Infraestruturas de Portugal has launched a €21,500,000 tender for the development and certification of STM (Sistema de Gestão de Tráfego – Traffic Management System) across two lots. Published on 2 September 2025 with applications due 22 September 2025, this open procurement procedure uses quality and price evaluation criteria with EU funding support. Lot 1 focuses on the Lisbon Metropolitan Area (€14,000,000) while Lot 2 covers Extra-Regional NUTS 3 territories (€7,500,000). The 20-day application window and Portuguese language requirement target established engineering consultancy firms with railway infrastructure expertise. With Infraestruturas de Portugal’s extensive procurement history showing €22B in total contract awards and strong relationships with specialized engineering consultants, this opportunity represents significant potential for firms specializing in railway traffic management systems and certification services.

Understanding the Tender Framework

This procurement operates under an open procedure, published on 2 September 2025 with applications due 22 September 2025, providing a 20-day window for bid preparation. Tender opening is scheduled for 23 September 2025, one day after the deadline. The contract carries document ID 00570728-2025 and reference number 10020551, sourced through TED (Tenders Electronic Daily).

The contract duration is not specified in the documentation, indicating this information will be detailed in the full tender specifications. The evaluation criteria combine quality and price considerations, showing Infraestruturas de Portugal seeks both competitive costs and proven technical capabilities. Portuguese language requirement for offers reflects domestic procurement requirements and technical documentation needs.

The contract benefits from EU funding support, indicating alignment with European infrastructure development programs. The service-based nature focuses on technical development and certification rather than physical construction, requiring suppliers with specialized engineering expertise and certification capabilities.

Understanding the Buyer Organization

Infraestruturas de Portugal operates as Portugal’s national railway infrastructure manager, functioning as a body governed by public law with primary activity in general public services. The organization maintains contact through publicar.dcl@infraestruturasdeportugal.pt and phone +351 212879000, with additional information available at https://www.infraestruturasdeportugal.pt.

The procurement context reveals substantial and consistent market activity from Infraestruturas de Portugal. The organization currently has 17 open tenders worth €160M total, demonstrating extensive ongoing procurement operations. Historical data shows 724 renewals worth €6.9B and 2.3K contract awards totaling €22B, indicating Infraestruturas de Portugal operates as a major procurement entity within Portugal’s infrastructure sector.

The organization has completed 494 similar contract awards worth €756M, with 190 similar renewals worth €230M, showing established patterns in engineering consultancy procurement. This data suggests successful suppliers face strong potential for future projects and contract renewals based on performance.

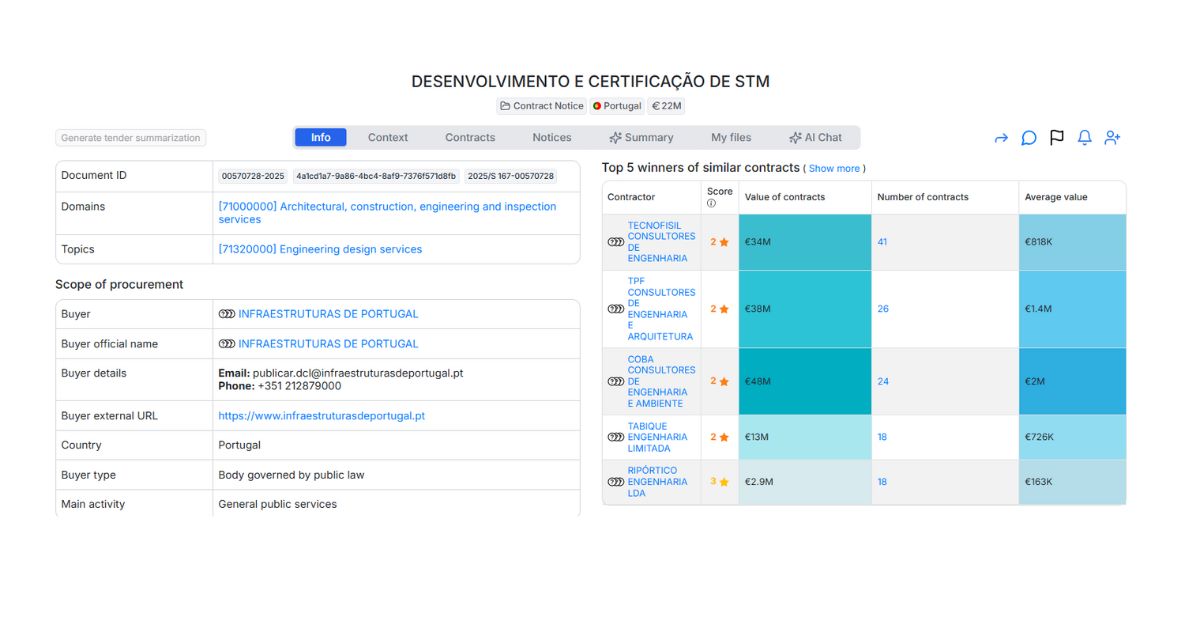

Infraestruturas de Portugal’s supplier base shows established relationships with specialized engineering consultancy providers. Top contractors include COBA CONSULTORES DE ENGENHARIA E AMBIENTE (€48M across 24 contracts), TPF CONSULTORES DE ENGENHARIA E ARQUITETURA (€38M across 26 contracts), and TECNOFISIL CONSULTORES DE ENGENHARIA (€33M across 40 contracts). Contractor data shows primarily Portuguese suppliers (448 contracts worth €633M) with some Spanish (30 contracts worth €104M), Swiss (2 contracts worth €18M), French (4 contracts worth €963K), and US suppliers (1 contract worth €895K).

The broader market context shows 858 other buyers with similar projects totaling €5.2B, positioning this procurement within a substantial European market for railway infrastructure engineering services.

Comprehensive Service Requirements

The tender specifies development and certification of STM (Sistema de Gestão de Tráfego – Traffic Management System) across two geographic divisions. The basic tender documentation provides limited technical details, indicating comprehensive specifications are contained in the full tender documents available through the provided links.

Lot 1 addresses STM development and certification for the Lisbon Metropolitan Area, valued at €14,000,000. Performance location specification as “Area Metropolitana de Lisboa” indicates work focused on Portugal’s capital region and surrounding metropolitan infrastructure. The higher value allocation suggests more complex technical requirements or larger geographic coverage within the metropolitan area.

Lot 2 covers STM development and certification for Extra-Regional NUTS 3 territories, valued at €7,500,000. The “Extra-Regio NUTS 3” designation typically refers to territories not belonging to any specific region at NUTS 2 level, often including special administrative areas or cross-border territories. This lot structure indicates specialized requirements for areas outside standard regional classifications.

Both lots use Quality and Price as award criteria, indicating evaluation will balance technical capabilities with cost competitiveness. The substantial contract values suggest comprehensive system development including design, implementation planning, testing procedures, and formal certification processes required for railway traffic management systems.

Market Positioning and Competition Analysis

The engineering consultancy market for railway infrastructure demonstrates specific competitive characteristics based on documented procurement history. Infraestruturas de Portugal’s established contractor base shows relationships with major Portuguese and international engineering firms capable of complex infrastructure projects. The quality and price evaluation approach balances technical expertise requirements with cost considerations.

Market entry requires suppliers to demonstrate capabilities in railway traffic management system development and certification processes. The EU funding support indicates compliance with European railway standards and procurement regulations will be required. The Portuguese language requirement suggests local presence or partnerships will be advantageous for project coordination and stakeholder communication.

The substantial contract values indicate opportunities for major engineering consultancy firms with established railway expertise. The two-lot structure allows for specialization based on geographic focus or technical capabilities, though suppliers could potentially bid for both lots if they demonstrate appropriate capacity.

Strategic Analysis Based on Documentation

Success factors emerge from the documented requirements and procurement history. The quality and price evaluation indicates suppliers must balance competitive pricing with demonstrated technical capabilities in railway traffic management and certification processes. The 20-day application window requires suppliers to have established capabilities and documentation ready for comprehensive bid preparation.

The established pattern of contract awards (494 similar awards worth €756M) and renewals (190 renewals worth €230M) suggests successful suppliers face strong potential for ongoing relationships and future project opportunities. The average contract values ranging from €163K to €2.4M among top contractors indicate diverse project scales and specialization opportunities.

The EU funding context indicates alignment with European railway development programs, potentially creating opportunities for broader European market access for successful suppliers.

Actionable Guidance

Based on the documented requirements, interested suppliers should verify their capabilities in railway traffic management system development and certification processes. The Portuguese language requirement and local performance locations suggest suppliers should establish appropriate local partnerships or capabilities for effective project delivery.

The quality and price evaluation approach indicates suppliers should prepare comprehensive technical documentation demonstrating railway expertise while presenting competitive pricing strategies. Evidence of successful STM development projects and certification experience will be important evaluation factors.

The 22 September 2025 deadline requires preparation of Portuguese-language bid documentation within the 20-day window. Suppliers should contact Infraestruturas de Portugal directly at publicar.dcl@infraestruturasdeportugal.pt for detailed technical specifications and requirements not included in the basic tender notice.

Market Context and Related Opportunities

This procurement operates within the broader European railway infrastructure development market, as indicated by the 858 similar buyers with €5.2B total project value. The substantial renewal activity (190 renewals worth €230M) indicates ongoing infrastructure development creating sustained business opportunities beyond this specific tender.

The documented contractor relationships demonstrate opportunities for established engineering consultancy firms specializing in railway infrastructure. Companies like COBA, TPF, and TECNOFISIL represent successful long-term partnerships with average contract values ranging from €834K to €2M, indicating consistent procurement patterns in the infrastructure engineering sector.

This tender represents an opportunity for qualified engineering consultancy firms to establish or strengthen relationships with Portugal’s national railway infrastructure manager while demonstrating capabilities in traffic management system development within the European railway development context.

Want to see the full documentation and other relevant public tenders, sign-up for free on Hermix, here: https://hermix.com/sign-up/

No credit card required, not questions asked.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.