COUNTESS OF CHESTER HOSPITAL NHS FOUNDATION TRUST has issued an open tender for a framework agreement covering falls prevention, rehabilitation and recovery services worth €19,167,239.80 over 4 years. This multi-lot procurement supports NHS delivery of patient care across England and Wales under the Provider Selection Regime, with bids due November 10, 2025.

Executive Summary

COUNTESS OF CHESTER HOSPITAL NHS FOUNDATION TRUST seeks healthcare service providers for a framework agreement covering falls prevention, post-fall rehabilitation, and recovery services. The framework totals €19,167,239.80 with values shared across three lots over a 4-year term. Bids close November 10, 2025, with tender opening the same day. This open procedure procurement follows The Health Care Services (Provider Selection Regime) Regulations 2023 and The Health Services (Provider Selection Regime) (Wales) Regulations 2025. The 2023 National Audit of Inpatient Falls identified more than 60,000 femoral fractures in England and Wales in 2022 due to falls, with 2,033 occurring in inpatient settings. Services will provide falls support planning, risk assessments, person-centered plans for independent living, strength and balance improvements, hospital admission reduction, falls prevention education, and interventions in home and residential care settings. Performance locations span all English regions and Wales. Healthcare providers with experience in falls prevention programs, elderly care rehabilitation, home-based health interventions, and NHS framework delivery should have prioritized this opportunity. The buyer’s extensive procurement history (682 contracts worth €44 billion) demonstrates sustained demand for health and social care services.

Tender Overview

Basic Information

Document ID: ukfts_061162-2025 Reference Number: F/096/FPRRS/25/SB Publication Date: October 1, 2025 Deadline: November 10, 2025 Tender Opening Date: November 10, 2025 Status: Open Source: UK – Find a Tender Service

Financial Summary

Total Estimated Value: €19,167,239.80 Contract Duration: 4 years EU Funding: No

The procurement consists of 3 lots with shared framework values.

Budget Breakdown

Lot 1 – Falls Prevention Services: €19,167,239.80 Lot 2 – Post Fall Rehabilitation and Recovery Services: €19,167,239.80 Lot 3 – Combination of All Services: €19,167,239.80

The documentation states “Framework lot values may be shared with other lots,” indicating the €19,167,239.80 represents the total framework value distributed across lots rather than the sum of all three.

Framework Structure

Lot 3 operates as an automatic award: All tenderers awarded to Lot 1 and Lot 2 will automatically be awarded onto Lot 3.

Service Scope

Falls Prevention Services (Lot 1): Services delivered to prevent the chance of a fall

Post Fall Rehabilitation and Recovery Services (Lot 2): Services supporting recovery after falls have occurred

Combination of All Services (Lot 3): Comprehensive service delivery combining prevention and post-fall care

Buyer Profile Analysis

Organization Overview

Official Name: COUNTESS OF CHESTER HOSPITAL NHS FOUNDATION TRUST Contact Person: Ian Bailiff Contact Email: info@coch-cps.co.uk External URL: https://health-family.force.com/s/welcome

Buyer Type: Body governed by public law Main Activity: Health Country: United Kingdom

Organizational Background

COUNTESS OF CHESTER HOSPITAL NHS FOUNDATION TRUST operates as a body governed by public law with the main activity of health services.

Procurement History

The buyer’s procurement data shows extensive contracting activity:

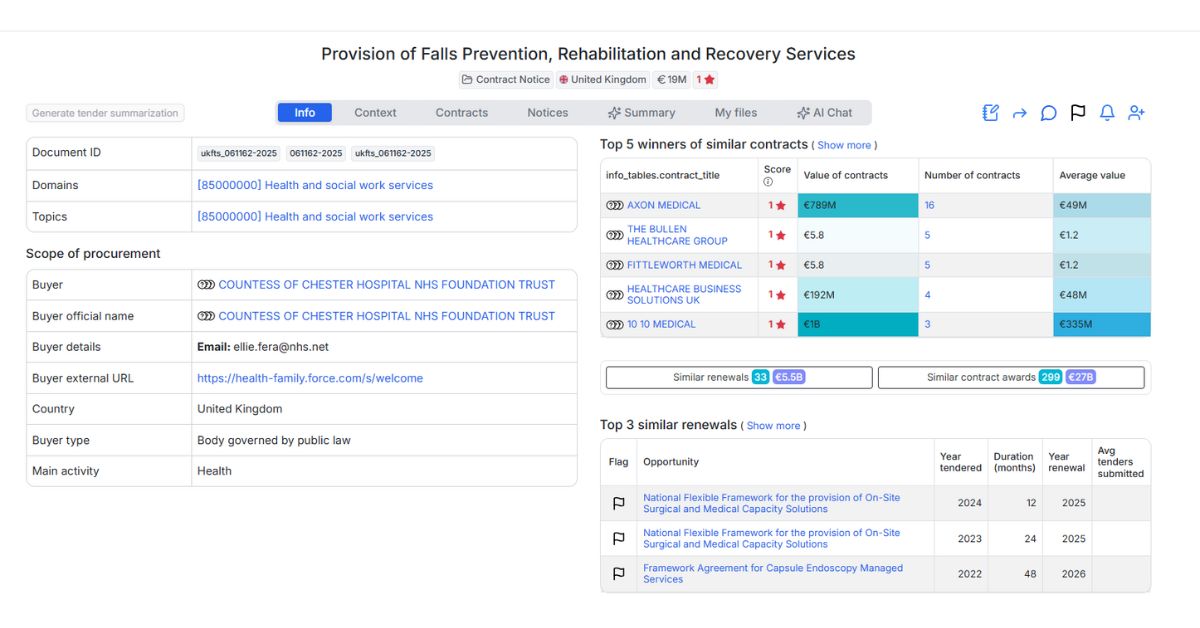

Previous Contract Winners (Top 10):

- Axonmedical Ltd: €789M across 14 contracts, average €56M per contract

- THE BULLEN HEALTHCARE GROUP LTD: €5.8M across 5 contracts, average €1.2M per contract

- FITTLEWORTH MEDICAL LTD: €5.8 across 5 contracts, average €1.2M per contract

- HEALTHCARE BUSINESS SOLUTIONS UK: €192M across 4 contracts, average €48M per contract

- SHS PARTNERS SURGICAL: €128M across 3 contracts, average €43M per contract

- MINDLER LTD: €34M across 3 contracts, average €17M per contract

- OPTIMUM MEDICAL SOLUTIONS LIMITED: €3.5 across 3 contracts, average €1.2M per contract

- PORTLAND CLINICAL: €1B across 2 contracts, average €502M per contract

- SAH DIAGNOSTICS: €920M across 2 contracts, average €920M per contract

- AM DIAGNOSTIC IMAGING LIMITED: €68M across 2 contracts, average €34M per contract

Contractor countries represented:

- United Kingdom: €27B across 282 contracts, average €130M per contract

- Finland: 1 contract

Total procurement activity:

- 682 contract awards worth €44B total

- 283 similar contract awards worth €27B

- 31 similar renewals worth €5.5B

- 93 total renewals worth €22B

- 4 similar open tenders worth €333M

- 5 total open tenders worth €445M

- 4 similar prior notices worth €0

- 15 total prior notices worth €34M

The market data indicates 4,600 other buyers with similar projects valued at €421 billion.

Working Relationship Indicators

The procurement follows an open procedure under The Health Care Services (Provider Selection Regime) Regulations 2023 and The Health Services (Provider Selection Regime) (Wales) Regulations 2025.

The framework is available for use by all Relevant Authorities as defined in section 12ZB(7) of the National Health Service Act 2006 and section 10A(9) of the National Health Service (Wales) Act 2006, including combined authorities, integrated care boards, local authorities in England, NHS England, NHS foundation trusts, NHS trusts, county councils in Wales, county borough councils in Wales, local health boards, and special health authorities.

The 4-year framework term provides long-term service stability for participating authorities.

Scope and Requirements Analysis

Service Categories

The framework addresses falls prevention and post-fall care across three integrated lots:

Falls Prevention Services (Lot 1): Services delivered to prevent the chance of falls, including:

- Falls support planning and risk assessments for individuals and their homes

- Person-centered plans to maximize older people’s potential for independent living

- Interventions to reduce fall risks and injuries by improving strength and balance

- Reduction of hospital admissions resulting from falls

- Falls prevention education and awareness for multi-organizations, agencies, care homes, and the public

- Delivery of falls prevention interventions in both home and residential care settings

Post Fall Rehabilitation and Recovery Services (Lot 2): Services supporting individuals after falls have occurred

Combination of All Services (Lot 3): Comprehensive service delivery automatically awarded to providers winning both Lot 1 and Lot 2

Clinical Context

The 2023 National Audit of Inpatient Falls report on 2022 clinical data identified:

More than 60,000 people sustained femoral fractures in England and Wales in 2022 due to falls

2,033 of these fractures occurred in inpatient settings

The services aim to address this significant healthcare challenge through prevention, intervention, and recovery support.

Technical Requirements

Services must align with NHS core Key Performance Indicators and standards. Specific requirements are detailed in the full tender documentation.

Geographic Coverage

Services will be performed across:

- South East England

- East of England

- Yorkshire and the Humber

- South West England

- Wales

- London

- East Midlands England

- North East England

- North West England

- West Midlands England

Market Opportunity Assessment

Target Businesses

This procurement targets:

Falls Prevention Specialists: Organizations with expertise in elderly falls prevention, strength and balance programs, and home safety assessments

Healthcare Service Providers: Companies delivering rehabilitation and recovery services in community and residential settings

NHS Framework Contractors: Firms experienced with NHS framework agreements and Provider Selection Regime compliance

Home-Based Care Providers: Organizations capable of delivering interventions in individuals’ homes and residential care facilities

Multi-Regional Operators: Providers with capacity to serve multiple English regions and Wales

Education and Training Providers: Organizations offering falls prevention awareness and education to healthcare staff, care homes, and the public

Competition Analysis

The procurement history reveals significant NHS healthcare contracting activity:

Axonmedical Ltd dominates with €789M across 14 contracts, averaging €56M per contract, though this contractor’s profile suggests medical equipment rather than falls prevention services.

PORTLAND CLINICAL (€1B, 2 contracts) and SAH DIAGNOSTICS (€920M, 2 contracts) represent major healthcare service contractors with substantial average contract values.

HEALTHCARE BUSINESS SOLUTIONS UK (€192M, 4 contracts) and SHS PARTNERS SURGICAL (€128M, 3 contracts) demonstrate mid-tier positioning in healthcare services.

Market context:

- 283 similar contract awards worth €27B from this buyer

- 31 renewal opportunities worth €5.5B

- 4,600 buyers with similar healthcare projects worth €421B

UK contractors dominate the market (€27B across 282 contracts), with minimal international participation.

Barriers to Entry

NHS Experience: Understanding of NHS procurement, Key Performance Indicators, and healthcare service delivery standards

Provider Selection Regime Compliance: Familiarity with The Health Care Services (Provider Selection Regime) Regulations 2023 and Wales 2025 regulations

Falls Prevention Expertise: Specialized knowledge of elderly care, fall risk assessment, strength and balance interventions, and home safety modifications

Multi-Regional Capacity: Ability to deliver services across all English regions and Wales

Framework Agreement Understanding: Experience managing call-off contracts under framework structures with multiple participating authorities

Clinical Standards: Compliance with NHS clinical standards and patient care requirements

Long-Term Service Delivery: Capability to sustain service quality over 4-year framework term

Strategic Insights

Key Success Factors

Note: This tender closes November 10, 2025.

Successful bids would demonstrate:

- Previous falls prevention or elderly care rehabilitation service delivery

- Experience with NHS framework agreements and Provider Selection Regime

- Multi-regional service delivery capability across England and Wales

- Evidence-based approaches to falls prevention and post-fall rehabilitation

- Track record in home-based and residential care interventions

- Quality assurance systems meeting NHS Key Performance Indicators

- References from NHS trusts, integrated care boards, or local authorities

- Staff qualifications appropriate for falls prevention and rehabilitation services

- Capacity to deliver across multiple lots simultaneously

- Understanding of National Audit of Inpatient Falls recommendations and NHS elderly care priorities

The framework structure with automatic Lot 3 awards for combined Lot 1 and 2 winners encourages comprehensive service proposals.

Risk Assessment

Potential challenges include:

Geographic Distribution: Delivering services across all English regions and Wales requires substantial operational infrastructure or strong regional partnership networks.

Multi-Authority Framework: Framework agreements serving multiple Relevant Authorities create complexity in managing diverse call-off requirements, service specifications, and reporting obligations.

Clinical Outcomes: Falls prevention effectiveness depends on patient engagement, home environment modifications, and sustained behavior changes. Service quality must demonstrate measurable fall reduction.

Post-Fall Services: Rehabilitation and recovery services require rapid response capabilities and coordination with NHS acute care services.

Four-Year Commitment: Long framework term requires sustained service quality, staff retention, and operational stability despite potential NHS reorganizations.

Value Distribution: Framework lot values may be shared across lots, creating uncertainty about actual spending allocation between prevention and post-fall services.

Provider Selection Regime: Compliance with relatively new regulations (2023 for England, 2025 for Wales) requires understanding of evolving NHS procurement frameworks.

Regulatory Considerations

All services must comply with:

- The Health Care Services (Provider Selection Regime) Regulations 2023

- The Health Services (Provider Selection Regime) (Wales) Regulations 2025

- NHS Key Performance Indicators and standards

- Relevant health and safety regulations for home-based care delivery

Specific regulatory requirements are detailed in the full tender documentation.

Actionable Recommendations

For Potential Bidders

Note: This tender closes November 10, 2025.

Firms interested in this NHS falls prevention framework should:

- Review full tender documentation immediately given November 10 deadline

- Assess capability across both Lot 1 (prevention) and Lot 2 (post-fall) to qualify for automatic Lot 3 award

- Compile references from NHS trusts, integrated care boards, or local authorities

- Demonstrate understanding of National Audit of Inpatient Falls findings and NHS response priorities

- Prepare multi-regional delivery methodology covering all specified English regions and Wales

- Document compliance with Provider Selection Regime regulations

- Present quality assurance systems aligned with NHS Key Performance Indicators

- Show evidence-based approaches to falls prevention and rehabilitation

- Address both home-based and residential care service delivery

- Consider partnerships for geographic coverage if regional presence is limited

For Industry Observers

This tender reveals several significant trends:

Prevention-Focused Healthcare: NHS emphasis on falls prevention reflects broader shift toward proactive health interventions reducing acute care costs.

Framework Agreement Preference: The 4-year framework serving multiple Relevant Authorities enables flexible procurement across NHS organizational structures.

Provider Selection Regime Implementation: This framework demonstrates NHS adoption of new Provider Selection Regime regulations replacing previous procurement frameworks.

Integrated Service Lots: The three-lot structure with automatic combined awards for Lot 1+2 winners encourages comprehensive service proposals over specialized approaches.

Geographic Scope: All-England and Wales coverage requirements favor larger providers or strong consortium arrangements over regional specialists.

Inpatient Falls Crisis: The 2,033 inpatient fractures in 2022 highlight significant NHS patient safety challenges driving falls prevention investment.

Related Opportunities

The tender documentation references only the original contract notice published October 1, 2025.

The buyer’s procurement profile shows:

- 31 similar renewal opportunities worth €5.5B

- 4 similar open tenders worth €333M

This suggests regular procurement cycles for health and social care services. Firms should monitor COUNTESS OF CHESTER HOSPITAL NHS FOUNDATION TRUST notices for future opportunities.

Similar opportunities exist with 4,600 other buyers conducting health and social work projects worth €421 billion.

Healthcare service providers should monitor:

- UK Find a Tender Service for NHS and social care opportunities

- COUNTESS OF CHESTER HOSPITAL NHS FOUNDATION TRUST procurement notices

- Other NHS foundation trusts and integrated care boards for comparable frameworks

- Local authority social care procurement for community-based elderly care services

Want to see the full documentation and other relevant public tenders, sign-up for free on Hermix, here: https://hermix.com/sign-up/

No credit card required, not questions asked.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.