A three-year processing agreement for 3,500-5,000 tonnes of food waste annually from residential kerbside collections and commercial trade customers in Bedfordshire.

Create a free account and see the full public tender details here: https://app.hermix.com/opportunities/ukfts_085239-2025

Luton Council has published a €1,443,180 food waste treatment public tender in the UK covering residential and commercial organic waste streams across the town of 225,000 residents. With a January 26, 2026 deadline and 36-month contract duration, this open procedure opportunity provides waste management specialists access to a mid-sized English local authority market where pricing, quality, and social value carry equal weight in award decisions. The per-tonne pricing model and mixed waste source requirements position this contract squarely within the UK’s evolving food waste infrastructure landscape, driven by statutory separate collection obligations and net zero commitments requiring diversion from landfill.

Opportunity Overview

Contracting Authority: Luton Council

Reference Number: DN794752

Tender Title: AT1377 Food Waste Contract

Scope of Services:

Food waste treatment contract handling all organic waste arising from:

Residential Collections:

- Kerbside food waste collections from households across Luton

- Separate food waste bins/caddies collected as part of municipal waste service

- Expected to represent majority of tonnage

Commercial Collections:

- Food waste from Council’s trade waste customers

- Businesses, schools, public facilities using Council commercial waste services

- Variable volumes dependent on trade customer base

Treatment Requirements:

- Provide complete treatment solution for collected food waste

- Per-tonne pricing structure for processing costs

- Facility must handle 3,500-5,000 tonnes per annum

- Treatment method not specified (likely anaerobic digestion or in-vessel composting)

- Compliance with UK waste treatment regulations

Volume Profile:

Expected annual tonnage: 3,500-5,000 tonnes (approximately 67-96 tonnes per week)

Location: Luton, Bedfordshire (United Kingdom)

Contract Value: €1,443,180.41 over 36 months (approximately €481K per annum)

Per-Tonne Rate: Approximately €96-137 per tonne based on volume range

Contract Duration: 36 months

Contract Type: Works

Procedure Type: Open

Key Dates:

- Publication: December 22, 2025

- Submission Deadline: January 26, 2026 (35 days)

- Tender Opening: January 26, 2026

Award Criteria:

- Price: 50% weighting

- Quality: 30% weighting

- Social Value: 20% weighting

Contact: Caroline Sturman

Email: caroline.sturman@luton.gov.uk

EU Funding: No

Prior Notices: Two prior information notices published October 20, 2025 (€676K each) indicating procurement planning commenced several months ahead of formal tender.

Track UK food waste and organic treatment opportunities effortlessly. Create your free Hermix account at https://hermix.com/sign-up/ for AI-powered monitoring across local authority waste management tenders and environmental services contracts.

Strategic Context: Luton Council and UK Food Waste Policy

Luton serves as a large town and unitary authority in Bedfordshire, approximately 50 kilometers north of London, with a population of 225,000 residents. As a unitary authority, Luton Council manages all local government functions including waste collection and disposal, making it both collector and contracting authority for treatment services.

UK Food Waste Policy Framework:

This tender reflects statutory obligations under the Environment Act 2021 requiring all English local authorities to provide separate food waste collections for households by March 2026. The legislation aims to divert food waste from landfill and residual waste incineration, supporting UK net zero commitments and circular economy objectives.

Waste Treatment Hierarchy:

UK waste policy prioritizes anaerobic digestion (AD) and in-vessel composting for food waste treatment. AD facilities convert organic waste into biogas (renewable energy) and digestate (soil improver), providing environmental benefits over landfill or energy-from-waste facilities. The per-tonne pricing model in this tender is standard for AD and composting gate fees.

Luton’s Waste Management Context:

Luton’s 3,500-5,000 tonne annual food waste volume suggests approximately 45-65% household participation in separate food waste collections, consistent with national averages for established schemes. The inclusion of commercial trade waste indicates Luton operates business waste services alongside residential collections, common among English unitary authorities.

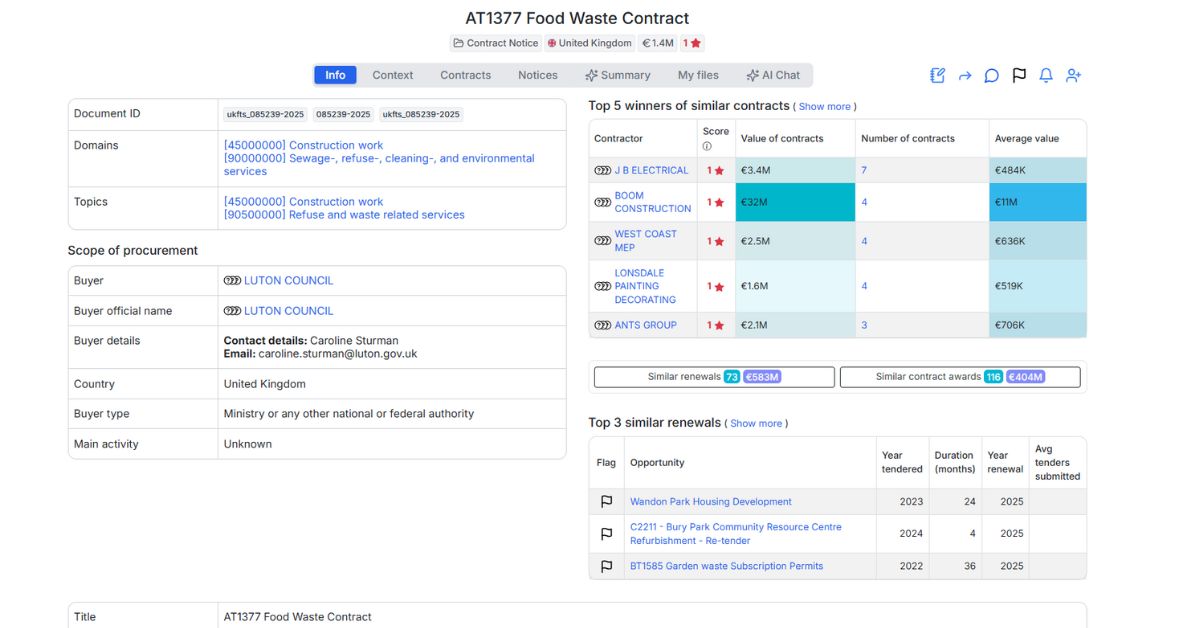

Buyer Procurement Activity:

- Total Contract Awards: 955 contracts worth €1 billion

- Active Pipeline: 1 open tender valued at €11 million

- Renewal Forecast: 261 upcoming renewals worth €1.4 billion

Waste and Environmental Services:

- Similar Contract Awards: 116 contracts totaling €404 million (average: €3.7M per contract)

- Similar Renewals: 73 upcoming renewals worth €583 million

The substantial renewal pipeline (€1.4B across 261 contracts) indicates Luton Council maintains significant ongoing procurement activity across all service areas, though most visible contracts are construction and property maintenance rather than waste-specific services.

Competitive Landscape: Data Limitations and Market Reality

Historical contract data reveals an important limitation in the available dataset. The top contractors visible in Luton Council’s procurement history are predominantly construction, electrical, and mechanical engineering firms, not waste management specialists.

Visible Top Contractors (All Categories):

- BOOM CONSTRUCTION – €32M across 4 contracts (€11M average)

- CHURCHILL CONTRACT SERVICES – €8M across 2 contracts (€4M average)

- GOSHEN MULTISERVICES – €7.9M across 2 contracts (€4M average)

- LIFE BUILD SOLUTIONS – €7.2M across 2 contracts (€7.2M average)

- J B ELECTRICAL – €3.4M across 7 contracts (€484K average)

- WEST COAST MEP – €2.5M across 4 contracts (€636K average)

Critical Observation:

These contractors represent construction, building services, electrical, painting, and general works categories. They are not food waste treatment specialists and will not compete for this opportunity. The data visibility issue stems from category classification where waste treatment contracts may be under-represented in public contract registers compared to construction awards.

Actual Competitive Field:

The real competition for Luton’s food waste contract will come from:

National Waste Management Groups:

- Veolia UK (major AD network operator)

- Suez UK (Environnement)

- Biffa (waste management with AD facilities)

- Viridor (waste treatment and energy recovery)

Regional AD Facility Operators:

- Operators of anaerobic digestion plants in Bedfordshire, Hertfordshire, Buckinghamshire

- In-vessel composting facilities within economic haulage distance

- Specialist food waste processors serving Home Counties authorities

Key Competitive Factor – Location:

Per-tonne gate fees for food waste treatment are highly sensitive to haulage distance. Facilities within 30-50 kilometers of Luton will have significant cost advantage over distant processors. Bidders will compete primarily on facility proximity, treatment capacity availability, and processing efficiency.100% UK Market:

All 116 visible waste and environmental service contracts were awarded to UK-based entities, confirming domestic market for municipal waste treatment services.

Commercial and Procedural Signals

Per-Tonne Pricing Model:

The tender specifies costs “on a per tonne basis,” standard for waste treatment gate fees. Based on the €1,443,180 contract value and 3,500-5,000 tonne annual volume range, implied per-tonne rates are approximately €96-137 per tonne. This range is commercially reasonable for food waste AD or composting gate fees in Southeast England, though actual rates will vary based on haulage distance, facility type, and market conditions.

Award Criteria Balance:

Price (50%): Dominant but not overwhelming weighting reflects cost sensitivity balanced against quality considerations. Lowest price will not automatically win if quality or social value scores are weak.

Quality (30%): Substantial weighting indicates Luton Council values operational reliability, environmental performance, and service standards beyond pure cost. Quality criteria likely include facility certifications, contingency arrangements, reporting systems, and customer service.

Social Value (20%): Significant weighting reflecting Public Services (Social Value) Act 2012 requirements. Bidders must demonstrate local economic benefits, employment opportunities, environmental sustainability, and community engagement. Social value delivery in waste contracts typically includes workforce training, local supply chain usage, educational initiatives, and carbon reduction commitments.

Open Procedure Approach:

Standard open procedure (not restricted) indicates all qualifying waste treatment operators can submit proposals without pre-qualification stage. Selection based on published award criteria with no negotiation phase.

36-Month Duration:

Three-year term is relatively short for waste treatment contracts, which often run 5-7 years to provide facility operators certainty for capacity planning. The shorter duration may reflect:

- Luton Council testing market before committing to longer term

- Transitional contract bridging to future waste strategy

- Alignment with collection contract end dates

- Flexibility to respond to changing waste volumes as separate food waste collections mature

Volume Range:

The 3,500-5,000 tonne range (43% variation) creates pricing uncertainty for bidders. Operators must structure per-tonne rates viable across this volume swing, or include minimum tonnage guarantees with price adjustments for lower volumes.

Narrative Insight: UK Food Waste Infrastructure Transition

Luton Council’s €1.4M food waste tender represents one of hundreds of similar English local authority procurements driven by Environment Act 2021 requirements for separate food waste collections. The March 2026 implementation deadline creates concentrated demand for AD and composting treatment capacity across England, potentially tightening market and supporting gate fee prices.

The contract’s per-tonne structure shifts volume risk to the Council (paying for actual tonnage) rather than operators (guaranteed minimum volumes). This arrangement suits established AD facilities with diverse waste feedstock sources who can flexibly accommodate Luton’s volumes within existing capacity. New entrants or dedicated facility developments would prefer longer contracts with minimum tonnage guarantees.

The 3,500-5,000 tonne annual volume positions Luton as mid-sized opportunity for regional AD operators. A facility processing 30,000-50,000 tonnes annually (common AD plant scale) could easily absorb Luton’s volumes as supplementary feedstock. Conversely, very large waste groups with national networks may view this as below minimum efficient contract size given mobilization costs.

Social value weighting (20%) reflects broader trend in English local government procurement toward community benefit outcomes. For waste contracts, social value increasingly focuses on carbon reduction (measuring AD biogas environmental benefits), local workforce development (apprenticeships, training), and circular economy initiatives (promoting digestate usage in local agriculture).

The contract’s timing—with prior notices in October 2025 and formal tender December 2025 for presumed March/April 2026 start—aligns with Environment Act separate collection deadline, suggesting Luton is implementing statutory food waste collections and requires treatment capacity in place for launch.

Practical Takeaways for Bidders

Who This Tender Suits:

- Anaerobic digestion facility operators in Bedfordshire, Hertfordshire, Buckinghamshire

- In-vessel composting plants within 50km of Luton

- Regional waste management companies with food waste treatment capacity

- National waste groups with Southeast England infrastructure

- Operators with spare capacity seeking supplementary feedstock volumes

Critical Success Factors:

Facility Location: Proximity to Luton is paramount. Haulage costs dominate food waste treatment economics. Facilities within 30km radius have significant competitive advantage. Bidders should clearly state facility location and distance from Luton.

Treatment Capacity Availability: Demonstrate sufficient capacity to reliably process 5,000 tonnes annually without compromising existing contracts or facility performance. Include contingency capacity for seasonal peaks.

Quality Delivery: Develop robust quality submission addressing facility certifications (PAS 110 for AD digestate, PAS 100 for compost), environmental permits, operational track records, and contingency arrangements for facility downtime.

Social Value Strategy: Articulate tangible local benefits including workforce opportunities, supply chain engagement, educational partnerships with Luton schools, carbon reduction quantification, and digestate usage promoting circular economy.

Pricing Flexibility: Structure per-tonne rates viable across 3,500-5,000 tonne range. Consider volume-based discounts or minimum tonnage thresholds to manage commercial risk.

Volume Risk Management: Understand that per-tonne pricing without minimum guarantees transfers volume risk to contractor. Price accordingly or propose contractual protections.

Contract Mobilization: Plan for rapid mobilization to support Luton’s anticipated spring 2026 separate food waste collection launch. Demonstrate readiness for immediate service commencement.

Trade Waste Considerations: Address commercial waste handling including potential contamination risks, different collection schedules, and quality assurance for mixed-source feedstock.

Conclusion

Luton Council’s €1,443,180 food waste treatment tender represents straightforward opportunity for Southeast England AD and composting operators to secure mid-volume municipal contract supporting UK statutory separate collection requirements. The balanced award criteria (50% price, 30% quality, 20% social value) reward cost-competitive bids demonstrating operational excellence and local community benefits, rather than pure lowest-price competition.

While the visible historical contractor data shows construction firms rather than waste specialists, the actual competitive field will comprise regional AD facility operators and national waste groups with treatment infrastructure within economic haulage distance of Luton. For appropriately positioned waste treatment businesses, this contract offers three-year revenue stream, municipal sector credentials, and potential foundation for longer-term partnership as Luton’s food waste collections mature.

Hermix automates tracking of UK local authority waste and environmental services opportunities. Access real-time monitoring, competitive intelligence, and renewal forecasts. Create your free account at https://hermix.com/sign-up/and win more waste management contracts across European and UK public procurement markets.