An 84-month framework across five regional lots signals strategic NHS investment in reducing health inequalities for children with special educational needs through school-based sight testing and spectacle dispensing.

Create a free account and see the full public tender details here: https://app.hermix.com/opportunities/ukcf_7736a3c3-2b23-4327-a6d8-20fa5c6a813f-877944

NHS South, Central and West Commissioning Support Unit has published a £13.5 million (€18.9M) tender for comprehensive sight testing and spectacle dispensing services targeting children and young people with Special Educational Needs and Disabilities (SEND) across southeast England. With a February 6, 2026 deadline and contracts running for up to seven years, this procurement represents one of the UK’s most significant investments in accessible ophthalmology services for vulnerable young people.

The framework encompasses five geographic lots covering Thames Valley, Hampshire and Isle of Wight, Kent and Medway, Surrey, and Sussex, providing services directly within Special Educational Settings rather than requiring families to navigate traditional high-street optometry. The commissioning unit’s procurement history of 987 contracts worth £1.7 billion (€2.0B), combined with 119 upcoming renewals valued at £2.5 billion (€3B), positions this as part of a broader NHS commitment to reducing health inequalities through innovative service delivery models.

Opportunity Overview

Contracting Authority: NHS South, Central and West Commissioning Support Unit

Reference Number: C401955

Tender Title: Sight Testing and Dispensing of Spectacles to Children and Young People in Special Educational Settings across the South East

Service Scope:

Providers will deliver annual sight testing and spectacle dispensing services directly within Special Educational Settings for children and young people with autism and/or learning disabilities. Evidence from the 2021 NHS England Proof of Concept programme demonstrated this in-school delivery model is both effective and impactful for populations facing significant barriers to accessing routine eye care.

Service Components:

- Annual sight tests for eligible SEND children in school settings (unless clinically inappropriate)

- Spectacle dispensing and fitting services delivered on-site

- Timely identification and management of vision needs

- Coordination with educational staff and healthcare professionals

- Reduction of health inequalities through accessible service delivery

Geographic Coverage (5 Lots):

Lot 1: Thames Valley

Buckinghamshire, Oxfordshire, Berkshire West, Berkshire East

- 5-year value: £2,355,000

- 7-year value (with extension): £3,297,000

Lot 2: Hampshire and Isle of Wight

Including North East Hampshire

- 5-year value: £2,180,000

- 7-year value (with extension): £3,052,000

Lot 3: Kent and Medway

- 5-year value: £3,265,000

- 7-year value (with extension): £4,571,000

Lot 4: Surrey

Including Surrey Heath and Farnham

- 5-year value: £1,625,000

- 7-year value (with extension): £2,275,000

Lot 5: Sussex

- 5-year value: £1,980,000

- 7-year value (with extension): £2,772,000

Total Framework Value: £11,405,000 (5 years) / £15,967,000 (with 2-year extension) = €18,859,700.93

Contract Duration: 60 months initial term with optional 24-month extension (84 months total)

Service Commencement: 2026

Procedure Type: Open procedure (above threshold)

Key Dates:

- Publication: January 5, 2026

- Submission Deadline: February 6, 2026 at 12:00 noon (32 days from publication)

- Tender Opening: February 6, 2026

EU Funding: No

Submission Portal: Atamis e-procurement system at https://health-family.force.com/s/Welcome

Looking to win NHS healthcare service contracts faster? Create your free Hermix account at https://hermix.com/sign-up/ and access AI-powered tender analysis, competitive intelligence, and automated monitoring across the UK’s NHS procurement market.

Authority Profile: NHS Commissioning and SEND Service Innovation

NHS South, Central and West Commissioning Support Unit operates as a specialized procurement and commissioning body serving multiple Integrated Care Boards (ICBs) across southeast England. This tender supports six ICBs currently, consolidating to four from April 1, 2026, through planned mergers: NHS Thames Valley ICB, Hampshire and Isle of Wight ICB, Kent and Medway ICB, and Surrey and Sussex ICB.

Overall Procurement Activity:

- Total Contract Awards: 987 contracts worth €2.0 billion

- Active Tender Pipeline: 1 open tender valued at €5,600

- Renewal Forecast: 119 potential renewals worth €3 billion

Health Services Procurement:

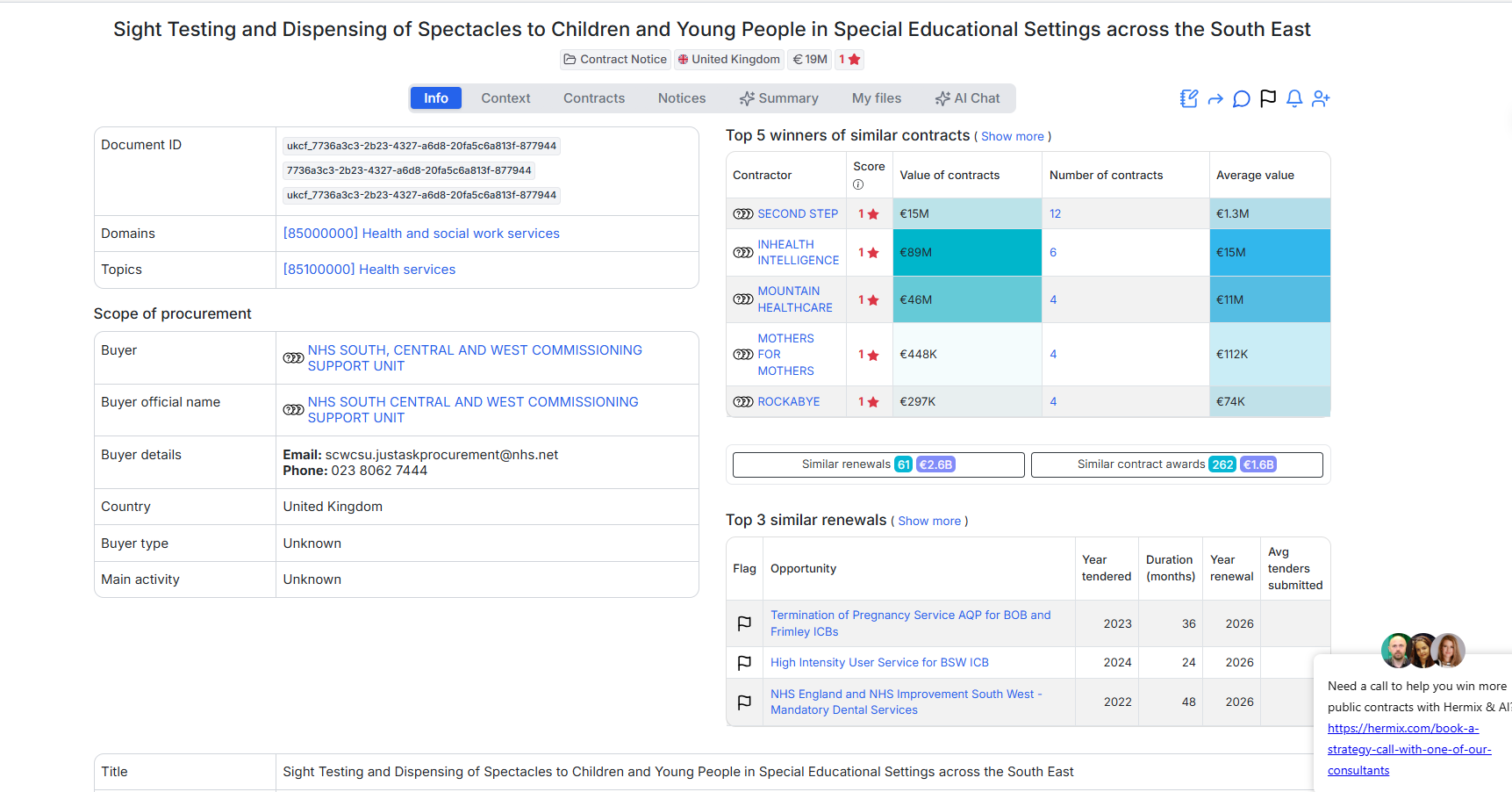

- Similar Contract Awards: 262 contracts totaling €1.6 billion (average: €6.1M per contract)

- Similar Renewals: 60 upcoming renewals worth €2.6 billion

- Prior Notices: 86 similar prior notices worth €65 million

The commissioning unit operates within a broader UK NHS health services market where 5,700 similar authorities have ophthalmology and SEND service needs, collectively representing £570 billion (€675B) in related procurement. This positions successful bidders not only for this southeast framework but potentially for similar SEND eye care services being rolled out nationally following the 2021 Proof of Concept programme.

Competitive Landscape: Diverse Healthcare and Social Service Providers

Historical contract awards for similar health services reveal a mixed market of NHS trusts, private healthcare providers, and specialized social care organizations.

Top Contract Winners (Similar Services):

- SECOND STEP – €15M across 12 contracts (€1.3M average)

- INHEALTH INTELLIGENCE – €89M across 6 contracts (€15M average)

- MOUNTAIN HEALTHCARE – €46M across 4 contracts (€11M average)

- MOTHERS FOR MOTHERS – €448K across 4 contracts (€112K average)

- ROCKABYE – €297K across 4 contracts (€74K average)

- OXLEAS NHS FOUNDATION TRUST – €347M across 3 contracts (€116M average)

- SOMERSET NHS FOUNDATION TRUST – €27M across 3 contracts (€9.1M average)

- NEC SOFTWARE SOLUTIONS UK – €26M across 3 contracts (€8.8M average)

- ST MUNGO’S – €4.7M across 3 contracts (€1.6M average)

- EPIC CONSULTANTS – €786K across 3 contracts (€262K average)

Key Competitive Observations:

Diverse Provider Types: The competitive landscape includes NHS Foundation Trusts (Oxleas, Somerset), private healthcare companies (InHealth Intelligence, Mountain Healthcare), social care charities (Second Step, St Mungo’s), and maternity/family support organizations (Mothers for Mothers, Rockabye). This diversity suggests the commissioning unit values different organizational models for different service types.

Scale Variation: Contract values range from under €500K (Mothers for Mothers, Rockabye) to over €300M (Oxleas NHS Foundation Trust), indicating procurement across vastly different service scopes. For this SEND eye care tender, mid-tier healthcare providers like InHealth Intelligence (€15M average) or Mountain Healthcare (€11M average) represent the most relevant benchmarks.

100% UK Provider Base: All 262historical contractors are UK-based, with an average contract value of €6.1M. This suggests strong domestic supply chain preferences, regulatory requirements favoring UK-registered healthcare providers, or practical necessities around CQC registration and NHS operational integration.

Repeat Business Patterns: Second Step’s 12 contracts and InHealth Intelligence’s 6 contracts demonstrate sustained relationships with the commissioning unit, suggesting performance quality and contract compliance drive renewal opportunities.

Commercial and Procedural Signals

Open Procedure Above Threshold: This tender follows standard EU-derived UK public procurement rules for healthcare services above financial thresholds, ensuring transparent, non-discriminatory competition open to all qualified providers.

General Ophthalmic Additional Services Model Contract: The tender specifies use of this NHS standard contract for Special Educational Settings, providing established terms, conditions, and service level frameworks. Bidders should familiarize themselves with this model contract’s requirements before submission.

TUPE Assessment: The commissioners state their view that Transfer of Undertakings (Protection of Employment) Regulations 2006 do not apply, as this represents new service provision rather than transfer of existing staff. However, bidders must conduct independent TUPE assessments and price accordingly.

Multi-Lot Bidding Strategy: Providers can bid for one, several, or all five lots. Geographic presence, service capacity, and optometry workforce availability across the southeast will determine optimal lot selection strategies.

Contract Amendment Flexibility: The tender explicitly notes contracts may be amended during the term to reflect co-commissioning arrangements, mandated directives, or service changes with associated funding adjustments, providing flexibility for service evolution.

Tight Deadline: The 32-day window from publication (January 5) to deadline (February 6 at noon) requires immediate mobilization including understanding SEND populations across each lot’s geography, optometry capacity planning, and partnership development with Special Educational Settings.

Strategic Context: Addressing SEND Health Inequalities

This procurement reflects NHS England’s national commitment to reducing health inequalities for children with special educational needs and disabilities, a population facing significant barriers to accessing routine healthcare including eye care.

Evidence-Based Service Model: The 2021 NHS England Proof of Concept programme demonstrated that delivering sight tests directly within Special Educational Settings dramatically improves access for SEND children who might otherwise miss routine eye care due to anxiety, communication challenges, or family barriers to attending high-street opticians.

Educational Outcomes Link: Unidentified vision problems directly impact educational attainment. By ensuring annual sight tests and timely spectacle provision for SEND children, this service aims to improve both health outcomes and educational engagement.

Hermix users analyzing NHS tenders gain immediate advantages. The platform delivers instant competitive intelligence on all 10 historical contractors, authority spending pattern analysis, and renewal pipeline visibility across 119 upcoming opportunities worth €3 billion. Rather than manually researching NHS procurement frameworks and contractor track records, Hermix provides AI-powered analysis that helps healthcare providers consistently qualify the right opportunities and win more public sector contracts.

Practical Takeaways for Bidders

Who This Tender Suits:

- Optometry practices with mobile/outreach service capabilities

- Private healthcare providers specializing in pediatric ophthalmology

- Organizations experienced in SEND service delivery

- Providers with established relationships with Special Educational Settings

- Multi-location optometry groups with southeast England presence

Critical Attention Points:

SEND Expertise: Successful delivery requires understanding autism spectrum conditions, learning disabilities, and communication adjustments necessary for effective sight testing with vulnerable children. Demonstrate staff training, experience, and person-centered care approaches.

School-Based Delivery Model: Services must be delivered within Special Educational Settings, requiring mobile equipment, flexible scheduling around school routines, and effective liaison with teaching staff and SENCOs (Special Educational Needs Coordinators).

Geographic Coverage: Each lot covers substantial geography requiring either multiple clinic locations, mobile service teams, or partnership arrangements to ensure timely access across all schools within the region.

Annual Service Volumes: With thousands of SEND children across each lot’s geography, plan workforce capacity for systematic annual testing cycles while maintaining quality and child-centered approaches.

Multi-Lot Strategy: Carefully assess which lots match your operational footprint and capacity. Bidding all five lots requires demonstrating substantial optometry workforce and operational infrastructure across the entire southeast.

Create your free Hermix account today at https://hermix.com/sign-up/ and transform NHS tender analysis from days of research into minutes of actionable intelligence that wins more public healthcare contracts.