We’ve cleaned up and analyzed the Financial Transparency System (FTS) data, and we’re proud to deliver the insights on European Commission spending patterns. Our analysis reveals important changes in procurement opportunities that will probably change how businesses approach the EU market.

The €50 Billion Reality Check

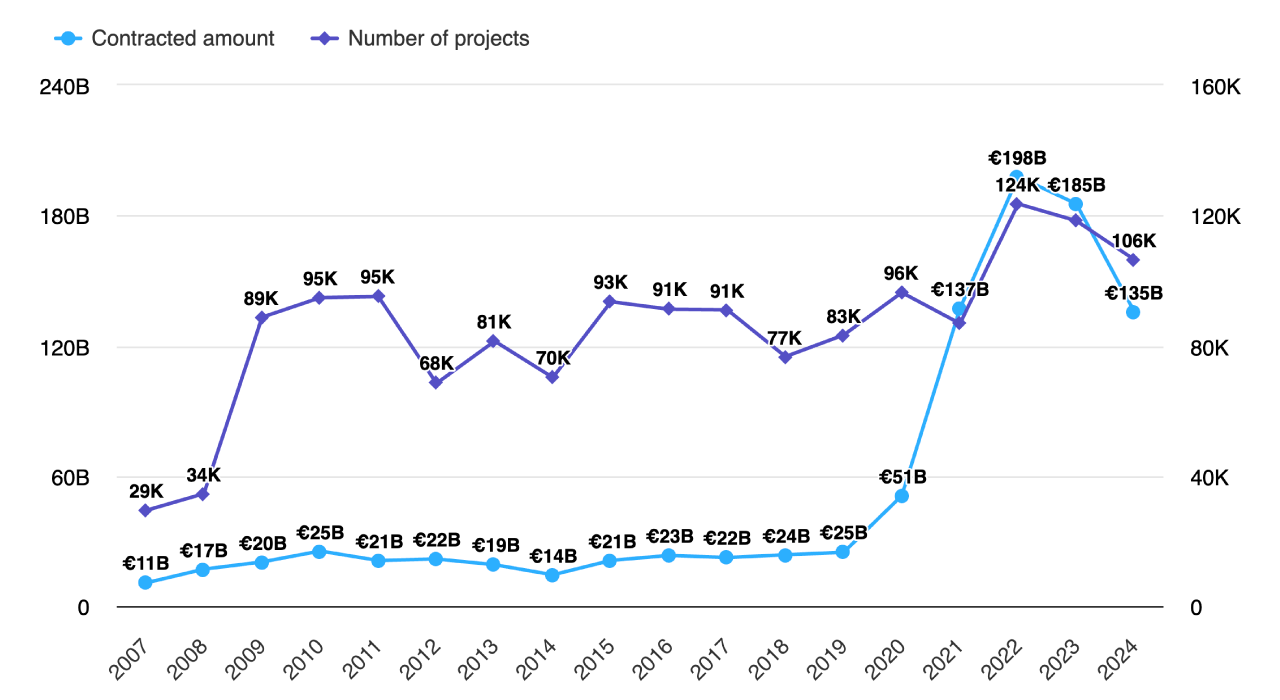

European Commission spending dropped from €185.3 billion in 2023 to €135.5 billion in 2024, representing a massive €49.9 billion decrease. This 26.9% decline marks the end of the pandemic-era spending surge that peaked at €197.8 billion in 2022.

It is interesting to note the data reveals a fundamental shift in EU priorities, not only numbers getting smaller, moving from emergency recovery programs to strategic long-term investments. Companies that understand these patterns will capture the opportunities others miss.

The European Commission spending decline primarily reflects the winding down of Recovery and Resilience Facility programs (RRF). Action Grants, historically the largest funding category, fell €7.5 billion from €32.3 billion to €24.8 billion. This represents a 23.3% decrease in the category that has dominated EU funding for the past three years.

However, the performant public procurement teams are already pivoting to the sectors experiencing explosive growth. The data shows clear winners emerging from this transition.

Construction Contracts: The €500 Million Opportunity

Building contracts exploded by 444%, jumping from €112.7 million in 2023 to €613.0 million in 2024. This €500.3 million increase represents the largest construction spending surge since the infrastructure boom of 2017-2018.

The growth isn’t random. It reflects the EU’s strategic shift toward physical infrastructure that supports digital transformation and green transition goals. Projects range from data center construction to renewable energy facilities and smart building implementations across member states.

For construction companies and their suppliers, this represents immediate opportunities. The spending pattern suggests sustained growth rather than a one-time spike. Historical data shows that when EC construction spending crosses the €600 million threshold, it typically maintains that level for multiple years.

The geographic distribution of these contracts spans all major EU markets, with particular concentration in Eastern European member states implementing digital infrastructure upgrades. Companies with experience in government construction projects should prioritize EU tender monitoring in this sector.

Research and Development: Innovation Investment Surge

Research and development contracts surged 408%, reaching €539.5 million in 2024 compared to €106.2 million in 2023. This €433.3 million increase signals the EU’s commitment to maintaining technological competitiveness through direct R&D investment.

The spending pattern aligns with the European Innovation Agenda and reflects priorities in artificial intelligence, quantum computing, biotechnology, and clean energy research. Unlike previous years where R&D spending fluctuated based on program cycles, the 2024 increase suggests a structural shift toward sustained innovation investment.

Research institutions, technology companies, and consulting firms specializing in innovation should note that this spending category has historically shown strong year-over-year growth once it crosses the €500 million threshold. The EU’s multi-annual financial framework supports continued expansion in this area through 2027.

The contracts span both fundamental research and applied development projects, with particular emphasis on technologies that support the Green Deal and Digital Decade objectives. Companies with proven track records in collaborative research projects are well-positioned to capture these opportunities.

Operating Grants: The €3 Billion Transformation

Operating grants experienced the most dramatic growth, increasing by 1,027% from €288.4 million to €3.25 billion. This €2.96 billion increase represents a fundamental change in how the EU supports ongoing operations of key organizations and initiatives.

This category includes funding for agencies, partnerships, and long-term operational support for strategic projects & initiatves. The massive increase suggests the EU is moving from project-based funding to sustained operational support for critical functions.

The growth reflects several strategic priorities: strengthening EU agencies’ operational capacity, supporting digital transformation initiatives, and maintaining operational continuity for programs transitioning from emergency funding to regular budget lines.

Organizations providing operational support services, management consulting, and ongoing technical assistance should prioritize this category. The European Commission spending pattern indicates sustained growth rather than temporary increases, making it attractive for companies seeking predictable revenue streams.

IT Services: Steady Growth in Digital Infrastructure

IT services and telecommunication charges grew by €108 million, from €1.099 billion to €1.207 billion, representing a 9.8% increase. While less dramatic than other categories, this growth continues a consistent upward trend that began in 2019.

The spending reflects the EU’s ongoing digital transformation efforts, including cybersecurity improvements, data management systems, and digital service delivery platforms. The steady growth pattern suggests reliable opportunities for IT service providers.

Historical analysis shows IT spending has grown consistently from €787.6 million in 2019 to €1.207 billion in 2024, representing a 53% increase over five years. This consistent growth makes IT services one of the most predictable opportunity areas for companies targeting EU contracts.

The contracts span cloud services, cybersecurity solutions, software development, and digital infrastructure management. Companies with experience in government IT projects should expect continued growth in this sector through 2025.

Strategic Implications for Business Development

The data reveals three critical insights for companies targeting EU procurement:

Pivot from declining sectors: Action Grants, while still the largest category, are declining. Companies heavily dependent on these grants should diversify into growth sectors immediately.

Focus on infrastructure and innovation: The combined growth in construction, R&D, and IT services represents over €1 billion in new opportunities. These sectors align with long-term EU strategic priorities.

Prepare for sustained growth: Unlike previous spending spikes driven by crisis response, the 2024 patterns suggest structural changes that will persist through the current budget cycle.

Market Intelligence Advantage

This analysis aims to show what Hermix provides to business development teams: real-time insights into where European Commission spending is shifting, helping clients identify emerging opportunities before competitors recognize the trends.

The €1 billion in combined growth across construction, R&D, and operating grants represents concrete targets for procurement strategies. Companies using this intelligence can adjust their business development focus months ahead of competitors still chasing declining opportunities.

Ready to see the full breakdown? All this data is live in Hermix, updated with 2024 figures. You can filter by sector, track yearly trends, and identify exactly where opportunities are growing.

Apply for your trial account right now: https://hermix.com/sign-up/