A 48-month contract for electromechanical maintenance across two geographic sectors in France’s Loire department signals steady procurement activity from an authority with €222 million in historical contract awards.

Loire Forez Agglomération is returning to the market with a substantial wastewater infrastructure maintenance opportunity. The French public authority has published a €2 million open procedure tender covering comprehensive maintenance services for pumping stations, storm overflows, and treatment plants across its territory. With a deadline of January 6, 2026, and a four-year contract term, this procurement represents a significant commitment to maintaining operational reliability in critical environmental infrastructure.

The tender’s split into northern and southern geographic sectors, combined with the authority’s track record of 343 total contract awards valued at €222 million, positions this as both a strategic opportunity for established regional operators and a revealing window into how French inter-municipal authorities structure essential services procurement.

Opportunity Overview

Contracting Authority: Loire Forez Agglomération

Reference Number: 25LFAS095

Tender Title: Prestations de maintenance en assainissement (Wastewater Maintenance Services)

Scope of Work:

The contract encompasses electromechanical maintenance, piping, boilermaking, automation systems, and all operational maintenance work required to keep wastewater infrastructure functioning. Specific facilities include:

- Pumping stations (postes de relèvement)

- Storm overflow structures (déversoirs d’orage)

- Wastewater treatment plants (stations d’épuration)

Location: Loire department, France

Contract Structure: Two lots

- Lot 1: Secteur Nord (Northern Sector)

- Lot 2: Secteur Sud (Southern Sector)

Estimated Total Value: €2,000,000.00

Contract Duration: 48 months (4 years)

Procedure Type: Open procedure

Award Criteria: Quality and Price

Key Dates:

- Publication: December 8, 2025

- Submission Deadline: January 6, 2026

- Tender Opening: January 6, 2026

Language Requirements: French only

Contact Details for Loire Forez Agglomération’s Tender:

- Contact Person: Bazile Christophe

- Email: commandepublique@loireforez.fr

- Phone: 04 26 54 70 00

Ready to qualify tenders like this in minutes instead of hours?

Create your free Hermix account at https://hermix.com/sign-up/ and access AI-powered tender analysis, competitive intelligence, and automated monitoring across Europe’s €2 trillion public procurement market.

Authority Profile: Loire Forez Agglomération

Loire Forez Agglomération is an inter-municipal cooperation structure (établissement public de coopération intercommunale) in the Loire department of France’s Auvergne-Rhône-Alpes region. As a body governed by public law focused on general public services, the authority coordinates essential infrastructure and services across multiple communes in the Forez area.

The authority demonstrates consistent procurement activity across environmental infrastructure and municipal services:

Overall Procurement Activity:

- Total Contract Awards: 343 contracts worth €222 million

- Active Tender Pipeline: 1 open tender valued at €7.6M

- Renewal Forecast: 168 potential contract renewals worth €174 million

Wastewater and Similar Services:

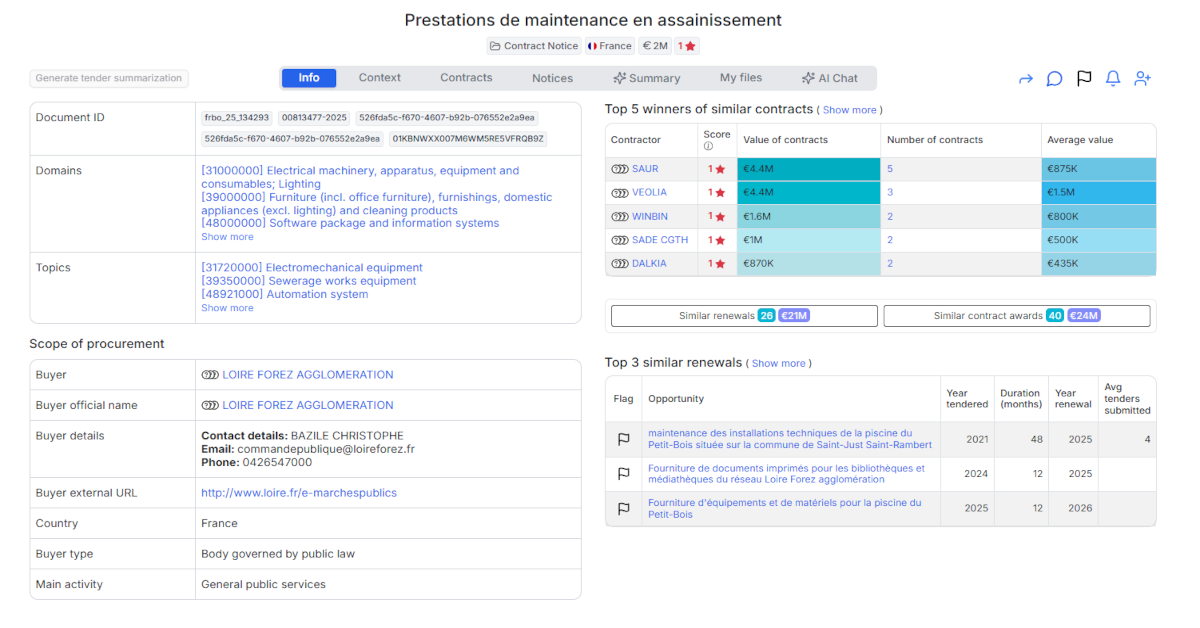

- Similar Contract Awards: 40 contracts totaling €24 million (average value: €600K)

- Similar Renewals: 26 upcoming renewals worth €21 million (average: €808K)

- No Similar Open Tenders: This is currently the only active procurement in this category

The authority’s procurement pattern reveals steady, recurring investment in wastewater infrastructure maintenance. The fact that 26 similar contracts are approaching renewal over the coming period suggests systematic contract cycling, likely aligned with standard French public service delegation timeframes.

Loire Forez Agglomération operates within a broader market context where 22,000 other French authorities have similar wastewater maintenance needs, collectively representing €69 billion in related procurement activity. This positions any successful bidder not just for this specific contract, but potentially for relationship-building that could extend to neighboring authorities or future contract renewals.

Competitive Landscape: Major National Players Dominate

Historical contract awards for similar wastewater maintenance services in Loire Forez Agglomération’s procurement sphere reveal a market dominated by France’s major environmental services providers, with a clear concentration among the top two contractors.

Top Contract Winners (Similar Services):

- SAUR – €4.4M across 5 contracts (€875K average)

- VEOLIA – €4.4M across 3 contracts (€1.5M average)

- WINBIN – €1.6M across 2 contracts (€800K average)

- SADE CGTH – €1M across 2 contracts (€500K average)

- DALKIA – €870K across 2 contracts (€435K average)

- DALKIA 54 – €756K across 2 contracts (€378K average)

- AGEC SASU – €26K across 2 contracts (€13K average)

- ESE FRANCE – €2.3M for 1 contract

- TDS ENVIRONNEMENT – €2M for 1 contract

- ASTECH – €1M for 1 contract

Key Competitive Observations:

Market Concentration: SAUR and VEOLIA together account for €8.8 million of the €24 million in similar contract awards, representing 37% market share between just two contractors. Both companies secured contracts with substantial average values (€875K for SAUR, €1.5M for VEOLIA), indicating their capability to handle larger, more complex maintenance operations.

Geographic Pattern: All 36 historical contract winners are French companies. There is no evidence of cross-border competition in this data set, suggesting either strong local market knowledge requirements, language barriers, or established relationships between French authorities and domestic environmental services providers.

Contract Size Distribution: The market shows a clear divide between major multi-contract winners (SAUR, VEOLIA, WINBIN) who demonstrate repeat business capability, and single-contract specialists (ESE FRANCE, TDS ENVIRONNEMENT, ASTECH) who may have won based on specific technical capabilities or competitive pricing for particular project types.

Dalkia’s Dual Presence: The appearance of both DALKIA and DALKIA 54 (a regional entity) with different contract histories suggests that even within large national groups, regional subsidiaries compete independently, potentially offering more tailored local service approaches.

Emerging Players: AGEC SASU’s presence with two small-value contracts (€13K average) indicates that opportunities exist for smaller, specialized maintenance providers, though likely for specific technical tasks rather than comprehensive facility management.

Commercial and Procedural Signals

Award Criteria Structure:

The tender evaluates bids on both Quality and Price, though specific weightings are not disclosed in the available documentation. This dual-criteria approach is standard for French wastewater maintenance contracts, where technical reliability, response times, and regulatory compliance matter as much as cost efficiency.

Language Constraint:

Offers must be submitted in French only. This represents a significant procedural barrier for non-Francophone contractors and effectively limits competition to French companies or those with established French operations and French-speaking technical staff capable of managing day-to-day maintenance operations and documentation.

Lot Structure Strategy:

The division into Secteur Nord and Secteur Sud allows the authority to potentially diversify risk across two contractors or enable a single bidder to demonstrate operational capacity across both geographic areas. Bidders can likely submit for one or both lots, though this is not explicitly confirmed in the available documentation.

Contract Duration:

The 48-month (4-year) term aligns with typical French service delegation cycles for wastewater infrastructure maintenance. This provides stability for contractors to invest in local resources, equipment positioning, and staff training while ensuring the authority can re-evaluate market conditions and performance within a reasonable timeframe.

Submission and Opening:

Both the deadline and tender opening occur on January 6, 2026, indicating a rapid evaluation timeline likely to follow. The nearly one-month window from publication (December 8) to deadline provides adequate time for site visits and technical proposal preparation, but demands efficient bid team mobilization.

No EU Funding:

The absence of European Union co-financing means standard French procurement rules apply without additional EU-specific reporting, compliance, or eligibility requirements, simplifying the administrative framework but also removing any EU policy preferences that might favor smaller businesses or cross-border participation.

Strategic Context: What the Numbers Tell Us About This Opportunity

The procurement data surrounding Loire Forez Agglomération’s wastewater maintenance tender reveals several strategic patterns that extend beyond the immediate €2 million contract value.

Authority’s Procurement Maturity:

With 343 historical contracts totaling €222 million and 168 renewal opportunities worth €174 million on the horizon, Loire Forez Agglomération demonstrates sophisticated, ongoing procurement management. The authority isn’t experimenting with wastewater maintenance procurement, it’s executing a systematic, well-established process. For bidders, this means clear evaluation standards, documented expectations, and likely detailed technical specifications.

The Renewal Pipeline Signal:

The 26 similar contracts approaching renewal (€21M total value) within the authority’s portfolio suggest this tender may be part of a broader infrastructure maintenance refresh cycle. Successful performance on this contract could position a bidder favorably for upcoming renewals, particularly if they can demonstrate improved service delivery or cost efficiency compared to incumbents.

Market Consolidation Pattern:

The dominance of SAUR and VEOLIA, both securing multiple contracts with high average values, indicates the authority’s historical comfort with national-scale environmental services providers. However, the presence of mid-sized regional players like WINBIN (€1.6M) and specialized firms like TDS ENVIRONNEMENT (€2M single contract) shows pathways exist for contractors who can differentiate on technical capability, local presence, or specialized expertise in electromechanical systems or automation.

Hermix users analyzing this tender can instantly access this competitive intelligence, including detailed contractor profiles, partnership analysis, and authority spending patterns, in minutes rather than hours. The platform’s AI-powered analysis identifies not just who won past contracts, but patterns in award criteria, typical contract durations, and authority preferences that help you qualify opportunities faster and bid smarter. By connecting this tender to 168 renewal opportunities and 343 historical awards, Hermix transforms isolated procurement notices into strategic market intelligence.

The Geographic Factor:

The 100% French contractor base in historical awards suggests either explicit local presence requirements embedded in past specifications, or practical necessities around response times, local parts supply, and French-language operational documentation that create natural barriers to entry. Bidders without established Loire operations should carefully evaluate whether partnership with a local technical services firm might strengthen their position.

Technical Complexity Indicator:

The scope covering electromechanical systems, automation, piping, and boilermaking across three different infrastructure types (pumping stations, storm overflows, treatment plants) points to a contract requiring multi-disciplinary technical teams. This isn’t basic facilities maintenance, it’s specialized environmental engineering services. The €2 million value over four years (€500K annually) suggests a substantial workload requiring dedicated staff, not occasional call-out services.

Practical Takeaways for Bidders

Who This Tender Suits:

- French environmental services companies with established Loire or Auvergne-Rhône-Alpes regional operations

- Wastewater infrastructure maintenance specialists with expertise across electromechanical systems, automation, and civil works

- Mid-to-large contractors capable of mobilizing multi-disciplinary teams across two geographic sectors

- Companies with French-speaking technical staff and operational documentation capacity

- Firms seeking multi-year stability (48 months) in environmental infrastructure services

Critical Attention Points:

Technical Proposal Development:

Your bid must demonstrate competence across four distinct technical domains, electromechanical maintenance, piping, boilermaking (chaudronnerie), and automation systems. Generic maintenance capability statements won’t suffice. Expect detailed technical questions about specific equipment types, preventive maintenance protocols, emergency response capabilities, and regulatory compliance approaches for each infrastructure type.

Quality-Price Balance:

While specific weighting isn’t disclosed, the inclusion of quality criteria alongside price means technical proposal strength matters significantly. Past awards to VEOLIA at €1.5M average versus SAUR at €875K average suggest the authority values comprehensive service quality and may accept premium pricing for demonstrated reliability and technical sophistication.

Geographic Lot Strategy:

Evaluate carefully whether to bid on one lot or both. Bidding both demonstrates greater resource capacity and may offer cost efficiencies (shared management, equipment, emergency response resources), but also increases delivery risk if awarded both. Consider whether partnership strategies might strengthen a two-lot bid.

Language and Documentation:

All proposal materials, technical specifications, safety documentation, and ongoing operational reporting will be in French. Ensure your bid team includes native French speakers who understand French wastewater regulatory terminology and technical standards (likely references to AQSE, CEREMA, and French Ministry of Ecological Transition guidelines).

Site Visit Imperative:

With only 29 days between publication and deadline, prioritize site visits for the specific pumping stations, storm overflows, and treatment plants covered. Understanding current equipment conditions, access logistics, and existing operational challenges will be essential to accurate pricing and credible technical proposals.

Incumbent Research:

While the current contract holder(s) aren’t disclosed in this notice, the historical winner data provides likely candidates. If SAUR or VEOLIA currently hold these contracts, study their publicly available service delivery models. If neither is incumbent, investigate why, it might reveal authority dissatisfaction or opportunity for new approaches.

Compliance Documentation:

Prepare standard French procurement compliance documents: insurance certificates, professional qualifications (relevant diplomas for key personnel), company financial statements, quality management certifications (ISO 9001, ISO 14001 if held), and any specialized certifications for wastewater facility operations or electrical work.

Positioning for Success in French Wastewater Procurement

Loire Forez Agglomération’s €2 million wastewater maintenance tender exemplifies the steady, substantial procurement opportunities that characterize French inter-municipal environmental infrastructure management. The authority’s 343 historical contracts (€222M), combined with 168 upcoming renewals (€174M), signal consistent, professional procurement operations where past performance and technical credibility drive award decisions as much as competitive pricing.

The competitive landscape, dominated by SAUR and VEOLIA but with demonstrated openings for specialized mid-tier firms, rewards bidders who combine technical excellence across multiple disciplines with proven local operational capability. For companies already established in France’s Auvergne-Rhône-Alpes region or seeking entry into systematic, multi-year environmental services contracts, this tender offers both immediate opportunity and potential positioning for the broader renewal pipeline ahead.

Understanding authority procurement patterns, competitor positioning, and the technical requirements embedded in France’s wastewater regulatory framework transforms bid decisions from opportunistic reactions into strategic market entry or expansion moves.

Hermix makes this analysis possible in minutes. Instead of manually searching tender portals, researching contractor histories, and compiling authority spending data, Hermix’s AI-powered platform delivers instant competitive intelligence, automated tender monitoring, and strategic procurement insights across Europe’s entire public sector market.

Create your free account today at https://hermix.com/sign-up/ and win more public contracts with the data-driven approach that helps companies like Capgemini, Publicis-Sapient, and Indra consistently succeed in B2G sales.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.