A nine-month research commission assesses transport network readiness for major energy transition investments in Aberdeen City and Aberdeenshire, supporting Scotland’s net zero objectives and offshore wind sector growth.

North East Scotland Regional Transport Partnership (NESTRANS), operating through Scottish Government procurement frameworks, has published a €225,497 consultancy tender for a strategic transport infrastructure study. With a deadline of January 16, 2026, this nine-month research project will assess the scale, nature, and impact of transformational opportunities, particularly major energy transition projects, on strategic transport networks in Northeast Scotland. Supported by the Aberdeen City Region Deal, the study focuses on infrastructure readiness and resilience as the region positions itself as a hub for offshore renewable energy, advanced manufacturing, and emerging sectors including space launch operations.

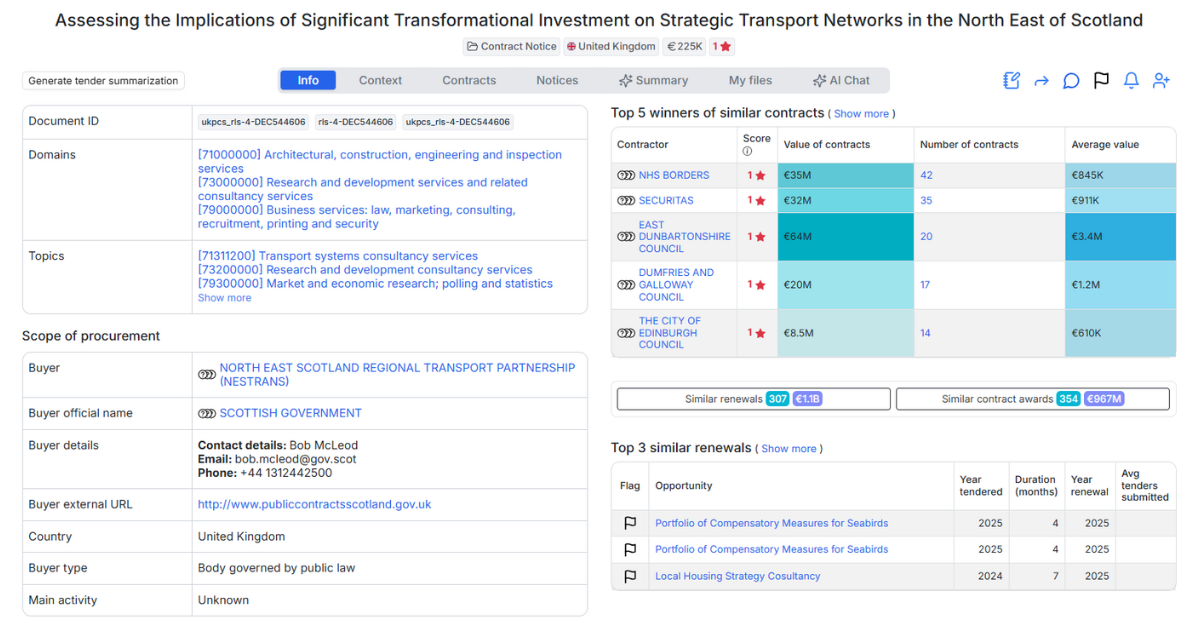

The research will build on existing regional economic and transport strategies, aligning with national net zero targets, innovation plans, and inclusive growth objectives. With 2,900 historical contracts worth €9 billion and 1,100 renewals valued at €5.2 billion approaching, this represents both immediate consultancy opportunity and insight into Scotland’s strategic infrastructure planning priorities as it transitions from oil and gas dependency toward renewable energy leadership.

Opportunity Overview

Contracting Authority: North East Scotland Regional Transport Partnership (NESTRANS)

Buyer Official Name: Scottish Government

Reference Number: ocds-r6ebe6-0000817172

Tender Title: Assessing the Implications of Significant Transformational Investment on Strategic Transport Networks in the North East of Scotland

Scope of Work:

Commission a comprehensive study to identify and assess transformational opportunities impacting strategic transport infrastructure in North East Scotland, including:

Energy Transition Projects:

- Major offshore wind developments and onshore logistics requirements

- Port infrastructure expansions supporting renewable energy sector

- Energy storage and grid connection projects

- Hydrogen production and distribution networks

- Carbon capture and storage (CCS) infrastructure

Emerging Sectors:

- Life sciences and biotechnology

- Digital infrastructure and data centers

- Advanced manufacturing

- Space launch operations (potential spaceport developments)

Research Objectives:

- Assess readiness and resilience of strategic transport networks

- Identify infrastructure gaps and capacity constraints

- Evaluate impacts on road, rail, port, and airport infrastructure

- Analyze alignment with net zero targets and inclusive growth objectives

- Inform future infrastructure investment priorities

- Support policy development and delivery planning

Methodology Requirements:

- Build on existing regional economic and transport strategies

- Integrate with neighboring regional plans

- Align with national policy frameworks including net zero targets

- Coordinate with innovation and infrastructure plans at national scale

- Ensure inclusive growth considerations

Deliverables: Research report informing future infrastructure investment, policy development, and delivery planning ensuring alignment with national objectives.

Location: North East Scotland (Aberdeen City and Aberdeenshire)

Contract Value: €225,496.94

Contract Duration: 9 months

Contract Type: Services

Procedure Type: Open

Key Dates:

- Publication: December 1, 2025

- Submission Deadline: January 16, 2026 (46 days)

- Tender Opening: January 16, 2026

Contact: Angela Hocking

Track Scottish infrastructure consultancy opportunities automatically.

Create your free Hermix account at https://hermix.com/sign-up/ for AI-powered monitoring across UK public sector research commissions, transport planning tenders, and strategic consultancy opportunities.

Strategic Context: Aberdeen’s Energy Transition and Regional Development

Northeast Scotland, centered on Aberdeen City and Aberdeenshire, faces profound economic transformation as the region transitions from decades of oil and gas dominance toward renewable energy leadership. Aberdeen, historically known as Europe’s “oil capital,” is repositioning as a global hub for offshore wind, hydrogen, and clean energy technologies.

Aberdeen City Region Deal provides £250 million investment supporting economic diversification, infrastructure development, and innovation. This NESTRANS study directly supports Region Deal objectives by ensuring transport infrastructure can accommodate transformational projects including offshore wind manufacturing facilities, port expansions, and emerging sector developments.

Energy Transition Scale: ScotWind leasing round awarded rights for up to 25GW offshore wind capacity in Scottish waters, with significant port logistics, manufacturing, and operations support requirements. Northeast Scotland’s existing energy sector expertise, port infrastructure, and skilled workforce position it strategically for offshore wind supply chain leadership, but only if transport networks can handle dramatically increased heavy cargo movements, workforce mobility, and just-in-time manufacturing logistics.

Buyer Procurement Activity:

- Total Contract Awards: 2,900 contracts worth €9 billion

- Active Tender Pipeline: 76 open tenders valued at €667 million

- Renewal Forecast: 1,100 renewals worth €5.2 billion

Consultancy and Research Services:

- Similar Contract Awards: 344 contracts totaling €965 million (average: €2.9M per contract)

- Similar Open Tenders: 22 opportunities worth €60 million

- Similar Renewals: 294 upcoming renewals worth €1 billion

Competitive Landscape: Diverse Contractor Base

Historical contract awards reveal a diverse market spanning public sector bodies, security services, and specialized consultancies, though the “similar contracts” category is broad and includes non-consultancy services.

Top Contract Winners (All Categories):

- EAST DUNBARTONSHIRE COUNCIL: €64M across 20 contracts (€3.4M average)

- NHS BORDERS: €34M across 36 contracts (€963K average)

- SECURITAS: €32M across 35 contracts (€911K average)

- DUMFRIES AND GALLOWAY COUNCIL: €20M across 17 contracts (€1.2M average)

- REVVITY: €11M across 11 contracts (€1M average)

- ARGYLL AND BUTE COUNCIL: €9.4M across 6 contracts (€1.6M average)

- MORAY COUNCIL: €8.1M across 8 contracts (€1M average)

- THE CITY OF EDINBURGH COUNCIL: €7.9M across 13 contracts (€609K average)

Key Observations:

Public Sector Presence: Multiple Scottish local authorities appear as contractors, indicating inter-governmental service agreements or shared services arrangements common in the Scottish public sector. This may reflect consultancy work delivered by in-house council expertise or collaborative research projects.

Sector Diversity: The visible contractor list includes healthcare (NHS Borders), security services (Securitas), and various councils, suggesting the “similar contracts” category is broad and not limited to transport consultancy. Actual transport planning and research specialists may not be visible in this top-10 list.

100% UK Market: All 338 visible contracts (€965M total, average €2.9M) were awarded to UK-based entities, indicating domestic market focus for strategic research and consultancy work.

Contract Size Comparison: The €225K tender value is below the historical average (€2.9M), suggesting this is a focused research study rather than multi-year framework or large-scale consultancy engagement. The nine-month duration supports this interpretation.Transport Consultancy Specialists: The actual competitive field for this transport infrastructure study will likely include UK transport planning consultancies such as Steer, WSP, Jacobs, SYSTRA, Atkins (SNC-Lavalin), and Scottish-based firms with regional transport planning expertise.

Commercial and Procedural Signals

Open Procedure Approach:

Standard open procedure (rather than restricted or negotiated) indicates a transparent, competitive process where all qualifying bidders can submit proposals. Selection based on published award criteria without negotiation stage.

Nine-Month Duration:

Timeline suggests comprehensive research study including:

- Stakeholder consultation and data gathering (2-3 months)

- Analysis and modeling (3-4 months)

- Report drafting, review, and finalization (2-3 months)

Contractors should plan for sustained engagement rather than quick desktop study.

Aberdeen City Region Deal Context:

Funding support from Region Deal indicates strategic importance and likelihood of implementation follow-through. Findings will inform substantial infrastructure investment decisions worth tens or hundreds of millions.

Policy Alignment Requirements:

Explicit requirements to align with national net zero targets, inclusive growth objectives, and innovation strategies indicate multi-dimensional analysis beyond pure transport engineering. Successful proposals will demonstrate understanding of:

- Scottish Government transport and climate policy frameworks

- Just Transition principles for energy sector workforce

- Inclusive growth ensuring benefits reach all communities

- Innovation ecosystem development supporting emerging sectors

Stakeholder Complexity:

Northeast Scotland stakeholders include:

- Aberdeen City Council and Aberdeenshire Council

- Aberdeen Harbour Board (major port expansion underway)

- Transport Scotland (national transport agency)

- Energy sector employers and industry bodies

- Community groups and environmental organizations

Effective consultation and engagement capabilities will be essential.

Practical Takeaways for Bidders

Who This Tender Suits:

- UK transport planning consultancies with Scottish experience

- Economic development and infrastructure specialists

- Firms with energy sector and net zero transition expertise

- Consultancies experienced in regional transport strategies

- Multi-disciplinary teams combining transport, economics, and policy analysis

Critical Success Factors:

Transport Planning Expertise: Demonstrate experience developing regional transport strategies, particularly for areas undergoing economic transformation. Include examples of infrastructure readiness assessments for major industrial developments.

Energy Transition Knowledge: Show understanding of offshore wind logistics requirements, port infrastructure needs for the renewable energy sector, and hydrogen economy transport implications. Aberdeen’s specific context as an energy transition hub should be evident.

Scottish Policy Familiarity: Reference Scottish Government frameworks including National Transport Strategy, Climate Change Plan, and National Planning Framework 4. Understanding of Scottish political and policy context is essential.

Stakeholder Engagement Capability: Provide methodology for consulting diverse stakeholders including local authorities, transport operators, energy companies, community groups, and national agencies. Aberdeen’s complex governance landscape requires sophisticated engagement approaches.

Data and Modeling Capabilities: Demonstrate access to transport modeling tools, economic impact assessment methodologies, and ability to integrate multiple data sources including traffic data, port logistics, energy sector forecasts, and population projections.

Deliverables Quality: Provide samples of previous strategic research reports demonstrating clear writing, effective data visualization, actionable recommendations, and policy-ready outputs suitable for Scottish Government and local authority decision-makers.

Conclusion

NESTRANS’ €225,000 transport infrastructure study represents strategically important research informing Northeast Scotland’s transition from oil and gas dependency toward renewable energy leadership. While modest in value, the study’s findings will influence infrastructure investment decisions worth hundreds of millions as Aberdeen positions itself for offshore wind manufacturing, hydrogen economy development, and emerging sectors including space launch operations.

The buyer’s 2,900 historical contracts (€9B) and 1,100 approaching renewals (€5.2B) signal mature procurement operations embedded within Scotland’s strategic economic development frameworks. For transport planning consultancies and economic development specialists seeking positioning within UK renewable energy infrastructure markets, this tender offers both immediate opportunity and relationship-building potential with key Scottish public sector decision-makers.

Hermix makes tracking UK infrastructure consultancy opportunities effortless. Access automated monitoring, competitive intelligence, and strategic insights.

Create your free account at https://hermix.com/sign-up/ and win more public sector contracts across Europe’s complex procurement landscape.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.