Azienda Metropolitana Trasporti Catania (AMTS) has launched a €16,267,485.04 tender for comprehensive insurance services across seven specialized lots. Published on 2 September 2025 with applications due 29 September 2025, this 48-month open procurement procedure uses quality and price evaluation criteria. The contract is divided into distinct insurance categories, including mandatory motor vehicle liability insurance (€14,709,985.04), general third-party liability, professional indemnity, legal protection, all-risks coverage, cumulative accident insurance, and employee medical coverage. Located in Catania with Italian language requirements, this opportunity targets established insurance providers with expertise in public transport and municipal service coverage. With AMTS showing €39M in total renewals and the broader market indicating €11B across similar buyers, this represents substantial business potential for qualified insurance companies.

Understanding the Tender Framework

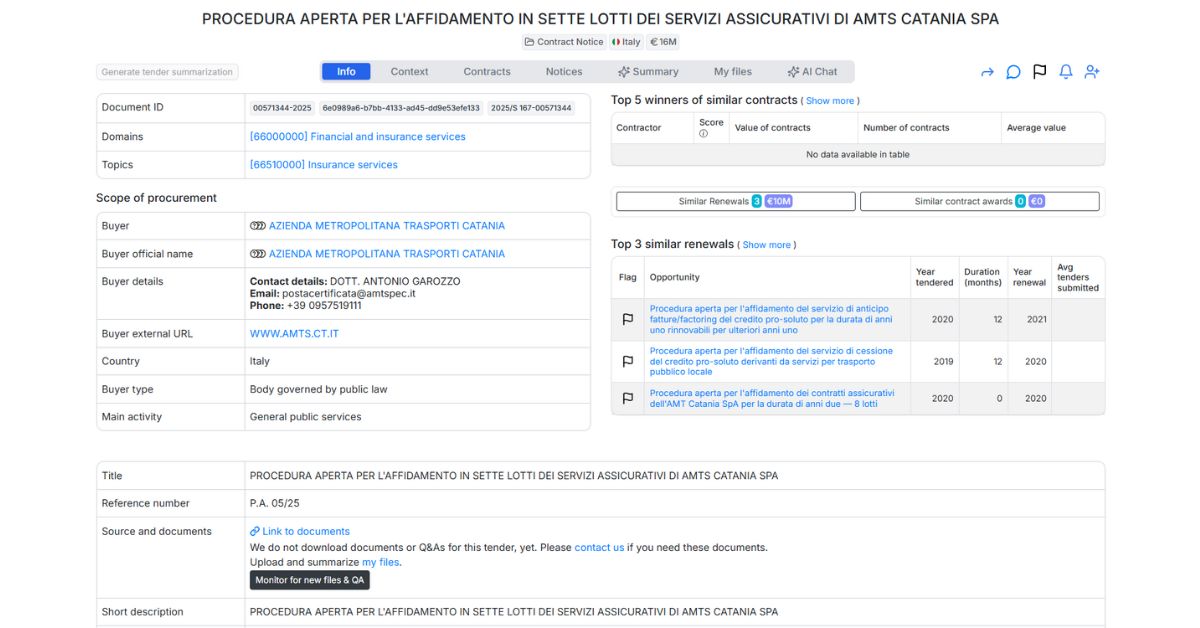

This procurement operates under an open procedure, published on 2 September 2025 with applications due 29 September 2025, providing a 27-day window for bid preparation. Tender opening occurs on 30 September 2025, one day after the deadline. The contract carries document ID 00571344-2025 and reference number P.A. 05/25, sourced through TED (Tenders Electronic Daily).

The 48-month contract duration provides a four-year insurance coverage commitment with substantial premium volume across multiple coverage categories. The evaluation criteria combine quality and price considerations, indicating AMTS seeks both competitive premiums and proven insurance service capabilities. Italian language requirement for offers reflects domestic procurement requirements and regulatory compliance needs.

The contract is not financed with EU funds, indicating direct transport authority funding for comprehensive insurance coverage requirements. The service-based nature requires established insurance carriers with authorization for Italian public sector business and transportation sector expertise.

Understanding the Buyer Organization

Azienda Metropolitana Trasporti Catania (AMTS) operates as Catania’s metropolitan public transport authority, functioning as a body governed by public law with primary activity in general public services. The organization maintains contact through postacertificata@amtspec.it and phone +39 0957519111, with additional information available at WWW.AMTS.CT.IT.

The procurement context reveals moderate but consistent organizational activity from AMTS. The organization currently has 2 open tenders worth €7.7M total, indicating ongoing procurement operations. Historical data shows 16 renewals worth €39M with 3 similar renewals worth €10M, demonstrating established insurance procurement patterns and organizational stability.

The absence of similar contract awards in the documented data suggests this represents either a new procurement approach or different contract structure for AMTS insurance requirements. The renewal activity (€39M across 16 contracts) indicates consistent procurement operations and potential for contract renewals based on performance.

The broader market context shows 1.7K other buyers with similar projects totaling €11B, positioning this procurement within a substantial European market for public transport and municipal authority insurance services.

Comprehensive Service Requirements

The tender addresses comprehensive insurance coverage for AMTS operations across seven specialized lots, each targeting specific risk categories and operational requirements. All lots specify performance in Catania and use price and quality evaluation criteria.

Lot 1 represents the dominant component at €14,709,985.04 for motor vehicle liability insurance (RCA) plus comprehensive motor coverage (CVT/ARD), reflecting the substantial fleet insurance requirements for public transport operations. This coverage addresses mandatory third-party liability and comprehensive vehicle protection for buses and transport equipment.

Lots 2-7 provide specialized coverage categories: RCTO (€225,000) for general third-party liability, RC Patrimoniale Colpa Lieve (€292,500) for professional indemnity with light fault coverage, Tutela Legale (€162,500) for legal protection services, All Risks (€360,000) for comprehensive property and operational coverage, Infortuni Cumulativa (€157,500) for cumulative accident insurance, and TCM Dipendenti (€360,000) for employee medical coverage.

The seven-lot structure allows for specialization based on insurance coverage expertise while maintaining comprehensive risk management across all operational categories. The substantial contract values indicate significant premium volumes requiring established insurance carriers with appropriate underwriting capacity and regulatory authorization.

Market Positioning and Competition Analysis

The public transport insurance market demonstrates specialized risk assessment and regulatory requirements specific to municipal transport operations. The substantial motor vehicle liability component (€14.7M) indicates major fleet operations requiring insurers with transportation sector expertise and appropriate underwriting capacity.

Market entry requires suppliers to demonstrate Italian insurance market authorization, public sector experience, and specific competencies in transport authority risk management. The 48-month contract duration provides substantial premium volume, requiring insurers with strong financial stability and claims handling capabilities.

The seven-lot structure allows insurers to specialize in specific coverage areas or demonstrate comprehensive capabilities across multiple insurance categories. The combination of mandatory and specialized coverage creates opportunities for both major insurance companies and specialist providers.

Strategic Analysis Based on Documentation

Success factors emerge from the documented requirements and public transport context. The quality and price evaluation indicates insurers must balance competitive premium pricing with demonstrated service capabilities, claims handling expertise, and regulatory compliance. The 27-day application window provides adequate time for comprehensive risk assessment and premium calculation.

The substantial motor vehicle liability allocation (90% of total value) indicates fleet operations represent the primary risk exposure, requiring insurers with proven transportation sector experience and appropriate underwriting guidelines. The comprehensive coverage approach suggests AMTS seeks integrated risk management rather than fragmented insurance arrangements.

The 48-month duration with established renewal patterns (3 similar renewals worth €10M) suggests successful insurers face strong potential for contract extensions based on claims experience and service performance.

Actionable Guidance

Based on the documented requirements, interested insurers should verify their authorization for Italian public sector business and demonstrate experience with public transport authority insurance requirements. The comprehensive lot structure requires either specialist expertise in specific coverage areas or integrated capabilities across multiple insurance categories.

The quality and price evaluation approach indicates insurers should prepare detailed service proposals demonstrating claims handling capabilities, risk management support, and regulatory compliance while presenting competitive premium strategies. Evidence of successful public transport insurance programs and municipal authority relationships will be important evaluation factors.

The 29 September 2025 deadline requires preparation of Italian-language documentation within the 27-day window. Insurers should contact AMTS directly at postacertificata@amtspec.it for detailed specifications and risk information not included in the basic tender notice.

Market Context and Related Opportunities

This procurement operates within the substantial European market for public transport and municipal insurance services, as indicated by the 1.7K similar buyers with €11B total project value. The comprehensive coverage approach and substantial contract value demonstrate significant business potential for qualified insurance providers.

The documented renewal activity (16 renewals worth €39M) indicates ongoing insurance requirements creating sustained business opportunities beyond this specific tender. The public transport sector’s insurance needs create potential for additional municipal authority relationships and expanded market presence.

This tender represents an opportunity for qualified insurance companies to establish or strengthen relationships with Sicilian public transport authorities while demonstrating capabilities in comprehensive municipal risk management and transportation sector insurance within the Italian market.

Want to see the full documentation and other relevant public tenders? Sign up for free on Hermix, here: https://hermix.com/sign-up/

No credit card required, no questions asked.

PS: This analysis is based on publicly available tender documentation and data provided by the contracting authority. While we strive to provide accurate information, users are responsible for verifying all details against official tender documents before making any procurement decisions.