A major Scottish port infrastructure project seeks civil engineering contractors for 100-acre site development supporting renewable energy and heavy industry logistics in the Moray Firth.

Ardersier Port (Scotland) Limited, operating through Moray Council procurement frameworks, has published an €11.3 million civil works tender for Phase 2 landside development at Ardersier Port near Inverness. With a deadline of January 16, 2026, this Pre-Qualification Questionnaire (PQQ) stage seeks experienced contractors capable of large-scale earthworks, ground strengthening, and utilities infrastructure across approximately 100 acres, with a variant option extending to 250 acres. The project represents strategic investment in port capacity supporting Scotland’s renewable energy sector, particularly offshore wind manufacturing and installation operations.

The scope encompasses tree clearance, site leveling using existing sand materials, ground strengthening to achieve 250kPa/m² load-bearing capacity, and comprehensive utilities rerouting including underground power supplies and drainage systems. The buyer’s procurement history of 2,800 contracts worth €5.2 billion, combined with 1,300 upcoming renewals valued at €9.2 billion, positions this as both significant infrastructure investment and revealing insight into Scotland’s port development priorities.

Opportunity Overview

Contracting Authority: Ardersier Port (Scotland) Limited

Buyer Official Name: Moray Council

Reference Number: ocds-r6ebe6-0000801448

Tender Title: Ardersier Port, Phase 2 – Landside Civils

Scope of Work:

Civil engineering works across approximately 100-acre gorse area, with the following key components:

Earthworks:

- Tree clearance and environmental screening

- Topsoil stripping and disposal from extension area

- Upfilling extension and yard areas to required levels using site-won sand

- Achieving uniform finished ground level coordinating with Phase 1 works

Ground Strengthening:

- Stone capping of extension and yard areas to 25t/m² capacity

- Achieving load-bearing capacity of 250kPa/m²

- Integration with existing Phase 1 infrastructure

Services Civil Works:

- Rerouting and undergrounding existing overhead power supply

- Rerouting existing water main supply

- Rerouting drainage ditch around new site perimeter

- Passive drainage system consistent with Phase 1 philosophy

Services Mechanical & Electrical Installations:

- Power supply underground installation

- Water supply rerouting and connections

- Drainage infrastructure mechanical systems

Coordination Requirements:

- Interface with client’s quayside civil works contractor

- Potential future street lighting (not currently in scope but may be added via permitted modification under Utilities Contracts (Scotland) Regulations 2016)

Variant Tender Option: Bidders may submit variant proposals for expanded scope covering Gorse & Woodland Area (approximately 250 acres), same works at significantly larger scale.

Location: Ardersier Port Approach, Ardersier, Inverness, Scotland, IV2 7QX

Estimated Total Value: €11,274,846.94

Contract Duration: Unknown (to be defined in ITT stage)

Contract Type: Works

Procedure Type: Negotiated with prior publication / competitive with negotiation

Key Dates:

- Publication: December 4, 2025

- Submission Deadline: January 16, 2026 (43 days)

- Tender Opening: January 16, 2026

Current Stage: Stage 2 – Pre-Qualification Questionnaire (PQQ)

Next Stage: Stage 3 – Invitation to Tender (ITT)

Monitor Scottish infrastructure tenders automatically.

Create your free Hermix account at https://hermix.com/sign-up/ for AI-powered tender tracking, competitive intelligence across UK construction markets, and automated alerts for port and energy infrastructure opportunities.

Project Context: Ardersier Port and Scotland’s Renewable Energy Ambitions

Ardersier Port occupies a strategic location on the Moray Firth in the Scottish Highlands, approximately 10 miles northeast of Inverness. The site has historical significance as a former oil rig fabrication yard and is being redeveloped to support Scotland’s offshore renewable energy sector, particularly offshore wind turbine manufacturing, assembly, and installation logistics.

Phase 2 landside civil works follow Phase 1 infrastructure development, indicating multi-phase investment in port capacity. The 100-acre development area (with 250-acre variant option) suggests substantial expansion to accommodate heavy industrial operations requiring significant hardstanding areas, load-bearing capacity for heavy machinery, and utilities infrastructure supporting manufacturing or logistics operations.

Buyer Procurement Activity:

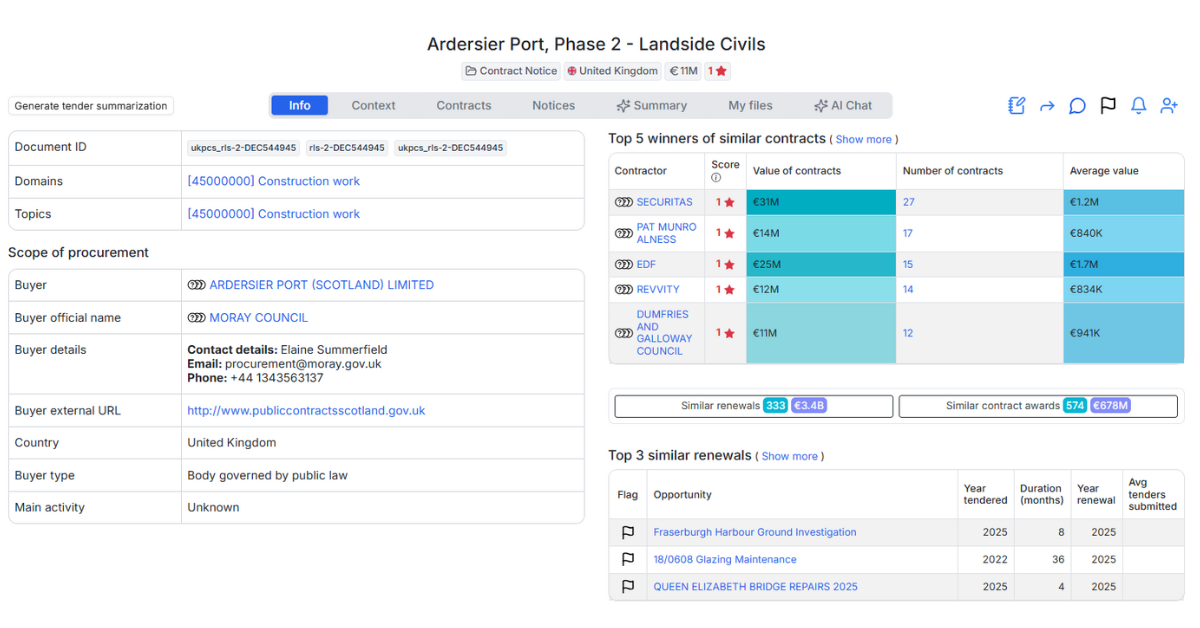

- Total Contract Awards: 2,800 contracts worth €5.2 billion

- Active Tender Pipeline: 79 open tenders valued at €1.6 billion

- Renewal Forecast: 1,300 potential renewals worth €9.2 billion

Construction and Civil Works:

- Similar Contract Awards: 574 contracts totaling €678 million (average: €1.2M per contract)

- Similar Open Tenders: 22 current opportunities worth €947 million

- Similar Renewals: 326 upcoming renewals worth €3.3 billion

Market Context:

The buyer operates within the broader UK construction and infrastructure market where 6,900 similar authorities represent €1.2 trillion in related procurement. This positions successful contractors not just for this Ardersier project, but potentially for relationships across Scotland’s port infrastructure network and renewable energy supply chain developments.

Competitive Landscape: Scottish Civil Engineering Specialists

Historical contract awards reveal a diverse market with both large national contractors and specialized regional firms, though construction-specific patterns show concentration among established Scottish civil engineering companies.

Top Contract Winners (All Categories):

- TAYLOR AND FRASER: €170M across 10 contracts (€17M average)

- SECURITAS: €31M across 27 contracts (€1.2M average)

- EDF: €25M across 15 contracts (€1.7M average)

- ARGYLL AND BUTE COUNCIL: €14M across 9 contracts (€1.6M average)

- REVVITY: €12M across 14 contracts (€834K average)

- PAT MUNRO (ALNESS) LTD: €9.9M across 19 contracts (€522K average)

- LEITHS SCOTLAND: €9.3M across 10 contracts (€934K average)

- MACKENZIE CONSTRUCTION: €8.8M across 10 contracts (€885K average)

Key Competitive Observations:

Civil Engineering Specialists: Taylor and Fraser’s €170M total with €17M average contract size signals capability for major infrastructure projects. Leiths Scotland and Mackenzie Construction both demonstrate repeat business with 10 contracts each, indicating successful relationship-building with Scottish public authorities.

Regional Presence: Pat Munro (Alness) Ltd is based in Alness, Ross-shire, approximately 30 miles from Ardersier, suggesting strong local knowledge and established relationships in Highland region civil works. This local presence may provide competitive advantages in site logistics, labor mobilization, and understanding of regional conditions.

100% UK Market: All 548 visible contracts (€677M total) were awarded to UK-based companies, with strong Scottish representation. This indicates either explicit local content requirements, practical advantages of Scottish presence for Highland projects, or competitive strength of Scottish civil engineering firms in regional procurement.

Contract Size Variation: The €11.3M tender value aligns well with historical patterns, exceeding the €1.2M average but within range of larger contracts secured by established firms. The scale suggests this is substantial but not unprecedented for the buyer’s procurement portfolio.

Port and Energy Sector Experience: While detailed sector breakdowns aren’t visible in this dataset, contractors with proven track records in port infrastructure, heavy industrial ground works, or renewable energy logistics facilities will likely have competitive advantages given Ardersier’s strategic role.

Commercial and Procedural Signals

Negotiated Procedure Approach:

Use of negotiated procedure with prior publication (rather than standard open procedure) signals the buyer’s desire for dialogue and flexibility. This suggests:

- Technical complexity requiring contractor input on methodology

- Potential for design refinement during procurement process

- Flexibility to negotiate terms, timelines, and risk allocation

- Recognition that optimal solutions may require collaboration

PQQ Stage Focus:

This is a Pre-Qualification stage, meaning initial submissions focus on demonstrating capability, experience, financial standing, and health & safety credentials rather than detailed pricing. Successful PQQ candidates will advance to Stage 3 (Invitation to Tender) for detailed technical and commercial proposals.

Variant Tender Option:

The 250-acre variant (versus 100-acre baseline) provides:

- Flexibility for buyer to scale scope based on budget and strategic priorities

- Opportunity for contractors to demonstrate scalability and efficiency at larger scope

- Potential for economies of scale in mobilization, equipment, and project management

- Testing of contractor capacity for future phases

Load-Bearing Capacity Requirements:

The specified 250kPa/m² (approximately 25 tonnes per square meter) load-bearing capacity indicates preparation for:

- Heavy mobile cranes and lifting equipment

- Large component storage and handling

- Wind turbine nacelle and blade assembly operations

- Heavy goods vehicle traffic and logistics operations

This technical requirement will eliminate contractors without specialized ground stabilization and heavy industrial civil engineering experience.

Site-Won Materials Approach:

Specifying use of existing sand materials from the site for upfilling indicates:

- Cost optimization through reduced materials import

- Environmental considerations minimizing off-site disposal

- Requirement for contractors experienced in material reuse and ground engineering

- Potential geotechnical challenges requiring specialist knowledge

Utilities Coordination Complexity:

Rerouting overhead power, water mains, and drainage while maintaining operational continuity requires:

- Coordination with utility providers (Scottish and Southern Electricity Networks, Scottish Water)

- Phased work programs minimizing service disruptions

- Temporary works and contingency planning

- Understanding of Scottish utilities regulations and approval processes

Strategic Context and Practical Takeaways

Scotland’s Green Freeport Ambitions:

Ardersier Port’s development aligns with Scotland’s Inverness and Cromarty Firth Green Freeport designation, which provides tax incentives and streamlined planning for renewable energy manufacturing and logistics. This tender represents infrastructure investment supporting offshore wind supply chain localization.

Offshore Wind Market Opportunity:

Scotland’s ScotWind leasing round awarded rights for up to 25GW of offshore wind capacity, creating demand for port facilities supporting turbine manufacturing, assembly, and installation. Ardersier’s deep-water access and large laydown areas position it strategically for this market.

Multi-Phase Development Pattern:

Reference to “Phase 2” and coordination with Phase 1 infrastructure indicates long-term development program. Successful Phase 2 contractors may be favorably positioned for future phases, extensions, or maintenance works.

Who This Tender Suits:

- Scottish civil engineering contractors with heavy industrial project experience

- Firms with port infrastructure, energy sector, or heavy industrial ground works portfolios

- Companies with Highland region presence or established Scottish operations

- Contractors experienced in earthworks at scale (100+ acre developments)

- Specialists in ground stabilization for heavy load-bearing requirements

Critical Success Factors:

PQQ Documentation Excellence: Demonstrate financial stability, health & safety credentials (required for all Scottish public sector work), insurance capacity (professional indemnity and public liability appropriate to €11M+ project), and technical capability through relevant project references.

Highland Region Understanding: Show knowledge of local conditions including Scottish weather patterns affecting earthworks programs, Highland Council planning and environmental requirements, and logistics for material delivery to remote sites.

Ground Engineering Expertise: Provide evidence of achieving specified load-bearing capacities in similar soil conditions, experience with site-won materials reuse, and geotechnical investigation and design capabilities.

Utilities Coordination Experience: Demonstrate successful delivery of projects requiring complex utilities diversions, coordination with multiple utility providers, and maintaining service continuity during construction.

Health, Safety, and Environmental Management: Scottish public sector procurement heavily weights HSE capability. Provide Construction Design and Management (CDM) compliance evidence, environmental management system certification (ISO 14001), and project-specific HSE plans.

Conclusion

Ardersier Port’s €11.3 million Phase 2 landside civil works represents significant infrastructure investment supporting Scotland’s renewable energy transition and green industrial strategy. The buyer’s 2,800 historical contracts (€5.2B) and 1,300 approaching renewals (€9.2B) signal mature procurement operations embedded within Scotland’s strategic infrastructure development programs.

The competitive landscape favors Scottish civil engineering firms with proven heavy industrial experience, though the scale and strategic importance may attract major UK contractors seeking entry to Scotland’s offshore wind supply chain market. For contractors positioned in Scottish regional markets or seeking expansion within the €1.2 trillion UK infrastructure sector, this tender offers both substantial immediate opportunity and strategic positioning for long-term relationships.

Hermix makes tracking UK infrastructure opportunities effortless. Access AI-powered monitoring across Scottish procurement, competitive intelligence on 2,800+ historical contracts, and automated alerts. Create your free account at https://hermix.com/sign-up/ and win more public contracts across Europe’s complex procurement landscape.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.