University Hospitals Bristol and Weston NHS Foundation Trust has issued a restricted competition for enterprise network replacement services worth £24.5 million. This procurement runs exclusively through the Crown Commercial Service Network Services 3 Framework, limiting participation to pre-qualified suppliers on Lot 2a.

Executive Summary

The Bristol & Weston NHS Purchasing Consortium (BWPC), acting on behalf of University Hospitals Bristol and Weston NHS Foundation Trust (UHBW), seeks a managed service provider for complete enterprise network infrastructure replacement. The contract spans 7 years with an option to extend for 3 additional years, valued at £24.5 million (€27.6 million). Bids closed September 1, 2025, with contract commencement planned for April 1, 2026. This procurement operates as a further competition under the Crown Commercial Service (CCS) Network Services 3 Framework Lot 2a for Local Connectivity Services. Only suppliers already appointed to this specific framework lot are eligible to participate. The network replacement program serves as a foundational element of UHBW’s Five-Year Digital Strategy, supporting the Trust’s vision for integrated, intelligent healthcare systems across all sites.

Tender Overview

Basic Information

Document ID: ukfts_051083-2025 Reference Number: BWPCIT001745 Publication Date: August 25, 2025 Deadline: September 1, 2025 (Note: The document text mentions September 24 at 12:00 pm, but the formal deadline field shows September 1, 2025) Tender Opening Date: September 1, 2025 Status: Closed Source: UK Find a Tender Service

Financial Summary

Total Estimated Value: £24,500,000 (€27,623,375.01) Contract Duration: 7 years with option to extend for 3 additional years EU Funding: No

The procurement consists of a single lot covering the complete enterprise network replacement program.

Budget Breakdown

The tender documentation does not provide detailed cost breakdowns by work category. The service encompasses design, deployment, and lifecycle support for a resilient, secure, and scalable network infrastructure across all UHBW sites.

Buyer Profile Analysis

Organization Overview

Official Name: University Hospitals Bristol and Weston NHS Foundation Trust Procurement Body: Bristol & Weston NHS Purchasing Consortium (BWPC) Contact Email: procurementtransformation@nbt.nhs.uk Procurement Email: Procurement@nbt.nhs.uk Procurement Platform: SAP Ariba Platform URL: https://service.ariba.com/supplier.aw/109549047/aw?awh=r&awssk=uy.bqbwd&dard=1

Buyer Type: Body governed by public law Main Activity: Health Country: United Kingdom Location: Trust Headquarters, Marlborough Street, Bristol BS1 3NU

Organizational Background

University Hospitals Bristol and Weston NHS Foundation Trust operates as a major acute hospital trust in the UK, serving Bristol, Weston-super-Mare, and surrounding areas.

The Bristol & Weston NHS Purchasing Consortium (BWPC) functions as a collaborative procurement organization serving NHS Trusts across the region. BWPC handles strategic sourcing and procurement activities, ensuring value for money and compliance with public sector regulations. The consortium uses the SAP Ariba e-procurement platform for all tendering processes, requiring supplier registration for platform access.

UHBW participates in the Bristol NHS Group, a collaborative initiative between local NHS organizations to deliver coordinated care across the region. The network replacement program aligns with the Group’s long-term strategic goals for integrated healthcare delivery.

Procurement History

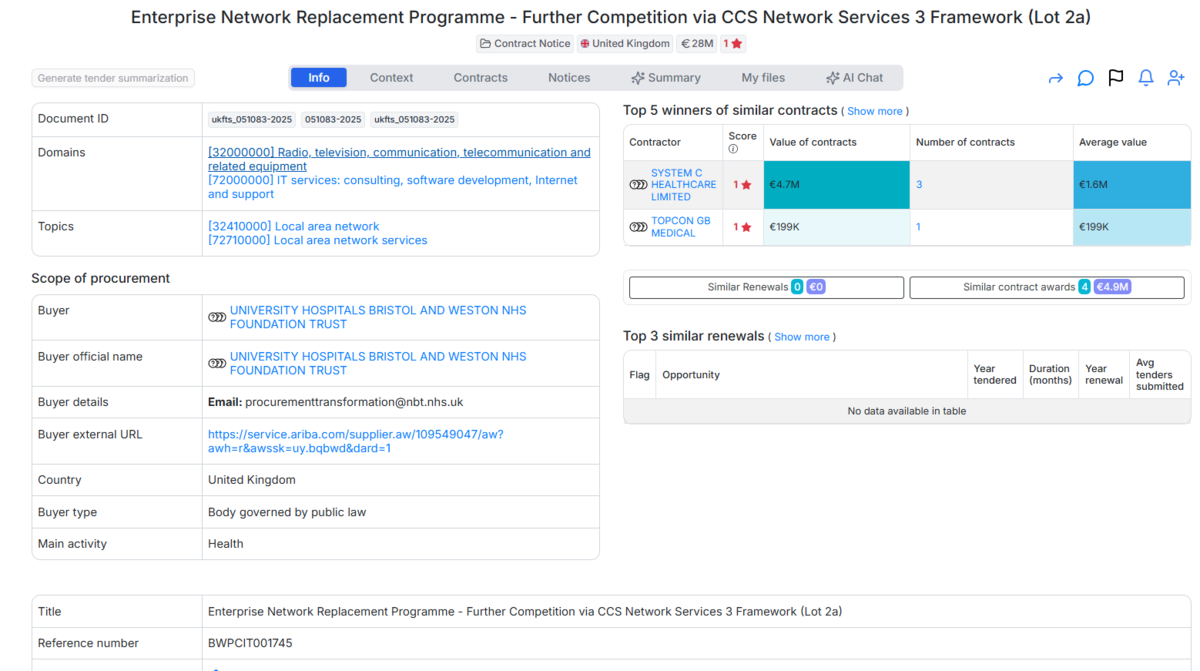

The buyer’s procurement data shows:

Previous Contract Winners:

- SYSTEM C HEALTHCARE LIMITED: €4.7M across 3 contracts, average €1.6M per contract

- TOPCON GB MEDICAL: €199K for 1 contract

Total procurement activity:

- 22 contract awards worth €15M total

- 4 similar contract awards worth €4.9M

- 1 renewal opportunity worth €846K

- No current open tenders listed

The market data indicates 3,900 other buyers with similar projects valued at €580 billion, demonstrating substantial activity in healthcare IT infrastructure across the UK public sector.

Working Relationship Indicators

BWPC manages all procurement communications through the SAP Ariba platform. The consortium issues invitations to participate using email addresses registered by suppliers on the CCS Network Services 3 Framework Lot 2a.

The tender documentation emphasizes that suppliers not listed on the CCS Network Services 3 Framework Lot 2a should not submit enquiries or attempt to participate. This strict framework compliance requirement indicates a formal, rule-based procurement approach.

The procurement follows a restricted procedure under the Public Contracts Regulations 2015, specifically using a Prior Information Notice as a call for competition under Regulation 48(5). No separate contract notice will be published beyond the initial notice.

Evaluation criteria are not disclosed in the available documentation, though the managed service scope suggests quality, technical capability, and lifecycle cost management will feature prominently in assessment.

Scope and Requirements Analysis

Service Categories

The Trust seeks a managed service covering:

Network Infrastructure Replacement: Complete replacement of existing enterprise network infrastructure across all UHBW sites

Design Services: Architecture and design of resilient, secure, and scalable network infrastructure

Deployment Services: Implementation and commissioning of new network infrastructure

Lifecycle Support: Ongoing maintenance and management throughout the contract term

The service must support UHBW’s Five-Year Digital Strategy, which outlines a vision for integrated, intelligent systems that empower clinicians and improve patient outcomes. The full strategy document is available at: https://www.uhbw.nhs.uk/assets/1/uhbw_five_year_digital_strategy_published.pdf

Technical Requirements

The tender documentation specifies requirements for:

Resilience: Infrastructure must provide high availability and failover capabilities to support critical healthcare operations

Security: Network design must meet NHS security standards and protect patient data

Scalability: Infrastructure must accommodate future growth and technology evolution

Performance: Network must deliver high-performance connectivity across all Trust sites

The specific technical standards, performance metrics, and security requirements are contained in the full competition documentation available only to eligible framework suppliers through the SAP Ariba platform.

Geographic Coverage

The network infrastructure serves all University Hospitals Bristol and Weston NHS Foundation Trust sites. The exact number of sites and specific locations are detailed in the competition documentation

Market Opportunity Assessment

Target Businesses

This procurement explicitly targets:

CCS Network Services 3 Framework Lot 2a Suppliers: Only firms already appointed to this specific framework lot qualify to participate

SAP Ariba Registration: Suppliers must be registered on BWPC’s SAP Ariba e-procurement platform

NHS Experience: Firms need understanding of NHS digital strategies, clinical workflows, and healthcare-specific network requirements

Managed Service Capability: Providers must offer complete lifecycle management, not just installation

Large-Scale Network Expertise: Experience with multi-site hospital network infrastructure

Security Credentials: Proven capability in healthcare data protection and NHS security standards

The framework restriction significantly narrows the eligible supplier pool. Firms not on CCS Network Services 3 Framework Lot 2a cannot participate regardless of capability.

Competition Analysis

The framework-based approach limits direct competition to suppliers already vetted and appointed to CCS Network Services 3 Framework Lot 2a. The number of eligible suppliers is not disclosed in the tender documentation but can be found on the Crown Commercial Service website: https://www.crowncommercial.gov.uk/agreements/RM6116:2a/lot-suppliers

Market data shows:

- 3,900 buyers with similar network infrastructure projects worth €580 billion

- No similar open tenders from this buyer

- 4 similar historical contract awards from this buyer worth €4.9M

- SYSTEM C HEALTHCARE LIMITED dominates historical awards with €4.7M across 3 contracts

The substantial contract value (£24.5M) and long duration (7-10 years) make this a significant opportunity within the NHS network services market. The buyer’s lack of current open tenders suggests focused procurement activity rather than continuous tendering.

Barriers to Entry

Framework Eligibility: The absolute requirement for CCS Network Services 3 Framework Lot 2a appointment eliminates all other suppliers

Platform Registration: Suppliers must register and operate through SAP Ariba

NHS Knowledge: Understanding of NHS digital strategies, clinical workflows, and healthcare-specific requirements

Scale: The £24.5M value and multi-site scope require substantial organizational capacity

Security Clearance: Healthcare data protection requirements and NHS security standards compliance

Long-Term Commitment: 7-year base term with potential 3-year extension demands sustained capability

Strategic Insights

Key Success Factors

Successful bids will demonstrate:

- Previous NHS network infrastructure projects of comparable scale and complexity

- Understanding of UHBW’s Five-Year Digital Strategy and how network infrastructure enables digital healthcare transformation

- Experience with multi-site hospital environments and clinical workflow requirements

- Managed service capability covering design, deployment, and lifecycle support

- Security expertise specific to healthcare data protection and NHS standards

- Integration capability with existing healthcare IT systems and future digital initiatives

- Resilience planning and high-availability architecture for critical healthcare operations

- Scalability approach to accommodate future growth and technology evolution

The tender documentation emphasizes the network’s role as a “foundational enabler” of UHBW’s digital strategy. Bidders should articulate how network infrastructure supports clinical outcomes and operational efficiency, not just technical specifications.

Risk Assessment

Potential challenges include:

Multi-Site Complexity: Deploying across multiple hospital locations while maintaining operational continuity presents coordination and timing challenges. Healthcare environments cannot tolerate extended network outages.

Clinical Operations Continuity: Network replacement must occur without disrupting patient care or clinical systems. Implementation planning requires detailed understanding of hospital operations and clinical workflows.

Security Requirements: NHS networks face constant cybersecurity threats. Infrastructure must meet stringent security standards while enabling clinical flexibility.

Technology Evolution: A 7-10 year contract must accommodate rapid technology changes in healthcare IT, IoT medical devices, and digital health applications.

Integration Requirements: The network must support existing clinical systems while enabling future digital initiatives outlined in UHBW’s strategy.

Bristol NHS Group Coordination: As part of the Bristol NHS Group collaborative initiative, network design decisions affect partner organizations and require coordination beyond UHBW alone.

Framework Constraints: Operating within CCS framework terms and conditions limits flexibility in contract negotiation and commercial arrangements.

Regulatory Considerations

All work must comply with:

- NHS Digital Technology Assessment Criteria (DTAC)

- NHS security standards and data protection requirements

- Healthcare-specific network resilience standards

- Public Contracts Regulations 2015

- CCS Network Services 3 Framework terms and conditions

- NHS data security and protection toolkit requirements

Actionable Recommendations

For Potential Bidders

Note: This tender closed September 1, 2025. The following recommendations apply to similar future opportunities.

Suppliers interested in future NHS network infrastructure tenders should:

- Obtain appointment to CCS Network Services 3 Framework Lot 2a before opportunities arise, as framework eligibility is non-negotiable

- Register on SAP Ariba platforms used by NHS procurement consortia

- Study UHBW’s Five-Year Digital Strategy (available at https://www.uhbw.nhs.uk/assets/1/uhbw_five_year_digital_strategy_published.pdf) to understand how network infrastructure enables broader digital transformation

- Build case studies from NHS network infrastructure projects, emphasizing clinical outcomes and operational improvements

- Develop relationships with Bristol NHS Group organizations to understand regional coordination requirements

- Prepare evidence of managed service capability covering design, deployment, and multi-year lifecycle support

- Document security credentials specific to healthcare data protection

- Calculate total cost of ownership models suitable for 7-10 year contracts with technology refresh requirements

- Monitor the CCS Network Services 3 Framework for renewal cycles and additional lot appointments

For Industry Observers

This tender reveals several significant trends:

Framework Dominance in NHS IT Procurement: The exclusive use of CCS frameworks for major IT contracts continues to consolidate market access. Suppliers without framework appointments cannot access opportunities regardless of capability or pricing.

Managed Service Model Preference: NHS trusts increasingly prefer comprehensive managed services over traditional project-based procurement. This shifts commercial models from capital expenditure to operational expenditure over extended contract terms.

Digital Strategy Integration: Network infrastructure procurement connects explicitly to broader digital transformation strategies. Technical specifications alone are insufficient. Suppliers must articulate how infrastructure enables clinical and operational outcomes.

Collaborative Procurement Growth: BWPC’s role demonstrates continued growth of procurement consortia serving multiple NHS organizations. This trend concentrates buying power and standardizes approach across regions.

Long Contract Terms: The 7-10 year duration reflects NHS desire for stability and lifecycle management partnerships. This favors larger suppliers with balance sheets supporting long-term commitments.

Related Opportunities

The tender documentation references a corrigendum published August 29, 2025 (Document ukfts_052371-2025). Interested parties should review both the original notice and corrigendum for complete requirements.

The buyer’s procurement profile shows 1 renewal opportunity worth €846K, suggesting additional upcoming procurement activity.

Similar opportunities exist with 3,900 other buyers in comparable sectors, with total market value of €580 billion across the UK public sector. The NHS Digital Transformation agenda drives consistent demand for network infrastructure modernization across trusts nationwide.

Suppliers should monitor:

- CCS Network Services 3 Framework for contract renewals and additional lot appointments

- BWPC procurement notices for related infrastructure opportunities

- Bristol NHS Group member organizations for coordinated procurement activities

- NHS Digital Transformation funding announcements driving regional infrastructure programs

Want to see the full documentation and other relevant public tenders, sign-up for free on Hermix, here: https://hermix.com/sign-up/

No credit card required, not questions asked.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.