A 56-month comprehensive IT infrastructure management contract for a German occupational safety organization signals strategic investment in enterprise-grade data center operations covering VMware, Cisco, and IBM systems.

Berufsgenossenschaft Rohstoffe und Chemische Industrie (BG RCI), Germany’s statutory accident insurance institution for the raw materials and chemical industry, has published a €230,000 open procedure tender for full-service data center support at its Nuremberg facility. With a deadline of January 30, 2026, and an exceptionally long 56-month contract term, this procurement represents a significant commitment to maintaining and modernizing critical IT infrastructure that supports occupational safety operations across Germany’s chemical and raw materials sectors.

The tender demands a comprehensive service provider capable of handling all aspects of data center operations—from firmware updates and second-level support to managing a major hardware migration involving 14 Lenovo servers, high-end Cisco networking equipment, Checkpoint firewall systems, and IBM FlashSystem storage. The authority’s procurement history of 112 contracts worth €22 million, combined with 48 upcoming renewals valued at €35 million, positions this as both an immediate technical opportunity and a potential gateway to ongoing relationships within Germany’s public sector insurance infrastructure.

Opportunity Overview

Contracting Authority: Berufsgenossenschaft Rohstoffe und Chemische Industrie (BG RCI)

Reference Number: 2025006086

Tender Title: 955140 – Dienstleistung – 190 Tage Service für RZ Nürnberg, gesetzt auf 5 Jahre (190-Day Service for Data Center Nuremberg, Set for 5 Years)

Scope of Work:

BG RCI requires a full-service provider (Volldienstleister) capable of supporting all aspects of data center operations at its Nuremberg facility. The contract encompasses:

Technical Support Services:

- Firmware updates for all hardware components

- System configurations and optimization

- Error analysis and troubleshooting

- Second-level support operations

Software Environment Management:

- VMware virtualization layer administration

- Microsoft Windows Server operations

- SharePoint platform support

- Microsoft SQL Server management

- Trellix security software

- Windows Server Update Services (WSUS)

Hardware Migration Project (2025/2026): The successful contractor must manage migration from existing infrastructure to new equipment:

- Servers: 14x Lenovo ThinkSystem SR630 V4

- Network Switches: 4x Cisco Nexus (high-end), 2x Cisco Catalyst

- Firewall System: 2x Checkpoint Appliances, 1x Management unit

- Storage: 2x IBM Storage FlashSystem 5300 (SAN-Storage)

Location: Nürnberg, Kreisfreie Stadt (Nuremberg), Germany

Contract Value: €230,000.00

Contract Duration: 56 months (approximately 4 years and 8 months)

Procedure Type: Open procedure

Award Criteria: Quality and Price (specific weightings not disclosed)

Key Dates:

- Publication: December 8, 2025

- Submission Deadline: January 30, 2026 (53 days from publication)

Language Requirements: German only

EU Funding: No

Contact Details For the Public Authority:

Department: Hauptverwaltung Langenhagen: Abteilung Informationstechnologie

Contact Person: Michael Beck

Email: michael.beck@bgrci.de

Phone: +49 622151080

Looking to qualify German public IT tenders faster? Create your free Hermix account at https://hermix.com/sign-up/and access AI-powered tender analysis, automated monitoring of German procurement portals, and competitive intelligence across Europe’s €2 trillion public procurement market—including instant translations and data center services market insights.

Authority Profile: BG RCI and Germany’s Occupational Insurance System

Berufsgenossenschaft Rohstoffe und Chemische Industrie (BG RCI) is one of Germany’s statutory accident insurance institutions (Berufsgenossenschaften), specifically serving companies in the raw materials extraction and chemical manufacturing sectors. As a body governed by public law operating within Germany’s social insurance system, BG RCI provides accident insurance, prevention services, and rehabilitation support for workers in these industries.

The organization operates multiple regional offices across Germany, with its IT infrastructure coordinated through the Langenhagen headquarters near Hannover. The Nuremberg data center covered by this tender likely serves as a critical regional hub supporting operations across southern Germany.

Overall Procurement Activity:

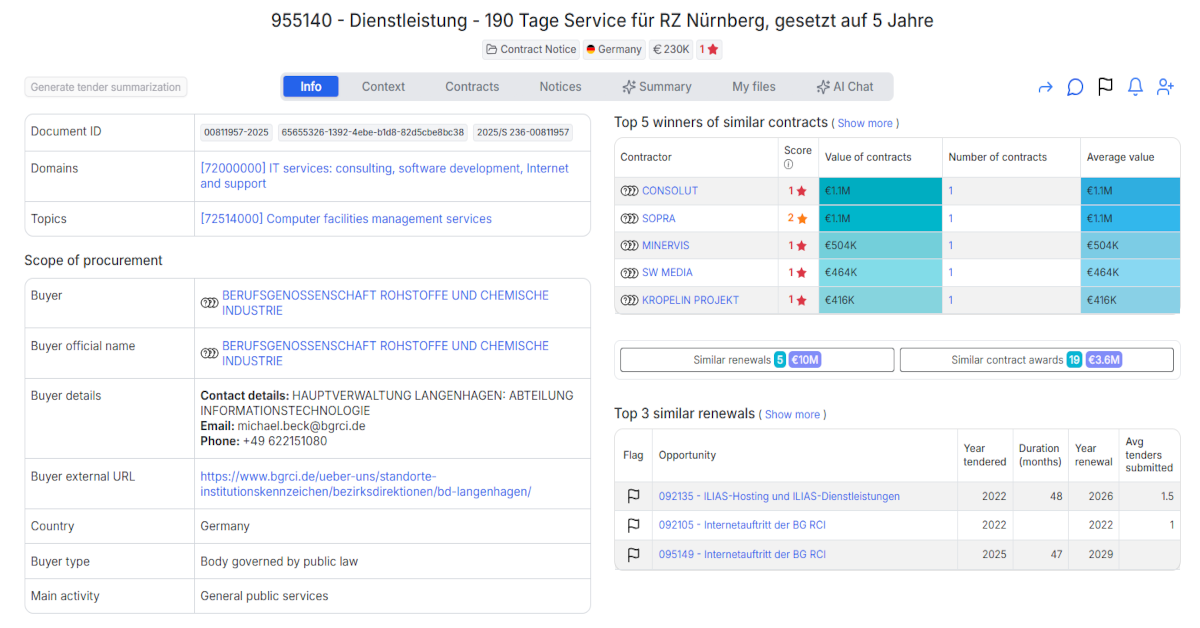

- Total Contract Awards: 112 contracts worth €22 million

- Active Tender Pipeline: 2 open tenders valued at €6.7 million

- Renewal Forecast: 48 potential contract renewals worth €35 million

IT Services and Data Center Management:

- Similar Contract Awards: 19 contracts totaling €3.6 million (average value: €189K per contract)

- Similar Open Tenders: 2 current opportunities worth €6.7 million (including this tender)

- Similar Renewals: 5 upcoming renewals worth €10 million (average: €2M per contract)

Market Context:

BG RCI operates within a broader German public sector IT services market where 5,600 other authorities have similar data center and IT infrastructure management needs, collectively representing €11 billion in related procurement activity. This positions successful bidders not just for this specific Nuremberg contract, but potentially for relationships across Germany’s Berufsgenossenschaften network and broader public insurance infrastructure.

The substantial difference between similar contract awards (€3.6M across 19 contracts, averaging €189K) and similar renewals (€10M across 5 contracts, averaging €2M) suggests BG RCI is moving toward larger, more comprehensive service contracts rather than fragmented smaller engagements. This €230,000 tender, with its 56-month duration, aligns with that strategic consolidation pattern.

Competitive Landscape: Specialized IT Service Providers Dominate

Historical contract awards for similar data center and IT facilities management services reveal a market dominated by German IT consulting and service providers, with notable variation in contract sizes and specializations.

Top Contract Winners (Similar Services):

- CONSOLUT – €1.1M for 1 contract (€1.1M per contract)

- SOPRA – €1.1M for 1 contract (€1.1M per contract)

- MINERVIS – €504K for 1 contract

- SW MEDIA – €464K for 1 contract

- KRÖPELIN PROJEKT – €416K for 1 contract

Key Competitive Observations:

Market Concentration at High Value: CONSOLUT and SOPRA each secured single contracts valued at €1.1 million—significantly larger than the €230,000 value of this tender. This suggests either multi-year framework agreements, more comprehensive service scopes, or contracts covering multiple facilities. Both companies demonstrate capability to handle substantial data center operations contracts for German public sector insurance institutions.

Mid-Tier Specialists: MINERVIS, SW MEDIA, and KRÖPELIN PROJEKT secured contracts in the €400K-€500K range, suggesting specialized capabilities in specific IT domains (possibly infrastructure management, network services, or software operations) that commanded premium pricing or covered extended service periods.

100% German Market: All 5 historical contract winners totaling €3.6 million are German companies. The data shows no evidence of cross-border competition, indicating either explicit German language and presence requirements, security clearance considerations for insurance sector data, or practical necessities around on-site response times and German IT regulatory compliance (including BSI security standards and data protection requirements under BDSG/DSGVO).

Average Contract Value Discrepancy: The historical average of €719K per contract (€3.6M ÷ 5 contracts) is more than three times the value of this tender (€230,000). This could indicate either that this Nuremberg facility is smaller in scope, that previous contracts included capital expenditure components not present here, or that BG RCI is testing a new procurement model with more focused service definitions.

Limited Repeat Business Visible: None of the top five contractors appear multiple times in the available data set (limited to 10 results), suggesting either high contractor rotation, specialized one-time projects, or that these are relatively recent contract awards without yet-visible renewal cycles.

Commercial and Procedural Signals

Award Criteria Structure:

The tender evaluates bids on both Quality and Price, though specific weightings are not disclosed in the available documentation. Given the technical complexity of managing enterprise-grade VMware environments, Cisco networking infrastructure, and mission-critical storage systems for a public insurance institution, quality factors likely include:

- Demonstrated technical competence across all specified platforms

- Response time commitments and escalation procedures

- Qualifications and certifications of assigned personnel

- Service level agreement (SLA) definitions

- Migration planning and risk management approach for the 2025/2026 hardware refresh

Language and Location Constraints:

Offers must be submitted in German only, with the service location explicitly stated as Nürnberg (Nuremberg). This creates natural barriers for non-German IT service providers and effectively requires:

- German-speaking technical staff capable of on-site presence in Nuremberg

- Familiarity with German IT terminology, regulatory frameworks, and documentation standards

- Understanding of German public sector procurement procedures and contract management practices

- Likely compliance with BSI (Bundesamt für Sicherheit in der Informationstechnik) security guidelines

Contract Duration Strategy:

The 56-month term is notably longer than standard German IT services contracts (typically 36-48 months). This extended duration suggests:

- BG RCI’s confidence in defining long-term service requirements

- Desire for contractor stability through the critical 2025/2026 hardware migration period and subsequent stabilization phase

- Potential cost optimization through reduced procurement overhead and relationship continuity

- Risk mitigation by ensuring the migration contractor remains responsible for post-migration support

Service Day Calculation:

The tender title references “190 Tage Service” (190 service days) set over 5 years (56 months). This translates to approximately 41 service days annually, or roughly one day per week of on-site or dedicated support. However, the scope description indicates comprehensive data center management, suggesting these may be:

- Billable on-site days for project work and major interventions

- Days of dedicated technical resource allocation beyond continuous remote monitoring

- Calculated effort for the hardware migration project component

Bidders should seek clarification on whether additional support is expected on a time-and-materials basis beyond the 190-day allocation.

Migration Complexity Signal:

The hardware migration component represents significant scope beyond routine maintenance:

- 14 new servers requiring physical installation, configuration, and data migration

- High-end networking equipment replacement (6 Cisco devices) requiring careful cut-over planning to avoid downtime

- Enterprise storage system deployment (IBM FlashSystem 5300) requiring data migration from existing SAN infrastructure

- Firewall system replacement with Checkpoint appliances requiring security policy migration and testing

This migration alone could constitute €50,000-€80,000 in professional services effort, suggesting the remaining €150,000-€180,000 covers approximately 4-5 years of ongoing maintenance and support.

No EU Funding:

The absence of European Union co-financing means standard German procurement law (GWB – Gesetz gegen Wettbewerbsbeschränkungen) applies without additional EU-specific requirements, simplifying compliance but also removing any EU policy preferences that might favor SMEs or cross-border providers.

Strategic Context: What the Numbers Reveal About This Opportunity

The procurement data surrounding BG RCI’s data center services tender reveals several strategic patterns that extend well beyond the immediate €230,000 contract value.

Authority’s IT Procurement Evolution:

With 112 historical contracts totaling €22 million and 48 renewal opportunities worth €35 million approaching, BG RCI demonstrates mature, systematic IT procurement operations. The organization has moved beyond ad-hoc IT services purchasing toward strategic infrastructure management. For bidders, this signals clear evaluation standards, documented technical expectations, and likely well-defined SLA frameworks based on years of operational experience.

The Consolidation Trend:

The shift from an average historical contract size of €189K (19 similar contracts totaling €3.6M) to larger anticipated renewals averaging €2 million (5 renewals totaling €10M) indicates BG RCI’s strategic move toward comprehensive, consolidated service relationships rather than multiple fragmented vendor arrangements. This €230,000 tender, while modest in value, may represent BG RCI’s test of a full-service model that could scale significantly upon contract renewal.

Hardware Migration as Strategic Inflection:

The 2025/2026 hardware refresh involving Lenovo servers, Cisco networking, and IBM storage represents a significant infrastructure modernization. BG RCI is not simply maintaining existing systems—it’s executing a deliberate technology stack upgrade. Successful contractors who demonstrate excellence during this migration phase position themselves favorably for the subsequent 4+ years of operational support and potential contract extensions.

Hermix users analyzing this tender gain immediate competitive advantages. Instead of manually translating German procurement notices, researching contractor histories across fragmented databases, and attempting to understand authority spending patterns, Hermix delivers instant AI-powered analysis—including automated German-to-English translation, competitive intelligence on all five historical winners, and strategic insights connecting this tender to 48 renewal opportunities and 112 historical awards. The platform transforms isolated German procurement notices into actionable market intelligence that helps companies like Capgemini, Unisys, and Publicis-Sapient consistently qualify the right opportunities and win more public sector IT contracts.

The Berufsgenossenschaften Network Effect:

BG RCI is one of nine German Berufsgenossenschaften, each operating similar IT infrastructure to support their respective industrial sectors. Excellence in serving BG RCI’s Nuremberg data center could open doors to opportunities across sister organizations including BG BAU (construction), BG ETEM (energy/textiles/electrical), and others—collectively representing hundreds of millions in IT procurement across Germany’s occupational insurance system.

Technical Complexity as Competitive Moat:

The requirement to support VMware virtualization, Microsoft enterprise applications, Trellix security software, high-end Cisco networking, and IBM enterprise storage simultaneously demands multi-vendor expertise rarely found in smaller IT service providers. This scope naturally favors mid-to-large German IT consultancies with dedicated data center practices, multi-certified technical staff, and established vendor partnerships.

Practical Takeaways for Bidders

Who This Tender Suits:

- German IT service providers with data center operations expertise and Nuremberg regional presence

- Mid-sized IT consultancies (50-500 employees) with multi-vendor technical certifications across VMware, Microsoft, Cisco, IBM, and Checkpoint

- Managed service providers specializing in German public sector and insurance industry clients

- Companies with German-speaking technical staff holding relevant certifications (VCP, MCSE, CCNP, IBM Certified Specialist)

- Firms seeking long-term stability (56 months) in enterprise IT infrastructure management

Critical Attention Points:

Multi-Vendor Certification Requirements:

Your bid must demonstrate certified expertise across at least five distinct technology platforms. Generic IT support capability statements will be insufficient. Expect detailed technical evaluation on:

- VMware vSphere administration and troubleshooting (VCP certification)

- Microsoft Windows Server, SQL Server, SharePoint (MCSE or equivalent)

- Cisco Nexus and Catalyst networking (CCNA minimum, CCNP preferred)

- IBM FlashSystem storage administration

- Checkpoint firewall management (CCSA/CCSE certifications)

Migration Project Management Capability:

The 2025/2026 hardware refresh represents complex change management requiring:

- Detailed migration planning with minimal service disruption

- Data center relocation or in-place hardware swap strategies

- Virtual machine migration from existing to new Lenovo infrastructure

- Storage area network (SAN) data migration with zero data loss

- Network cut-over planning for Cisco equipment replacement without connectivity interruptions

- Security policy migration and validation for Checkpoint firewalls

Your proposal should include specific methodologies, timeline estimates, and risk mitigation strategies for each migration component.

Service Day Allocation Strategy:

The “190 Tage Service” reference requires careful interpretation and pricing strategy. Clarify whether:

- These represent full on-site days (8 hours) or partial day allocations

- Additional support beyond 190 days is expected on time-and-materials basis

- Remote monitoring and support outside the 190-day allocation is included in the base price

- Emergency response and after-hours support are covered separately

German Language and Compliance Documentation:

All proposal materials, technical documentation, SLA definitions, and ongoing operational reporting will be in German. Ensure your bid team includes:

- Native German speakers familiar with German IT regulatory terminology

- Understanding of BSI (Bundesamt für Sicherheit in der Informationstechnik) security standards

- Familiarity with German public sector data protection requirements (BDSG/DSGVO)

- Experience with German insurance sector IT compliance frameworks

Quality-Price Balance:

While specific weighting isn’t disclosed, the historical presence of both €1.1M contracts (CONSOLUT, SOPRA) and this €230K tender suggests BG RCI values comprehensive technical capability and may accept premium pricing for demonstrated multi-vendor expertise and proven public sector experience. Don’t underprice at the risk of failing quality thresholds—focus on demonstrating superior technical depth and service reliability.

Site Visit and Current State Assessment:

With 53 days between publication and deadline, prioritize:

- Site visit to the Nuremberg data center to assess current infrastructure

- Meetings with BG RCI IT staff to understand existing pain points and service expectations

- Review of current hardware inventory and configurations

- Understanding of existing backup, disaster recovery, and business continuity requirements

- Clarification of any security clearance or background check requirements for personnel accessing insurance sector data

Incumbent Research:

While the current contract holder is not disclosed in this notice, the historical winner data provides likely candidates. If CONSOLUT or SOPRA currently hold this contract, study their publicly available data center service models and case studies. If neither is incumbent, investigate why—it might reveal authority dissatisfaction with previous performance or opportunity for differentiated approaches.

Reference Projects and Case Studies:

Prepare compelling reference projects demonstrating:

- Successful data center migrations with similar technology stacks (Lenovo/Dell/HP servers, Cisco networking, IBM or NetApp storage)

- Long-term managed services relationships with German public sector or insurance clients

- Multi-year contracts where you maintained high service levels (include SLA achievement data)

- Experience managing VMware environments at scale (200+ virtual machines)

- Checkpoint firewall implementations and ongoing management

Positioning for Success in German Public Sector IT Services

BG RCI’s €230,000 data center services tender exemplifies the specialized, technically demanding procurement opportunities that characterize Germany’s public sector insurance infrastructure landscape. The authority’s 112 historical contracts (€22M), combined with 48 upcoming renewals (€35M), signal mature, professional procurement operations where past performance, multi-vendor technical certification, and proven service reliability drive award decisions as much as competitive pricing.

The competitive landscape—dominated by specialized German IT consultancies like CONSOLUT and SOPRA, but with demonstrated openings for mid-tier firms with deep technical expertise—rewards bidders who combine comprehensive multi-vendor capabilities with proven local operational presence in Bavaria and established track records in German public sector IT services.

The 56-month contract term, encompassing both a major hardware migration and subsequent long-term operations support, offers successful contractors stability, recurring revenue, and potential positioning within Germany’s broader Berufsgenossenschaften network—nine occupational insurance organizations collectively representing hundreds of millions in IT infrastructure investment.

Understanding authority procurement patterns, competitor positioning, and the technical requirements embedded in Germany’s public sector IT regulatory framework transforms bid decisions from opportunistic responses into strategic market entry or expansion moves.

Hermix makes this analysis possible in minutes, even for German-language tenders. Instead of manually searching German procurement portals, translating technical specifications, researching contractor histories, and compiling authority spending data, Hermix’s AI-powered platform delivers instant competitive intelligence, automated tender monitoring across all German public buyers, and strategic procurement insights.

Create your free account today at https://hermix.com/sign-up/ and win more public contracts with the data-driven approach that helps companies consistently succeed in B2G sales across Europe’s complex, multilingual procurement landscape.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.