M&Y Maintenance and Construction (The Regenda Group) has launched a massive 10-year Dynamic Purchasing System (DPS) worth €518,995,166.91 across 49 specialized construction categories. This open procurement system allows subcontractors to join at any time and compete for individual contracts across North West England’s housing maintenance and construction sector. With no minimum or maximum limits on successful applicants per category and work spanning residential, commercial, and historical properties, this represents one of the UK’s largest ongoing construction frameworks. Based on the documented structure and approach, the opportunity appears well-suited to established contractors with experience in social housing and maintenance work, offering potential for steady revenue streams through 2030.

Understanding the Tender Framework

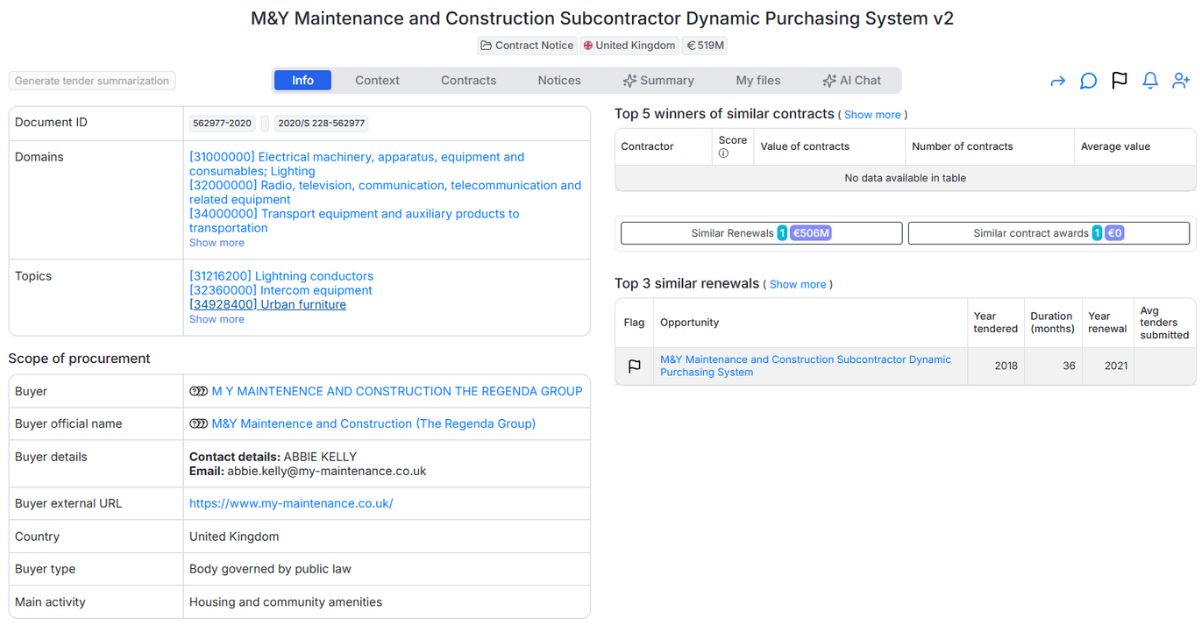

This procurement opportunity operates as a Dynamic Purchasing System, fundamentally different from traditional tenders. Published on 23 November 2020 with applications accepted until 17 November 2030, the framework carries the document ID 562977-2020 and reference number ST1000022. The system remains open throughout its 120-month duration, allowing new contractors to apply continuously rather than within restrictive deadline windows.

The financial scope is substantial, with a total estimated value of €518,995,166.91 spread across comprehensive construction and maintenance services. The largest individual categories include Electrical Works at €40,463,077.44, Electrical Compliance at €38,215,128.70, Cladding Systems at €35,967,179.95, and Demolition at €29,223,333.71. This distribution reflects significant investment planned across electrical infrastructure and building safety improvements.

Understanding the Buyer Organization

M&Y Maintenance and Construction operates as a wholly owned commercial subsidiary of Regenda Ltd, functioning as a body governed by public law with primary focus on housing and community amenities. The organization maintains operations in North West England and can be contacted through Abbie Kelly, with additional information available at https://www.my-maintenance.co.uk/.

The document establishes that M&Y operates within The Regenda Group structure, indicating it functions as part of a larger organizational framework while maintaining subsidiary status. The combination of commercial subsidiary operations under public law governance suggests a hybrid operational model serving public housing sector needs.

The procurement context data provides insight into M&Y’s market activity. The system shows one similar renewal worth €506M, indicating established procurement patterns. The broader market context shows €991B total value across similar projects with other buyers (13K+ organizations), positioning this opportunity within a substantial sector-wide market for construction and maintenance services.

M&Y’s documented approach to supplier engagement includes hosting virtual supplier engagement events, with presentations made available via Proactis platform. The stated policy of accepting all applicants who meet standard selection criteria, with no minimum or maximum limits per category, indicates an open, capacity-focused approach to supplier management. The evaluation criteria of “most economic tender” establishes that price competitiveness will be a primary factor in individual contract awards.

Service Requirements

The DPS encompasses 49 distinct service categories, creating opportunities across the full spectrum of construction and maintenance work. Electrical services dominate the value allocation, with Electrical Works (€40.5M) covering domestic and commercial rewires, upgrades, renewable technologies, vehicle charging points, street lighting, and ICT infrastructure. Electrical Compliance (€38.2M) addresses critical safety requirements including fire alarms, smoke alarms, emergency lighting, air conditioning, ventilation systems, testing, and CCTV installation.

Building infrastructure represents another major component, with Cladding Systems (€36M) covering both insulated and non-insulated systems for internal and external applications. Demolition work (€29.2M) includes building and structure removal with disposal responsibilities, while Modular Units (€28.1M) address construction pods and prefabricated solutions.

The framework encompasses substantial specialist services including Scaffolding (€22.5M) covering design, towers, and fixed scaffolding systems, General Building and Masonry work (€22.5M), and significant allocations for Flooring and Ceiling Systems (€18M each). Additional major categories include Painting and Decorating (€16.9M), Piling Works (€14M), and Pre-cast Concrete work (€18M).

All work takes place across North West England (UKD), with the scope covering individual and communal residential sites as the primary focus, supplemented by commercial, industrial, historical, and new build projects. The document specifies work within social housing and private rented sector properties, reflecting M&Y’s core operational focus.

Market Positioning and Competition Analysis

The DPS structure creates an open competitive environment with specific characteristics that define the market opportunity. The document establishes that all applicants meeting standard selection criteria will be admitted to the DPS, with no minimum or maximum number limits per category. This creates a potentially large supplier base while ensuring all participants meet baseline qualifications.

Competition occurs at two levels: initial qualification for DPS membership and subsequent competitive tendering for individual contracts among qualified suppliers. The document specifies that all contracts will be awarded through competitive tender procedures among qualified DPS contractors, using “most economic tender” evaluation criteria.

The 49-category structure allows contractors to specialize in specific areas or diversify across multiple service types by applying for multiple categories. The range of values from €280,993.59 (Pest Control) to €40,463,077.44 (Electrical Works) accommodates both specialist service providers and larger multi-disciplinary contractors.

The 10-year framework duration provides long-term business development opportunities while requiring sustained performance and relationship management. The document indicates this is version 2 of the DPS, suggesting an established and refined procurement approach based on previous experience.

Analysis of the Opportunity

Several factors emerge from the documented structure that indicate key success requirements. The “most economic tender” evaluation approach establishes price competitiveness as the primary award criterion, requiring efficient cost management and competitive pricing strategies from participants.

The multi-category structure allows strategic approaches ranging from specialization in high-value categories to diversification across complementary service areas. The substantial electrical allocations (€78.7M combined) indicate significant modernization and compliance investment planned across the housing portfolio.

The document’s emphasis on social housing and private rental sector properties indicates specific regulatory and compliance requirements that participants must navigate. The inclusion of “tenanted properties” in multiple categories suggests work must be conducted with minimal disruption to residents.

The open application system through 2030 means the competitive landscape can evolve throughout the framework duration, requiring ongoing competitive positioning rather than initial qualification alone.

Guidance for Market Participants

Based on the documented requirements, interested contractors should focus on understanding the standard selection criteria, which are not detailed in the available documentation but represent the primary barrier to participation. The document indicates these criteria apply uniformly across all categories.

The multi-category application opportunity suggests contractors should carefully assess their capabilities against the detailed service descriptions provided for each lot. Categories with “may include provision of design services” (Architectural Features, Bathroom Installation, General Building/Masonry, Kitchen Installation) indicate additional technical capability requirements.

The document’s reference to virtual supplier engagement events and materials available via Proactis indicates M&Y provides ongoing support and communication for interested suppliers. The provision of event materials post-session suggests comprehensive information is available to guide application preparation.

Market Context and Future Considerations

The procurement data positions this opportunity within broader market trends. The €506M similar renewal indicates successful framework models generate continued investment, while the €991B broader market value across 13K+ similar buyers suggests this procurement model’s growing adoption across the social housing sector.

The 10-year duration provides extended business development opportunity for successful participants, while the DPS structure allows for evolving supplier relationships based on performance and capability development over time.

This DPS represents a substantial opportunity for construction and maintenance contractors to establish long-term partnerships within North West England’s social housing sector. The documented scale, duration, and comprehensive service scope offer significant revenue potential for contractors capable of meeting the standard selection criteria and competing effectively within the established framework structure.

Want to see the full documentation and other relevant public tenders, sign-up for free on Hermix, here: https://hermix.com/sign-up/

No credit card required, not questions asked.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.