeline: Currently no other open tenders visible in available data

- Renewal Forecast: 32 potential contract renewals worth €435 million

Construction and Housing Development:

- Similar Contract Awards: 5 contracts totaling €57 billion (noting apparent data anomalies discussed below)

- Similar Renewals: 15 upcoming renewals worth €341 million

- No Similar Open Tenders: This is currently the only active major housing construction procurement

The council operates within a broader UK local authority housing construction market where 3,300 similar authorities have residential development needs, collectively representing £528 billion (€625B) in related procurement activity. Successful performance on this Bedfordwell Road scheme could position contractors for future phases of Eastbourne’s housing delivery program and relationships with neighboring East Sussex councils.

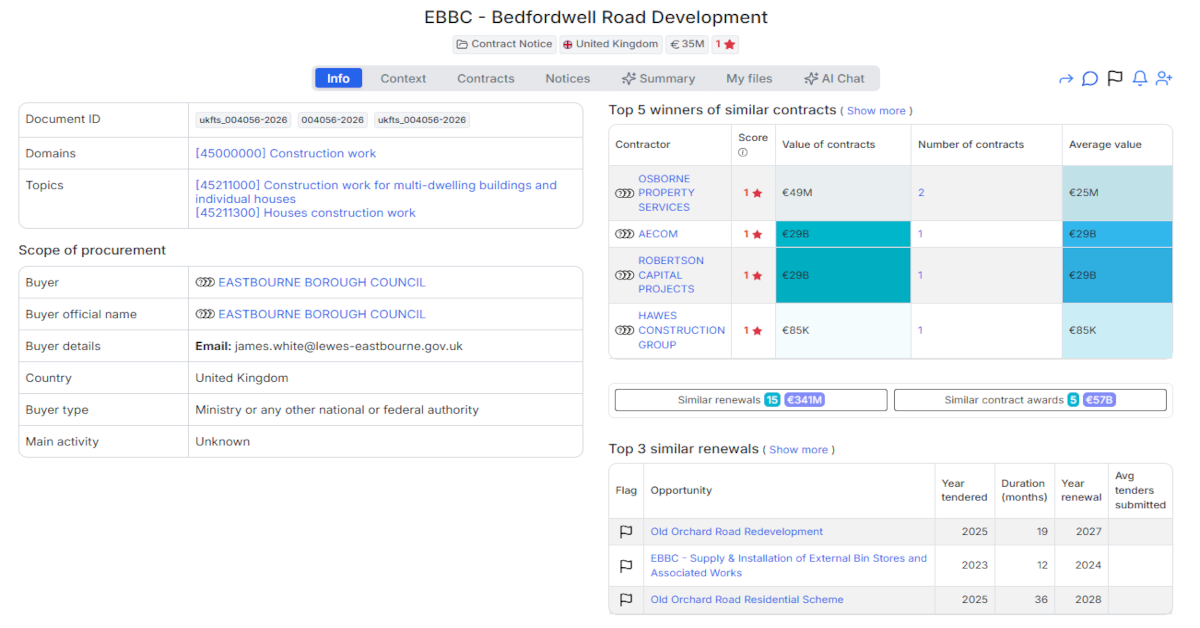

Competitive Landscape: Mixed Market with Anomalous Data

Historical contract awards for similar housing construction reveal a small number of completed projects, though data quality issues require careful interpretation.

Winners of Similar Contracts:

- CARDO SOUTH – €49M across 2 contracts (€25M average per contract)

- AECOM – €29B for 1 contract (€29B) [Data anomaly noted]

- ROBERTSON CAPITAL PROJECTS – €29B for 1 contract (€29B) [Data anomaly noted]

- HAWES CONSTRUCTION GROUP – €85K for 1 contract

Key Competitive Observations:

Data Quality Note: The reported contract values for AECOM and Robertson Capital Projects (€29 billion each) appear to be data entry or system errors, as these figures vastly exceed reasonable valuations for local authority housing projects. These anomalies likely represent misplaced decimal points or incorrect currency conversions. The realistic competitive landscape focuses on CARDO SOUTH and HAWES CONSTRUCTION GROUP.

Cardo South’s Track Record: With €49 million across 2 contracts averaging €25M each, Cardo South demonstrates proven capability delivering mid-sized housing developments for Eastbourne or similar UK authorities. This places them as the most credible historical benchmark for this £30M Bedfordwell Road scheme.

100% UK Contractor Base: All historical awards (excluding anomalous data) went to UK-based construction firms, indicating either explicit British supply chain preferences, practical requirements for local construction knowledge and building regulations compliance, or simply the competitive dynamics of UK residential construction procurement.

Scale Variation: The presence of both substantial projects (Cardo South’s €25M average) and very small contracts (Hawes Construction Group’s €85K) suggests Eastbourne procures housing construction across varying scales, from major developments to minor refurbishment or enabling works.

Commercial and Procedural Signals

Competitive Flexible Procedure:

This procurement uses the UK’s competitive flexible procedure, allowing the contracting authority to structure the competitive process with flexibility in evaluation stages, negotiation opportunities, and selection methodology. This often enables discussion with bidders to refine proposals around technical delivery, program timing, or value engineering opportunities.

Price-Based Award:

The award criteria specified as “simple description (price)” indicates this contract will be awarded primarily or entirely on pricing rather than quality considerations. For a design-and-build housing scheme, this suggests either:

- The council has very detailed technical specifications leaving limited room for quality differentiation

- Price competitiveness is the dominant selection factor

- The flexible procedure may incorporate quality checks at pre-qualification stage, with price determining the final award among qualified bidders

Bidders should prepare highly competitive pricing while ensuring full compliance with all technical, quality, and regulatory requirements embedded in the specification.

24-Month Build Program:

The two-year contract duration for 100 dwellings plus commercial and heritage components indicates an intensive construction program requiring:

- Rapid site mobilization and enabling works completion

- Efficient procurement of materials and subcontractors

- Parallel work streams to maintain program momentum

- Careful coordination of heritage refurbishment alongside new-build construction

Lot Structure and Value Discrepancy:

The tender shows an estimated total value of €35.4M but a lot value of only €7.5M. This significant discrepancy may indicate:

- The lot value represents an initial phase or portion of overall development

- Multiple lots exist beyond the single lot visible in available documentation

- Estimated total value includes options, variations, or future phases

- Data inconsistency in reporting systems

Bidders should seek clarification on the full scope covered by the advertised lot and whether additional work packages or phases are anticipated.

31-Day Procurement Window:

The deadline of February 16 provides 31 days from publication for bid preparation. For a £30M+ design-and-build scheme, this requires immediate mobilization including:

- Site visits to assess existing conditions and pump house heritage constraints

- Design team engagement for concept development

- Subcontractor and supply chain pricing

- Affordable housing delivery and shared ownership model understanding

- Remediation strategy development for former depot site

Strategic Context: Affordable Housing and Brownfield Regeneration

This Bedfordwell Road development exemplifies current UK local authority housing delivery priorities: maximizing affordable housing supply while regenerating brownfield sites and respecting heritage assets.

The Affordable Housing Focus:

With 80 of 100 dwellings designated for affordable rent, this scheme directly addresses Eastbourne’s social housing needs. The additional 20 shared ownership units provide intermediate housing options, creating a genuinely mixed-tenure community rather than purely social housing.

Brownfield Regeneration:

Transforming a former municipal depot into housing represents efficient land use, avoiding greenfield development while bringing underutilized brownfield land back into productive use. The remediation component suggests potential contamination or infrastructure challenges typical of former industrial/municipal sites.

Heritage Integration:

The requirement to repair and refurbish retained elements of the existing pump house demonstrates the council’s commitment to preserving local heritage assets within new developments. This adds complexity requiring specialist conservation skills alongside modern housebuilding expertise.

Hermix users analyzing UK housing tenders gain decisive competitive advantages. Rather than manually monitoring Find a Tender Service, researching council procurement histories, and attempting to understand local housing delivery contexts, Hermix delivers instant analysis including historical contractor performance, authority spending patterns, and renewal pipeline intelligence. The platform helps construction firms consistently qualify the right opportunities and win more public sector housing contracts across the UK’s £528 billion local authority construction market.

Practical Takeaways for Bidders

Who This Tender Suits:

- UK housebuilders with affordable housing delivery track records

- Design-and-build contractors experienced in mixed-tenure schemes

- Firms with heritage refurbishment capabilities alongside modern construction

- Companies with brownfield remediation and site enabling works expertise

- Contractors with established presence in southeast England construction markets

Critical Attention Points:

Price Competitiveness: With award based on price, your bid must be highly competitive while maintaining realistic margins for risk, program delivery, and quality compliance. Understand that lowest price wins, but ensure you can deliver profitably.

Affordable Housing Standards: The 80 rental units likely require compliance with Homes England affordable housing standards, including space standards, accessibility requirements, and energy performance criteria. Ensure full understanding of all applicable regulatory frameworks.

Heritage Sensitivity: The pump house refurbishment demands specialist conservation expertise. Partner with or employ heritage construction specialists if this isn’t your core strength. Demonstrate understanding of listed building or locally listed structure requirements if applicable.

Remediation Planning: Former depot sites typically present contamination, underground infrastructure, or foundation challenges. Conduct thorough site investigation analysis and price realistic remediation scope with appropriate contingencies.

Program Delivery: Twenty-four months for 100 dwellings requires 4+ completions monthly once construction is underway. Demonstrate robust program planning, subcontractor coordination, and materials procurement strategies to achieve this pace.

Shared Ownership Delivery: The 20 shared ownership units require understanding of this tenure model’s legal, financial, and administrative requirements. Ensure you can coordinate with shared ownership housing providers and comply with relevant schemes.

Create your free Hermix account today at https://hermix.com/sign-up/ and access AI-powered intelligence that transforms UK public sector tender analysis from hours of research into minutes of actionable insight.