Mutua Balear, Spain’s workplace accident and occupational disease mutual insurance organization, has launched a €1,027,772.19 tender for building cleaning services across its facilities. This 24-month contract divides into two geographic lots: Balearic Islands and Peninsula operations (€802,064.38) and Canary Islands operations (€225,707.81). Published on 2 September 2025 with applications due 26 September 2025, the open procurement procedure uses quality and price evaluation criteria. The tender excludes hospital facilities from the scope, focusing on standard office and administrative buildings. With historical procurement data showing similar contract values and established supplier relationships, this opportunity targets professional cleaning companies with multi-regional capabilities and experience serving public sector organizations.

Understanding the Tender Framework

This procurement operates under an open procedure, published on 2 September 2025 with a 24-day application window closing 26 September 2025. Tender opening is scheduled for 14 October 2025, providing transparency in the evaluation process. The contract carries document ID 00570849-2025 and reference number 2025-SES-058, sourced through TED (Tenders Electronic Daily).

The 24-month contract duration provides medium-term stability for both buyer and suppliers, allowing for operational consistency while maintaining reasonable contract management cycles. The evaluation criteria combine quality and price considerations, indicating Mutua Balear seeks both competitive costs and proven service delivery capabilities. Spanish language requirement for offers reflects the domestic nature of the services and regulatory environment.

The contract is not financed with EU funds, indicating direct organizational funding for cleaning services operations. The service-based nature focuses on ongoing operational support rather than capital procurement, requiring suppliers with established service delivery capabilities and staff management systems.

Understanding the Buyer Organization

Mutua Balear operates as the workplace accident and occupational disease mutual insurance organization number 183 within Spain’s social security system. The organization functions as a body governed by public law with primary activity in general public services. Contact is maintained through contratacion@mutuabalear.es and phone +034 971213423, with additional information available at http://www.mutuabalear.es.

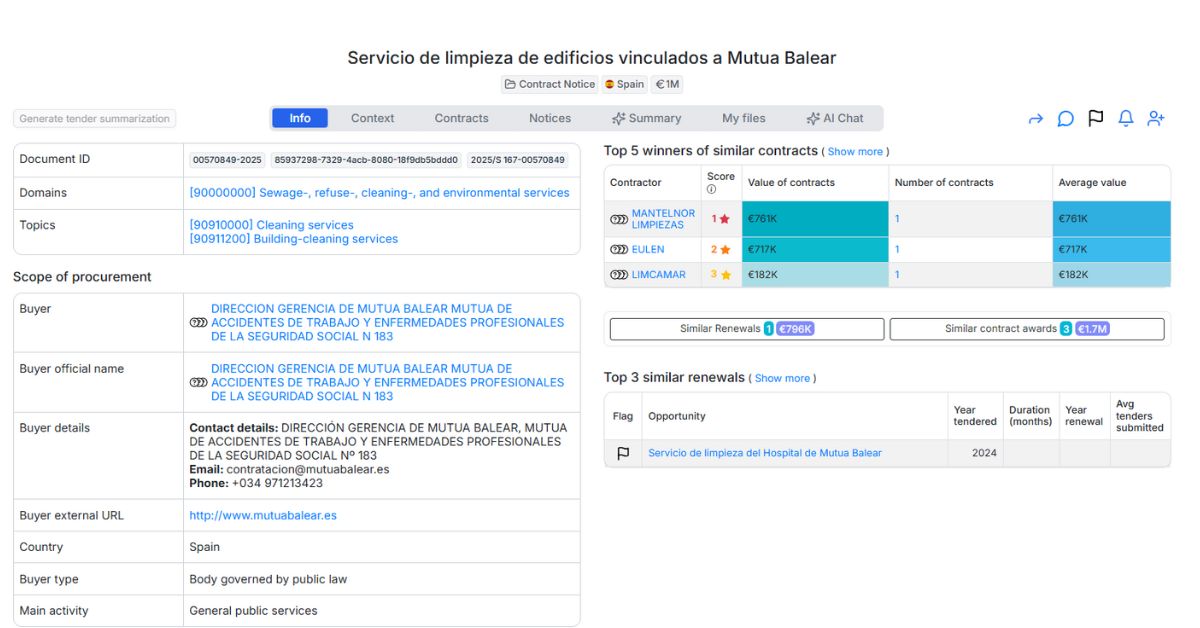

The procurement context reveals moderate but consistent market activity from Mutua Balear. The organization currently has 2 open tenders worth €1.2M total, indicating ongoing procurement operations. Historical data shows 27 renewals worth €25M and 56 contract awards totaling €8.9M, demonstrating established procurement patterns and organizational stability. The organization has completed 3 similar contract awards worth €1.7M, with 1 similar renewal worth €796K, indicating established cleaning service requirements and renewal patterns.

Mutua Balear’s supplier base shows established relationships with professional cleaning service providers. Historical contractors include MANTELNOR LIMPIEZAS (€761K for 1 contract), EULEN (€717K for 1 contract), and LIMCAMAR (€182K for 1 contract). All identified contractors operate from Spain, indicating preference for domestic suppliers with direct operational capability. The average contract value of €553K across 3 contracts aligns closely with the current tender’s structure and scope.

The broader market context shows 1.7K other buyers with similar projects totaling €15B, positioning Mutua Balear within a substantial sector-wide market for institutional cleaning services. This indicates established competitive markets and supplier capabilities for public sector cleaning contracts.

Comprehensive Service Requirements

The tender specifies cleaning services for buildings linked to Mutua Balear, explicitly excluding hospital facilities from the scope. The contract covers both ordinary and extraordinary cleaning services plus complementary services for Mutua Balear installations. This indicates requirements beyond basic cleaning to include specialized or periodic deep cleaning and additional facility maintenance support services.

Lot 1 covers cleaning services for the Balearic Islands (except hospital) and Peninsula operations, valued at €802,064.38. Performance locations specified as Eivissa y Formentera, Mallorca, and Menorca require suppliers to provide services across the complete Balearic archipelago. The Peninsula component suggests additional mainland Spanish facilities requiring coordinated service delivery.

Lot 2 addresses cleaning services for Canary Islands operations, valued at €225,707.81. Despite the lot description specifying Canary Islands, the performance location is listed as Eivissa y Formentera, Mallorca, and Menorca, which appears to be a documentation error in the tender notice. The separate lot structure indicates distinct operational requirements or supplier coordination needs for different geographic regions.

Both lots use Price and Quality as award criteria, indicating evaluation will balance cost competitiveness with service delivery capabilities, staff qualifications, and operational procedures. The multi-regional structure requires suppliers to demonstrate capacity for coordinated service delivery across island locations and potentially mainland facilities.

Market Positioning and Competition Analysis

The professional cleaning services market for mutual insurance organizations demonstrates specific competitive characteristics. Mutua Balear’s historical contractor base shows established relationships with major Spanish cleaning companies capable of multi-regional service delivery. The quality and price evaluation approach balances cost considerations with service reliability requirements, crucial for maintaining professional office environments.

Market entry requires suppliers to demonstrate capability for multi-regional operations across island locations, requiring either direct presence or established partnerships in the Balearic Islands and potentially Canary Islands. The 24-month contract duration provides sufficient stability for suppliers to establish operational infrastructure while allowing for performance-based relationship development.

The contract values indicate substantial operational scope, with Lot 1 representing the larger commitment at €802K over 24 months (approximately €33K monthly) and Lot 2 at €226K over 24 months (approximately €9K monthly). These scales suggest requirements for professional cleaning companies with established staff and operational systems rather than small local providers.

Strategic Analysis of the Opportunity

Success factors emerge from the documented requirements and market context. The quality and price evaluation indicates suppliers must balance competitive pricing with demonstrated service delivery capabilities, staff training programs, and operational reliability. The 24-day application window provides reasonable time for comprehensive bid preparation and partnership development if needed.

The multi-regional nature requires suppliers to demonstrate operational coordination capabilities across island locations. The exclusion of hospital facilities indicates focus on standard office cleaning requirements rather than specialized medical facility protocols, potentially broadening the pool of qualified suppliers.

The established pattern of similar contract awards (€1.7M across 3 contracts) and renewals (€796K for 1 renewal) suggests successful suppliers can expect potential for contract extensions or similar future opportunities. The average contract value of €553K aligns well with current lot sizes, indicating consistent procurement patterns.

Actionable Guidance for Market Participants

Interested suppliers should immediately verify their capabilities for multi-regional service delivery across the specified island locations. The combination of Balearic Islands, Peninsula, and potentially Canary Islands operations requires significant logistical coordination and local presence or partnerships.

The quality and price evaluation approach suggests suppliers should prepare comprehensive service delivery documentation demonstrating staff training, operational procedures, quality control systems, and cost-effective service delivery. Evidence of successful public sector cleaning contracts and regulatory compliance will be important evaluation factors.

The 26 September 2025 deadline requires preparation of Spanish-language bid documentation within the 24-day window. Suppliers should contact Mutua Balear directly at contratacion@mutuabalear.es for detailed specifications and technical requirements not included in the basic tender notice.

Market Context and Related Opportunities

This procurement operates within a substantial market for institutional cleaning services, as indicated by the 1.7K similar buyers with €15B total project value. The mutual insurance organization context suggests potential for similar opportunities with other mutual organizations within Spain’s social security system.

The established renewal pattern (1 renewal worth €796K) indicates successful suppliers can expect potential for contract extensions based on performance. Mutua Balear’s consistent procurement activity (56 total contract awards worth €8.9M) suggests ongoing service requirements beyond this specific tender.

This tender represents an opportunity for qualified cleaning service providers to establish relationships with Spain’s workplace mutual insurance system while demonstrating multi-regional service delivery capabilities across strategically important island and mainland locations.

Want to see the full documentation and other relevant public tenders, sign-up for free on Hermix, here: https://hermix.com/sign-up/

No credit card required, not questions asked.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.