The Union Nationale des Mutualités Socialistes (Solidaris) has launched an open tender for comprehensive insurance coverage across its nationwide network of socialist mutual insurance organizations. This 12-month framework agreement worth €30 million covers property, liability, accident, vehicle, and travel insurance for the entire Belgian socialist mutual sector.

Executive Summary

Solidaris, Belgium’s national union of socialist mutual insurance companies, seeks insurance providers to renew multiple insurance portfolios covering the organization and its network of provincial mutuals and associated entities across Belgium. The framework agreement spans €30 million over 12 months, with bids due October 10, 2025. This procurement consolidates insurance coverage for fire and related perils, IT risks, civil liability, school activities, work accidents, vehicles, and collective travel insurance. The tender reflects recent structural changes in the francophone mutual sector, where multiple organizations merged in 2022 to form Mutualité Solidaris Wallonie while maintaining distinct territorial units. Insurance providers must offer coverage across all Belgian provinces where socialist mutuals operate, accommodating both unified legal entities and territorial distinctions in policy structures.

Tender Overview

Basic Information

Document ID: 00629154-2025 Reference Number: 2025-085-UNMS-MP Publication Date: September 25, 2025 Deadline: October 10, 2025 Status: Open Source: TED BOSA

Financial Summary

Total Estimated Value: €30,000,000.00 Contract Duration: 12 months EU Funding: No

The procurement consists of a single lot covering all insurance categories for the entire Solidaris network.

Budget Breakdown

The framework agreement covers distinct insurance policies for each participating legal entity across the following risk categories:

Property Damage Insurance:

- Fire and related perils (named perils and all risks except)

- All risks IT equipment

- Stay and transport of valuables

- All risks artworks and exhibitions

- All risks wheelchairs

- All risks signage

Civil Liability and Legal Protection:

- General civil liability and objective fire/explosion liability (excluding hospital and polyclinic activities)

- Civil liability and objective fire/explosion liability for hospital and polyclinic activities

- Directors’ liability

- Civil liability for temporary activity organization

Combined School and Activity Insurance:

- Combined school insurance

- Associations coverage

- Volunteer organization coverage in welfare, public health, and family policy domains

- Sports federations

Work Accident and Collective Accident Insurance:

- Work accidents

- Private life accidents

- Bodily injury accidents (miscellaneous)

Vehicle Insurance:

- Vehicle coverage

- Comprehensive mission coverage

Collective Travel Insurance

The tender documentation does not provide specific budget allocations per insurance category.

Buyer Profile Analysis

Organizational Background

Solidaris – Union Nationale des Mutualités Socialistes represents the umbrella organization for all socialist mutuals (health insurance mutuals) across Belgian territory. A socialist mutual operates in each Belgian province, providing health insurance and related services to members.

Both Solidaris U.N.M.S. and the individual provincial socialist mutuals maintain their own networks of associated organizations. Within this procurement framework, Solidaris U.N.M.S. and the socialist mutuals represent umbrella entities, each covering multiple associations beneath them.

A significant structural change occurred on January 1, 2022, when several francophone mutuals merged to form Mutualité Solidaris Wallonie (Solidaris Wallonie). This merger created a single legal entity while maintaining distinct establishment units corresponding to the territories of the current mutuals. Insurance policies for these mutuals will be subscribed in the name of Solidaris Wallonie but must specify the relevant territory each time.

The tender documentation indicates that starting January 1, 2026, certain policies may be established solely in the name of Solidaris Wallonie without territory distinctions. Dialogue on this transition will occur after contract conclusion. Precise contact and billing details will be transmitted at the time of individual policy conclusion.

Procurement History

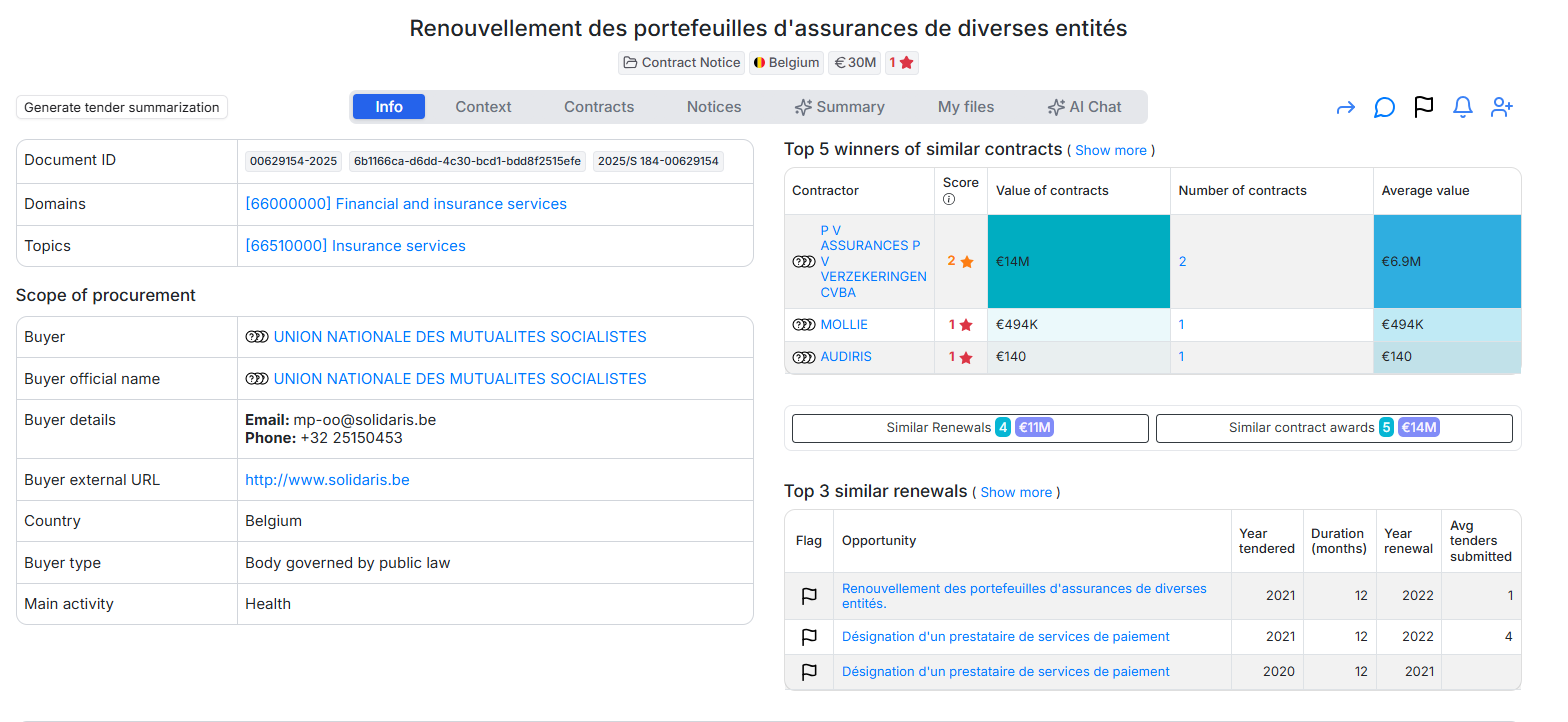

The buyer’s procurement data shows:

Previous Contract Winners:

- P V ASSURANCES P V VERZEKERINGEN CVBA: €14M across 2 contracts, average €6.9M per contract

- MOLLIE: €494K for 1 contract

- AUDIRIS: €140 for 1 contract

Previous winners are predominantly Belgian firms, with one contractor from the Netherlands (MOLLIE at €494K).

Total procurement activity:

- 171 contract awards worth €244M total

- 5 similar contract awards worth €14M

- 4 similar renewals worth €11M

- 70 total renewals worth €218M

The procurement data shows 392 other buyers with similar insurance projects valued at €599M across Belgium, indicating substantial activity in public sector insurance procurement.

Working Relationship Indicators

The procurement follows a negotiated procedure with prior publication of a call for competition. This approach allows for dialogue and negotiation during the evaluation process.

Evaluation criteria combine price and quality, though specific weightings are not disclosed in the available documentation. Given the healthcare sector context and the need to serve vulnerable populations, quality factors related to claims handling, service responsiveness, and coverage comprehensiveness will be important.

The framework agreement structure means individual insurance policies will be concluded separately for each participating legal entity as needs arise. The buyer emphasizes that precise contact and billing details will be provided at the time each specific policy is established.

Language requirements accommodate Belgium’s linguistic diversity, accepting offers in both French and Flemish.

Scope and Requirements Analysis

Service Categories

The framework agreement establishes the structure for concluding distinct insurance policies in the name of each participating legal entity for specific risk categories. Insurers must provide coverage across all specified insurance types, though individual policies will be issued separately.

Property Damage Insurance Requirements

Fire and Related Perils: Coverage on both named perils and all risks except basis IT Equipment: Comprehensive all risks coverage for information technology assets Valuables: Stay and transport coverage for valuable items Artworks and Exhibitions: All risks coverage for art collections and exhibition materials Wheelchairs: Comprehensive coverage for wheelchair equipment Signage: All risks coverage for organizational signage and displays

Civil Liability and Legal Protection Requirements

General Civil Liability: Coverage excluding hospital and polyclinic activities, including objective fire/explosion liability Hospital and Polyclinic Liability: Specialized coverage for healthcare facility operations, including objective fire/explosion liability Directors’ Liability: Protection for organizational leadership decisions and governance Temporary Activities: Civil liability coverage for organization of temporary events and activities

Combined School and Activity Insurance Requirements

School Insurance: Combined coverage for educational activities Association Coverage: Insurance for associated organizations within the network Volunteer Organizations: Coverage for volunteers working in welfare, public health, and family policy domains Sports Federations: Insurance for affiliated sports organizations

Work Accident and Collective Accident Requirements

Work Accidents: Statutory work accident insurance coverage Private Life Accidents: Coverage for accidents outside work contexts Bodily Injury: Miscellaneous bodily injury accident coverage

Vehicle Insurance Requirements

Vehicle Coverage: Standard vehicle insurance Comprehensive Mission Coverage: Enhanced coverage for vehicles used in organizational missions

Collective Travel Insurance Requirements

Group travel coverage for organizational trips and activities

Technical Requirements

The tender does not specify detailed technical requirements such as coverage limits, deductibles, or specific policy terms. These details are addressed during the negotiation process and individual policy establishment.

The structural complexity of the buyer organization requires insurers to accommodate:

- Multiple legal entities with distinct coverage needs

- Territorial distinctions within merged entities (Solidaris Wallonie)

- Transition planning for policy consolidation from January 1, 2026

- Flexible policy structures accommodating organizational evolution

Geographic Coverage

Coverage extends across all Belgian provinces where socialist mutuals operate. The exact number and locations of facilities, offices, and operational sites are detailed in the competition documentation.

The buyer organization operates throughout Belgium, serving both francophone and Dutch-speaking regions, reflected in the dual-language tender requirements.

Market Opportunity Assessment

Target Businesses

This procurement targets:

Multi-line Insurance Providers: Firms capable of offering the full range of property, liability, accident, vehicle, and travel insurance products

Public Sector Insurance Experience: Understanding of public law body requirements and health sector operations

Belgian Market Knowledge: Familiarity with Belgian insurance regulations, mutual insurance sector, and healthcare system context

Scale Capability: Capacity to handle €30 million in annual premiums across multiple entities and coverage types

Bilingual Service: Ability to operate in both French and Flemish to serve all network entities

Claims Management: Robust claims handling systems for healthcare organizations with diverse risk profiles

Multi-site Coverage: Experience providing insurance across multiple locations and organizational structures

The comprehensive scope favors established insurance companies or consortiums with broad product portfolios rather than specialist providers focused on single insurance lines.

Competition Analysis

The market data reveals:

- P V ASSURANCES P V VERZEKERINGEN CVBA dominates historical awards with €14M across 2 contracts

- 392 buyers with similar insurance projects worth €599M across Belgium

- 5 similar historical contract awards from this buyer worth €14M

- 4 similar renewal opportunities worth €11M

The buyer has 70 total renewal opportunities worth €218M, suggesting regular procurement cycles for various insurance needs. The €30 million value of this single tender represents a significant consolidation of insurance purchasing.

The presence of both Belgian and international providers (Netherlands) in historical awards indicates openness to cross-border suppliers within the EU market.

Barriers to Entry

Belgian Market Presence: Practical need for local operations to serve facilities across all provinces

Multi-line Capability: Single-line specialists cannot meet the comprehensive coverage requirements

Language Capacity: Bilingual service delivery in French and Flemish

Healthcare Sector Knowledge: Understanding of hospital operations, healthcare risks, and public health organization structures

Claims Infrastructure: Robust systems for handling diverse claim types across multiple locations

Regulatory Compliance: Knowledge of Belgian insurance regulations and public procurement rules

Financial Capacity: Sufficient underwriting capacity for €30 million annual premium volume

Strategic Insights

Key Success Factors

Successful bids will demonstrate:

- Comprehensive insurance portfolio covering all required lines without gaps or exclusions

- Experience with Belgian health sector organizations and mutual insurance companies

- Bilingual service capabilities accommodating both francophone and Dutch-speaking entities

- Understanding of the Solidaris organizational structure, including the 2022 merger creating Solidaris Wallonie

- Flexible policy structures accommodating territorial distinctions within unified legal entities

- Transition management capability for the January 2026 policy consolidation

- Claims handling expertise across diverse risk categories from property damage to professional liability

- Competitive pricing balanced with comprehensive coverage and service quality

- References from comparable public health or mutual insurance organizations

- Proposal addressing both immediate needs and longer-term organizational evolution

The evaluation criteria combining price and quality suggest that lowest cost alone will not win. Insurers must balance competitive premiums with demonstrated service capability and coverage comprehensiveness.

Risk Assessment

Potential challenges include:

Organizational Complexity: The buyer structure includes an umbrella organization (Solidaris U.N.M.S.), provincial mutuals, and associated entities beneath each. Insurers must navigate this multi-layered structure and understand which legal entity requires coverage for which risks.

Merger Transition: The 2022 creation of Solidaris Wallonie as a unified legal entity with distinct territorial units creates policy structuring complexity. Insurers must accommodate current territorial distinctions while preparing for potential full consolidation from January 2026.

Healthcare Risk Profile: Hospital and polyclinic activities present higher liability risks requiring specialized underwriting expertise. Mixing these higher-risk activities with standard organizational insurance complicates risk assessment and pricing.

Geographic Scope: Providing consistent service across all Belgian provinces requires substantial local presence or network partnerships.

Multi-line Coordination: Coordinating multiple insurance types across numerous entities demands sophisticated policy administration and claims systems.

Claims Volume: The large membership base of Belgian socialist mutuals generates substantial claims volume requiring efficient processing capability.

Regulatory Environment: Belgian insurance regulations and public procurement rules create compliance requirements throughout contract execution.

Premium Adequacy: The 12-month contract duration with €30 million value suggests high annual premium volume. Insurers must ensure pricing adequacy without long-term rate guarantees.

Regulatory Considerations

All coverage must comply with:

- Belgian insurance regulations and solvency requirements

- Public sector procurement rules under Belgian law

- Healthcare facility insurance standards

- Work accident insurance statutory requirements

- Vehicle insurance mandatory coverage laws

- Data protection regulations for handling member information

Actionable Recommendations

For Potential Bidders

Firms interested in bidding should:

- Review the complete tender documentation available through the official sources (TED and BOSA platforms)

- Assess internal capability across all required insurance lines, forming partnerships if gaps exist in the product portfolio

- Prepare detailed service proposals for each insurance category, emphasizing healthcare sector experience

- Document bilingual service capability with evidence of French and Flemish language support

- Develop pricing models accommodating both the current territorial structure and potential 2026 consolidation

- Gather references from Belgian health sector clients or comparable mutual insurance organizations

- Prepare claims handling protocols appropriate for healthcare organizations with multiple sites

- Calculate risk-adjusted pricing considering the mix of standard organizational risks and higher-risk hospital activities

- Develop policy structures flexible enough to accommodate organizational evolution without requiring complete renegotiation

- Contact the buyer (mp-oo@solidaris.be) to clarify questions about entity structures and coverage coordination

- Submit offers in the appropriate language (French or Flemish) by October 10, 2025

Bidders should emphasize value beyond price, including service quality, claims expertise, and understanding of the buyer’s unique organizational structure.

For Industry Observers

This tender reveals several significant trends:

Consolidation of Public Sector Insurance Purchasing: The €30 million single framework agreement consolidates multiple insurance lines for an entire organizational network. This trend favors large insurance providers over smaller specialists.

Organizational Evolution Impact: The 2022 merger creating Solidaris Wallonie demonstrates ongoing consolidation in Belgium’s mutual insurance sector. Insurance providers must adapt to evolving organizational structures while maintaining service continuity.

Healthcare Sector Specialization: The separation of hospital/polyclinic liability from general organizational liability recognizes distinct risk profiles requiring specialized underwriting.

Multi-line Bundling: Combining property, liability, accident, vehicle, and travel insurance in a single framework reflects buyer preference for coordinated coverage from fewer providers.

Language Requirements: The bilingual service requirement (French and Flemish) reflects Belgium’s linguistic diversity and limits practical market access to insurers with multilingual capabilities.

Related Opportunities

The tender documentation does not reference any corrigenda or related notices beyond the original contract notice published September 25, 2025.

The buyer’s procurement profile shows:

- 70 total renewal opportunities worth €218M

- 4 similar renewal opportunities worth €11M

This suggests regular insurance procurement cycles. Firms should monitor Solidaris procurement notices for related opportunities in specialized insurance lines or geographic subdivisions.

Similar opportunities exist with 392 other buyers in comparable sectors, with total market value of €599M across Belgium. The Belgian public health sector and mutual insurance organizations provide consistent demand for comprehensive insurance coverage.

Insurers should monitor:

- Solidaris procurement platform for related opportunities

- Belgian public procurement portals (TED and BOSA) for similar health sector insurance tenders

- Provincial mutual organizations for local insurance needs

- Associated entities within the Solidaris network for specialized coverage requirements

Want to see the full documentation and other relevant public tenders, sign-up for free on Hermix, here: https://hermix.com/sign-up/

No credit card required, not questions asked.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.